After the historic rate hike, what’s next for the dollar? The greenback also has an effect on the Fed.

The team at CIBC explains:

Here is their view, courtesy of eFXnews:

The Fed hiked, but it wasn’t quite the “dovish hike” that investors were looking for, notes CIBC World Markets.

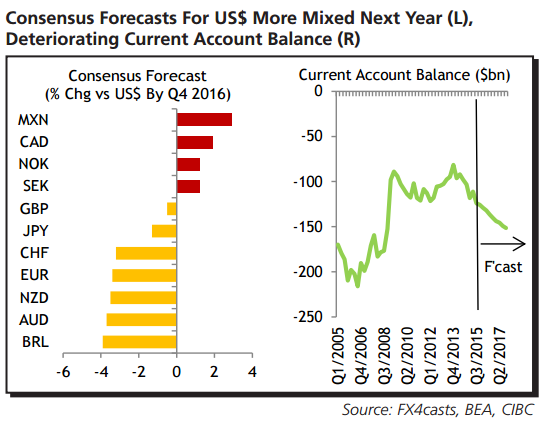

“With no dissents and no change to the dot plot forecast for the end of 2016, the US$ was given a boost as markets were forced to reassess how many hikes could come in the future. But in contrast to last year, consensus expectations for further greenback strength in 2016 aren’t as widespread as early 2015,” CIBC adds.

Why? “In part because the strengthening US$ is starting to have a more material impact on the economy, hurting manufacturing and seeing the current account deficit widen,” CIBC answers.

“We think that trend will continue, forcing the Fed to enact one fewer hike than they expect in 2016, which would help curb the US$’s appreciation longer term,” CIBC argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.