The Australian dollar rattled and rolled, enjoying the blockbuster jobs report but with some seeing a short AUD/USD trade. The team at Credit Suisse dive into a sector sometimes overlooked in the land down under: housing. Here is their view, courtesy of eFXnews: Australia’s housing market has been one of the country’s few bright spots … “AUD: Diving Into The Housing Market; Where To Target? –”

Month: December 2015

EUR/USD: Unto The Breach; Where To From Here? – Credit

EUR/USD is certainly looking for a new direction after the ECB bounce. What’s next into the Fed? The team at Credit Suisse weighs in: Here is their view, courtesy of eFXnews: The hawkish ECB outcome – at least relative to where the market felt the central bank had guided expectations – led to EUR jumping across the … “EUR/USD: Unto The Breach; Where To From Here? – Credit”

Best Counter-Trend Technical Trade For 2016: Sell USD/CAD –

The Canadian dollar suffered from falling oil prices, but its fate could change. The team at Bank of America Merrill Lynch explain: Here is their view, courtesy of eFXnews: If USD/CAD reaches 1.39, we suggest a short trade with a stop of 1.4225 and target of 1.30. A combination of long-term exhaustion, momentum divergence and … “Best Counter-Trend Technical Trade For 2016: Sell USD/CAD –”

NZ Dollar Ends Week with Limited Losses

The New Zealand dollar ended the week with losses but they were not as big as might have been if the reaction to the central bank’s policy decision was less positive. Yet the reaction was positive, negating the big chunk of the kiwi’s decline. At the start of the week, forecasters were quite bearish on the New Zealand currency, particularly because they expected an interest rate cut from the nation’s central bank. Indeed, the Reserve … “NZ Dollar Ends Week with Limited Losses”

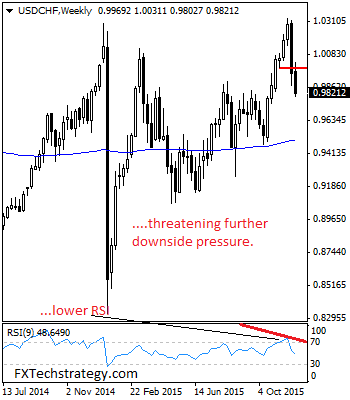

USDCHF Weakened For Second Week In A Row

USDCHF: Having USDCHF weakened for second week in a row, it now looks to extend that weakness in the new week. The present bearishness is coming on the back of its downside pressure triggered from the 1.0319 level on Nov 30th 2015. On the downside, support lies at the 0.9750 level. A turn below here … “USDCHF Weakened For Second Week In A Row”

Euro: 1.05 Support at Risk

Since the summer, market volatility has largely slowed and when we see market scenarios like these some currencies tend to perform better than others. Specifically, stability in the financial markets tends to benefit the US Dollars as forex investors are looking for safe haven stability from the world’s larger economies. This general rule has held … “Euro: 1.05 Support at Risk”

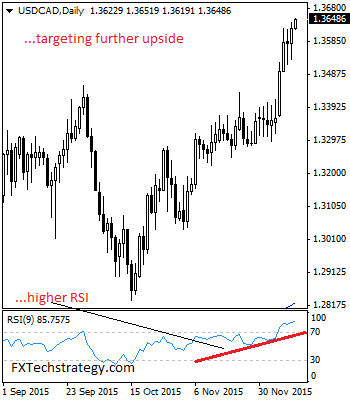

USDCAD Looks To Build Up On Its Bull Strength

USDCAD: Having continued to retain its bull pressure, USDCAD looks to build up on its bull strength. It continues to maintain its upside risk closing higher on Thursday and following during Friday trading session. On the upside, resistance resides at the 1.3700 level where a break will target the 1.3750 level. Further out, resistance comes … “USDCAD Looks To Build Up On Its Bull Strength”

Pound Rebounds vs. Dollar, Falls vs. Other Major Rivals

The Great Britain pound bounced against the US dollar after yesterday’s drop. The currency declined against other major rivals, including the euro, as the monetary policy decision of Britain’s central bank continued to weigh on the sterling. Yesterday, the Bank of England kept its interest rates and the size of asset purchase program unchanged. The accompanying statement was considered to be rather dovish by market participants, resulting in weakness of the pound. Now, traders wait for next … “Pound Rebounds vs. Dollar, Falls vs. Other Major Rivals”

Euro Continues to Gain Steam

Euro continues to gain ground today, heading higher against other major currencies. Euro is improving, and some forecasters have revised their expectations for next year’s performance. Thanks to the latest ECB decision that didn’t live up to expectations for exotic attempts to continue easing, the euro is heading higher right now. Even with somewhat anemic French economic data, the euro is still forging ahead against … “Euro Continues to Gain Steam”

Greenback Pulls Back as Traders Consider the Future

US dollar is lower today, dropping as Forex traders and analysts consider what’s next and try to look ahead to 2016. Even though the greenback is lower today and set to end the week with losses, there are some expectations that 2016 might be the year of the dollar. For now, the dollar is down as Forex traders have, for the most part, already priced in the expected Fed rate hike next week. Uncertainty … “Greenback Pulls Back as Traders Consider the Future”