The euro dropped on Wednesday as economic data released from the countries of the eurozone was not particularly supportive for the currency, breaking its three-day rally versus the US dollar and the Japanese yen. French gross domestic product expanded at the annual rate of 1.1 percent in the third quarter of 2015 according to the final estimate while economists had expected it to be the same as the preliminary reading of 1.2 percent. Also released from France, the consumer spending … “Euro Ends Three-Day Rally vs. Dollar & Yen”

Month: December 2015

CAD Gains for Second Day vs. USD & JPY

The Canadian dollar rallied today, rising for the second day against the US dollar and the Japanese yen, thanks to the jump of crude oil prices and encouraging domestic macroeconomic reports. Canada’s gross domestic product was unchanged in October after falling 0.5 percent in September. Retail sales edged up 0.1 percent in October following the 0.4 percent drop in the prior month. Meanwhile, prices for crude oil jumped more than 4 percent … “CAD Gains for Second Day vs. USD & JPY”

NZ Dollar Edges Lower Despite Supportive Data

The New Zealand dollar declined today, ignoring positive domestic macroeconomic data. The currency has been consolidating lately amid slow trading due to the holiday period. New Zealand’s trade deficit shrank to NZ$779 million in November from NZ$905 million in the previous month. It was smaller than a NZ$812 million shortage predicted by analysts. Yet the New Zealand dollar failed to profit from the supportive data, falling against its … “NZ Dollar Edges Lower Despite Supportive Data”

Pound Gains Even as Economic Growth Slows

The Great Britain pound gained today even though Britain’s economic growth slowed more than was estimated previously, meaning that the nation’s central bank has less incentive to start hiking interest rates. UK gross domestic product grew 0.4 percent in the third quarter from the previous three months according to the final estimate. The growth was slower than the preliminary estimate of 0.5 percent and the previous quarter’s expansion … “Pound Gains Even as Economic Growth Slows”

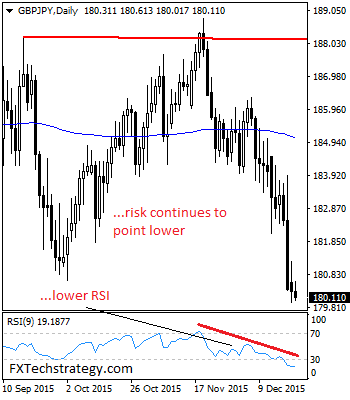

GBPJPY Faces Downside Pressure Medium Term

GBPJPY: Having continued to maintain its broader weakness, GBPJPY faces downside pressure medium term. This view remains valid while the cross trades and holds below its key resistance zone at 183.36. On the downside, support comes in at the 179.00 level where a violation will aim at the 178.00 level. A break below here will … “GBPJPY Faces Downside Pressure Medium Term”

MahiFX short-listed in FSTech Awards List

Christchurch and London based forex broker MahiFx is on the short list for the Most Disruptive Financial Sector Technology Award for their institutional product, MFX Compass. Here is more information from the official press release: Straightforward to implement into systems, MFX Compass provides small banks and brokers fast access to a scalable eFX trading business while … “MahiFX short-listed in FSTech Awards List”

USD: Don’t Fear The Fed – BofA Merrill

The Federal Reserve raised rates and the skies didn’t fall. In the following week, we do see some weakening of the dollar. What’s next? Here are some thoughts from the team at Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: Some global investors expect the US dollar will strengthen enough in 2016 … “USD: Don’t Fear The Fed – BofA Merrill”

USD/JPY: Trading the US New Home Sales Dec 2015

US New Home Sales indicator is released monthly, and provides analysts with important data the health and direction of the housing sector. A higher reading than the market prediction is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Wednesday at 15:00 GMT. Indicator Background US New … “USD/JPY: Trading the US New Home Sales Dec 2015”

Euro Gains Despite Discouraging News

The euro rallied against its major peers on Monday and retained its gains at the start of Tuesday’s trading even though news from the European Union was not especially encouraging. According the flash estimate, the consumer confidence index improved this month in the eurozone and the whole EU but remained in the negative territory. The German Producer Price Index dropped 2.5 percent in November from a year ago. On top of that all, the Spanish elections … “Euro Gains Despite Discouraging News”

Fed Hike Fails to Propel Dollar Higher

Traders are still not certain how to react to the decision of the Federal Reserve to hike interest rates. As a result, the US dollar demonstrated rather mixed performance, showing no clear trend. Initially, it looked like the Fed’s decision was very supportive for the US currency as many economists had anticipated. This resulted in uncertainty about the future of the currency despite the the gains. And indeed, the greenback struggled to keep its upside momentum, slowing … “Fed Hike Fails to Propel Dollar Higher”