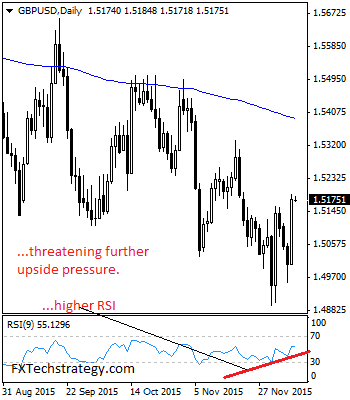

GBPUSD: Having rallied strongly to reverse its three-day weakness to close higher on Wednesday, GBPUSD faces further bullish offensive. This development leaves more upside threats likely towards the 1.5200 level. Support lies at the 1.5100 level where a break will turn attention to the 1.5050 level. Further down, support lies at the 1.5000 level. Below … “GBPUSD Faces Further Bullish Offensive”

Month: December 2015

BNP Paribas’ Top FX Trades & Market Drivers For 2016

2016 is around the corner, and we already asked the question: will the dollar rise or turn down? After providing the ideas from BofA, here are interesting ideas and targets from BNP Paribas. And despite the recent euro-rally, EUR/USD parity is still on the radar: Here is their view, courtesy of eFXnews: “We expect policy divergence … “BNP Paribas’ Top FX Trades & Market Drivers For 2016”

ECB running out of available action, Fed 2016 trajectory

Neil MacKinnon, Global Macro Strategist for VTB Capital, joined Zak Mir and Mike Ingram on the Tip TV Finance Show to discuss the reaction to the ECB meeting and the assumed Fed rate hike and trajectory of tightening into 2016. Key Points: MacKinnon noted that even though the deposit rate was cut and QE was … “ECB running out of available action, Fed 2016 trajectory”

Greenback Falters on Commodities and Interest Rate Revolt

The US dollar is struggling today, faltering as commodities move a little higher, and as it appears that there could be a revolt against higher interest rates from the Federal Reserve. For the past couple of months, the expectation has been that the Federal Reserve will raise interest rates at its meeting later this month. However, now it appears that there is a growing number of economists, analysts, and pundits that … “Greenback Falters on Commodities and Interest Rate Revolt”

UK Pound Gets Boost on Forecasts

UK pound is mostly higher today, getting some help from better performances by commodities, as well as improved forecasts for next year. Sterling is moving mostly higher today as most of the market awaits an announcement from the Federal Reserve. With commodities regaining some lost ground, high beta currencies and commodity currencies are getting a little help. UK pound is also getting some help from the better … “UK Pound Gets Boost on Forecasts”

Will the US dollar continue higher in 2016?

The US dollar enjoyed two years of substantial strength on monetary policy divergence from the rest of the world. And now, when the historic rate hike is basically around the corner, with more to come, will it continue rising? Here are the arguments for a stronger USD, for a weaker one and also a speculation for the … “Will the US dollar continue higher in 2016?”

NZ Dollar Follows Aussie in Decline

The New Zealand dollar behaved quite similar to its Australian counterpart during the Tuesday’s trading session, falling despite positive domestic macroeconomic data. The New Zealand dollar was hurt by China’s trade data, the same as the Australian dollar. And similarly to the Aussie, the kiwi was in decline for the second trading session. It is worth mentioning, though, that the losses were relatively small. NZD/USD declined from 0.6641 to 0.6622 as of 12:07 GMT … “NZ Dollar Follows Aussie in Decline”

On Expectations and Disappointments in EUR, USD and Oil

We start off by explaining the big Draghi Disappointment (and what could reverse the moves), the critical developments for a rate hike in the US, continue with slippery oil and sign off with the next events ahead. You are welcome to listen, subscribe, provide feedback and pledge support on Patreon. Draghi Disappointment: Draghi giveth and Draghi taketh away. … “On Expectations and Disappointments in EUR, USD and Oil”

Aussie Down After China’s Trade Surplus Shrinks Yet Again

The Australian dollar fell for the second day in a row today as China’s trade data was disappointing yet again. Economic data from Australia itself was positive but was unable to support the currency. China’s trade surplus fell in November for the fifth straight month as both imports and exports declined. It is a bad sign for Australia as the Asian nation is the major destination for Australian goods. On a positive note, National Australia Bank … “Aussie Down After China’s Trade Surplus Shrinks Yet Again”

AUD/USD: Trading the Australian jobs Dec 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Dec 2015”