Liquidity is low but currencies are certainly on the move. The team at Credit Suisse sees interesting technical behaviors: Here is their view, courtesy of eFXnews: Credit Suisse technical strategy team provide some insights on the technical setups, trade ideas and projected paths for EUR/USD, and AUD/USD. EUR/USD: Support at 1.0796/92 is holding for now, but a … “EUR/USD: Large Top; AUD/USD: Large Bearish Triangle – Credit”

Month: December 2015

Euro Holds Onto Gains Even with Uncertainty in Spain

The euro is holding on to some of its recent gains today, even with uncertainty over what’s happening in Spain. However, the euro’s gains might be short-lived, as the fate of economic reforms in Spain are in doubt, and as the US dollar is expected to gain ground in the coming year. Over the weekend, Spain held elections, and no party won a clear mandate to govern. This situation means uncertainty for what’s next for the Spanish economy. Economic … “Euro Holds Onto Gains Even with Uncertainty in Spain”

Indonesian Rupiah Rallies, Future Still Looks Bleak

The Indonesian rupiah rallied against the US dollar strongly, rising more than 1 percent today. Yet analysts are still worried that the future looks bleak for the currency. The current trading environment is adverse to riskier currencies of emerging markets due to the interest rate hike from the Federal Reserve, the drop of commodities and the economic slowdown in China. Indonesian policy makers have limited ability to support the rupiah as their foreign-currency reserves … “Indonesian Rupiah Rallies, Future Still Looks Bleak”

NZ Dollar Gains as Economic Data Helps

The New Zealand dollar rallied today, gaining on its US peer for the second consecutive trading session and rising versus the Japanese yen as well. Economic data released from New Zealand at the start of this week’s trading was beneficial to the currency. The Westpac Consumer Confidence rose from 106.0 to 110.7 this month. The reports about tourism and credit card spending were also encouraging. Now, market participants wait for the trade balance … “NZ Dollar Gains as Economic Data Helps”

EUR/USD: Trading the Final US GDP

US Final GDP is a key release and is published each quarter. GDP reports measure production and growth of the economy, and are considered by analysts as one the most important indicators of economic activity. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the Final US GDP”

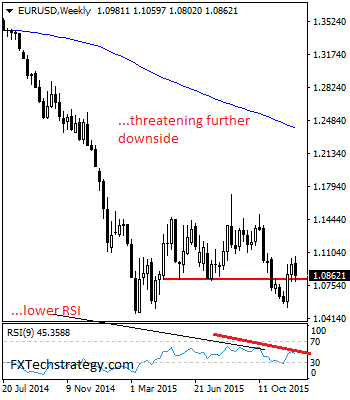

EURUSD Remains Bearish Below 1.1059 Zone

EURUSD: Except the pair sees a reversal of its past week losses, EURUSD remains bearish below 1.1059 zone, representing its Dec 15 2015 low. On the down, support is located at the 1.0800 level and if violated, expect more weakness to occur towards the 1.0750 level. Further down, support lies at the 1.0700 level where … “EURUSD Remains Bearish Below 1.1059 Zone”

The Fed & The Dollar’s Dilemma – CIBC

After the historic rate hike, what’s next for the dollar? The greenback also has an effect on the Fed. The team at CIBC explains: Here is their view, courtesy of eFXnews: The Fed hiked, but it wasn’t quite the “dovish hike” that investors were looking for, notes CIBC World Markets. “With no dissents and no … “The Fed & The Dollar’s Dilemma – CIBC”

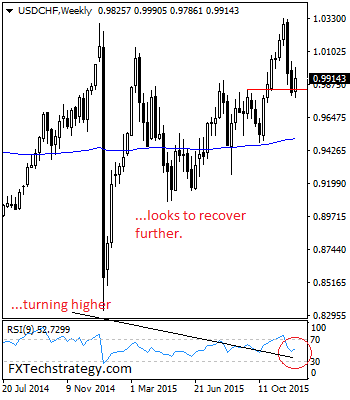

USDCHF Looks For More Strength On Recovery

USDCHF: Having halted its weakness to close higher the past week, USDCHF looks for more strength on recovery. This is coming on the back of its price halt at 0.9786 level on Dec 14 2015. A build up on that strength should call for a run at 0.9990 level where a break will set the … “USDCHF Looks For More Strength On Recovery”

US Dollar Ends Week of Fed Lift-Off with Gains, Future Unclear

The Forex market was in turmoil after the Federal Reserve’s decision to hike interest rates even though such an event had been expected by market participants. While the US dollar ended the week with gains against the vast majority of most-traded currencies, the future of the greenback is not that clear. The Federal Reserve decided to increase borrowing costs for the first time since 2006. The decision looked very bullish for the dollar, yet the currency … “US Dollar Ends Week of Fed Lift-Off with Gains, Future Unclear”

Canadian Dollar Continues to Follow Crude Oil Prices Down

The Canadian dollar ended the Friday’s trading session flat against its US counterpart. The loonie dropped against other major currencies, falling to the lowest level in three months versus the Japanese yen. As it was happening for some time lately, the Canadian currency followed crude oil prices yesterday. Unfortunately for the currency, crude is mostly going lower nowadays due to the pressure from oversupply. Prospects for an end to the US oil export … “Canadian Dollar Continues to Follow Crude Oil Prices Down”