The Australian dollar dropped today, falling more than 1 percent against its major peers and erasing its previous gains, as traders continued to anticipate an interest rate hike from the Federal Reserve. Yesterday, the currency jumped due to a positive employment report. Australian employment expanded by 71,400 jobs in November instead of falling by 10,000 as was predicted by analysts. Furthermore, the unemployment rate ticked down by 0.1 percentage point to 5.8 percent … “Aussie Erases Gains Cause by Amazing Employment Data”

Month: December 2015

A Hike Is A Hike; Stay Long USD Into FOMC – BNPP

Many suspect that the expected Fed hike is already priced in, leading to a “buy the rumor, sell the fact” reaction. Is it really so? Here is the view from BNP Paribas: Here is their view, courtesy of eFXnews: BNP Paribas expects the US Federal Reserve to hike rates by 25bp on Wednesday (16 December) and … “A Hike Is A Hike; Stay Long USD Into FOMC – BNPP”

Time To Enter AUD/USD Short – Deutsche Bank

The Australian dollar enjoyed better employment data, among other events, to move higher. Nevertheless, in the bigger picture, the team at Deutsche Bank sees room for the downside: Here is their view, courtesy of eFXnews: In a note today, Deutsche Bank advises clients to consider entering strategic short AUD/USD position from here targeting a move … “Time To Enter AUD/USD Short – Deutsche Bank”

NZ Dollar Higher After RBNZ Cuts Interest Rates

The New Zealand dollar gained after the Reserve Bank of New Zealand cut interest rates during its policy meeting at the end of yesterday’s trading session. The RBNZ reduced its key interest rate by 25 basis points to 2.5 percent, matching market expectations. The policy statement was not entirely positive for the NZ dollar as Governor Graeme Wheeler complained about the strength of the currency: The New Zealand dollar has risen since … “NZ Dollar Higher After RBNZ Cuts Interest Rates”

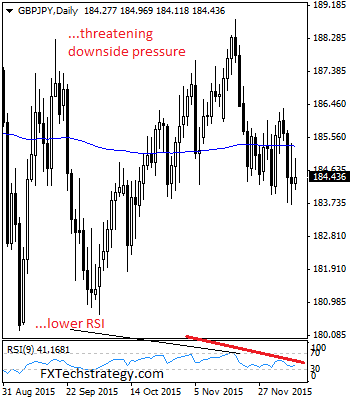

GBPJPY: Price Weakness Seen On Loss Upside Momentum

GBPJPY: With price weakness seen on loss upside momentum, further bear pressure is envisaged in the days ahead. This view remains valid as long as GBPJPY trades and holds below the 185.38/186.34 resistance zone. On the downside, support comes in at the 184.00 level where a violation will aim at the 183.00 level. A break … “GBPJPY: Price Weakness Seen On Loss Upside Momentum”

Long USD trade getting tired; Fed doesn’t want to be

Simon Smith, Chief Economist for FX Pro, joined Zak Mir and Bill Hubard, Chief Economist for Bullion Capital, on the Tip TV Finance Show to discuss the fallout from the ECB meeting, and a view ahead to the assumed Fed interest rate hike next week. Key Points: Smith noted that people are now looking beyond … “Long USD trade getting tired; Fed doesn’t want to be”

Japanese Yen Continues Solid Performance Following GDP

Japanese yen continues to gain ground today, thanks in part to the positive GDP data released earlier this week. Without expectations of further Bank of Japan cuts, the yen is doing well against its major counterparts. Earlier this week, Japan revised its third quarter GDP reading to 1.0 per cent year over year, which exceed expectations of 0.1 per cent. The expansion of the economy by 0.3 per … “Japanese Yen Continues Solid Performance Following GDP”

Euro Pulls Back and Consolidates After Recent Gains

Euro is pulling back a bit today, consolidating after recent gains. The 19-nation currency has been seeing better performance since last week’s policy announcement from the ECB, and today it appears that it’s time for a bit of a break. Last week, the European Central Bank delivered an announcement that didn’t meet anyone’s expectations. As a result, the euro has been gaining ground the last few days. From reaching … “Euro Pulls Back and Consolidates After Recent Gains”

The Case For Staying USD Bulls Into FOMC – Goldman Sachs

The US dollar suffered a short squeeze despite an advance in the odds for a rate hike. Does this build into a rise on the Fed December Decision? The team at Goldman Sachs makes the case for staying bullish: Here is their view, courtesy of eFXnews: “Next week, we expect the Fed to announce its first … “The Case For Staying USD Bulls Into FOMC – Goldman Sachs”

Best Contrarian Trade: Buy S/T EUR/USD Upside – BofA

EUR/USD has extended its recovery after a few days of consolidating the Draghi Disappointment. Does it have more room to the upside? The team at Bank of America Merrill Lynch explain: Here is their view, courtesy of eFXnews: Buying EUR/USD short-term upside is our top contrarian trade in the year ahead. It looks much less … “Best Contrarian Trade: Buy S/T EUR/USD Upside – BofA”