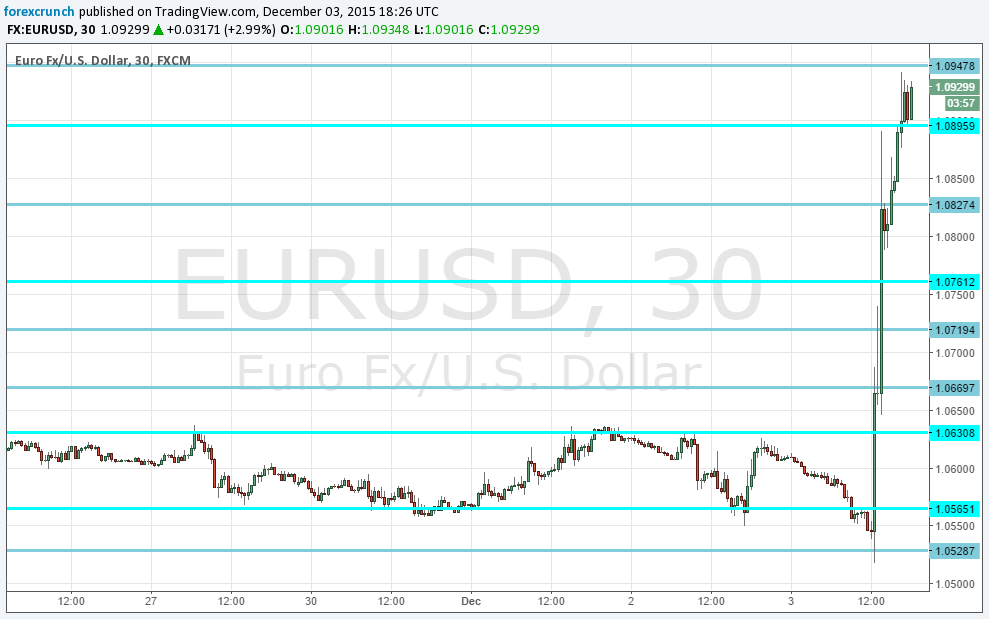

The major event during the past trading week was the monetary policy decision of the European Central Bank. It overshadowed even the very important US non-farm payrolls, sending the euro higher. The shared 19-nation currency jumped more than 2 percent against its major peers over the week. The ECB was holding the policy meeting on Thursday, and it should have been detrimental to the euro as the vast majority of market analysts had … “Euro Jumps More than 2 Percent During ECB Week”

Month: December 2015

Canadian Dollar Resilient in Face of Negative Fundamentals

The Canadian dollar fell against its US counterpart on Friday but was surprisingly robust against its other major peers like the euro and the Japanese yen. The currency demonstrated resilience despite negative fundamentals. Data released on Friday, showed that Canadian employment shrank in November much more than analysts had anticipated while the unemployment rate increased unexpectedly. Moreover, the trade balance deficit increased instead of falling as had … “Canadian Dollar Resilient in Face of Negative Fundamentals”

Dollar Ends Friday’s Trading with Gains

The US dollar rebounded today after the yesterday’s huge drop that followed a policy announcement from the European Central Bank. While US employment data was positive for the greenback, perhaps even more supportive to the US currency were comments from ECB President Mario Draghi. US employers added 211,000 jobs in November, a bit more than analysts had predicted. On top of that, the previous month’s huge gain was … “Dollar Ends Friday’s Trading with Gains”

Nonfarm Payrolls All But Guarantee Fed Rate Hike

US dollar is gaining ground today as the latest nonfarm payrolls reading points to a rate hike from the Federal Reserve later this month. With job growth remaining relatively steady, and the economy holding its own, many expect policymakers to begin tightening. According to the latest nonfarm payroll report from the US Department of Labor, there were 211,000 jobs created in the month of November, and the unemployment rate is holding steady … “Nonfarm Payrolls All But Guarantee Fed Rate Hike”

Swiss Franc Weaker amid Deflation

The Swiss franc fell against the US dollar today after the yesterday’s massive rally. The Swissie also declined versus the euro for the second day. Economic data from Switzerland was not supporting the Swiss currency, showing deflation. Consumer prices fell 0.1 percent in Switzerland last month after rising at the same rate in October. Pressure on the franc eased after the European Central Bank had performed a rather limited expansion of stimulus, … “Swiss Franc Weaker amid Deflation”

AUD Weaker vs. USD, Rises vs. EUR

The Australian dollar fell against its US counterpart ahead of US non-farm payrolls. The Aussie rose a bit versus the euro after yesterday’s big slumped that had followed the policy announcement from the European Central Bank. Released today, retail sales data demonstrated an increase by 0.5 percent in October from September that has exceeded analysts’ expectations. Earlier this week, the Reserve Bank of Australia held interest rates … “AUD Weaker vs. USD, Rises vs. EUR”

3 things that can push EUR/USD back down

EUR/USD had an incredible range of 460 pips on the ECB’s upset, nearly reaching 1.10 on these 10 points. Draghi and his colleagues had created huge expectations but eventually showed a lack of vigilance, to say the least. From here, we are seeing a correction. This may be temporary, before the next move higher. But what can … “3 things that can push EUR/USD back down”

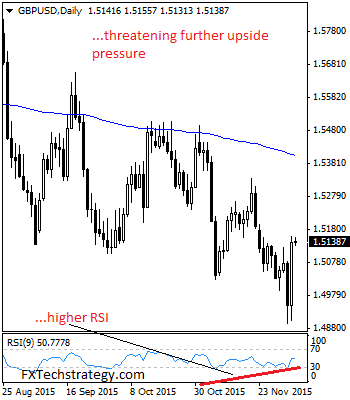

GBPUSD Rallied On Bullish Momentum

GBPUSD: Having GBPUSD rallied on bullish momentum on Thursday, it now targets the 1.5200 level on further bullish offensive. With that said, resistance stands at the 1.5200 levels with a turn above here allowing more strength to build up towards the 1.5250 level. Further out, resistance resides at the 1.5300 level followed by the 1.5350 … “GBPUSD Rallied On Bullish Momentum”

10 Points on 400 Pips in EUR/USD

Draghi didn’t deliver: The president of the European Central Bank created huge expectations for further easing and delivered very very little. This caused a massive rally in EUR/USD, lifting it around 400 pips in a dramatic day that will be remembered for a long time. Here are 10 points on this huge move. Will it extend further or … “10 Points on 400 Pips in EUR/USD”

Euro Surges After ECB Announcement Disappoints

Many Forex traders and analysts were expecting a dramatic easing announcement from the ECB today. Instead, the announcement avoided an exotic measures and, rather than weakening the euro, sent the 19-nation currency surging against its counterparts. For weeks, Mario Draghi has been hinting that exotic, desperate measures would be on the table for the eurozone. He has been talking about the importance of “doing what it takes” to stimulate the economy … “Euro Surges After ECB Announcement Disappoints”