USD/CAD has reached highs last seen in August 2003, 12.5 years ago, at nearly 1.42. But are we nearing an end of these gains? Here is an opinion from CIBC:

Here is their view, courtesy of eFXnews:

We’ve had a bearish near-term outlook on the Canadian dollar since mid-2014, admittedly one that we’ve had to move the goalposts on several times over the period. Each time we approached our target, we saw every reason for those long the US$ against the loonie to retain that position, given the track for commodity prices, interest differentials, and the need for Canada to shift growth towards exports from a longin-the-tooth housing run.

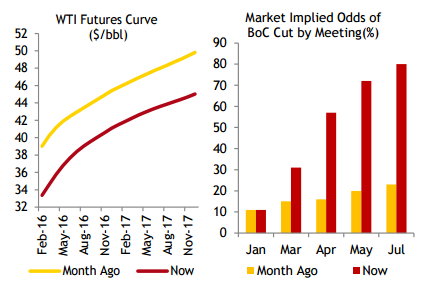

Once again, we find ourselves closing in on our target, in this case, one set at the magic 70 cent US mark. But this time is different, in that most of what could hurt the C$ is now priced in. Another rate cut by the Bank of Canada is nearly fully priced into OIS futures. Weak oil, ditto (Chart). True, we’re more hawkish on the Fed than the futures market, a negative for the C$ on its own. But that’s because we’re not as downbeat as the current mood appears to be over US and global economic prospects. For the Fed to hike rates through 1% by year end, the economic climate would likely have also supported at least some turn in resources, protecting the loonie.

One of those pearls of trading wisdom, warning not to try to catch a falling knife, can often be the case in FX markets. Previous periods of Canadian dollar weakening or strength have sometimes featured a week, or even a day, at a level several cents off the monthly average. So even if the worst is close at hand for the Canadian dollar’s monthly average, day traders going long the loonie could still face a painful loss.

But for those with longer horizons, it might soon be time to rethink. Canadian equity fund managers could stay long the S&P, but might want to hedge more of the FX risk inherent in those positions, taking some of the profit on the currency gains they’ve reaped. Exporters that have benefited by letting the dice roll might now think about locking in a larger portion of future revenue streams back into C$’s, or using options to protect against a C$ rebound. In contrast, importers that have been wise enough to fully shelter themselves against the tumbling loonie could restructure their hedges to a less-costly approach that protects only against larger adverse swings in the C$ and allows for participation in some of the benefits that would accrue if our currency recoups a few cents.

And, let’s be clear, it is only a few cents that are likely to be on the table. Even if oil recovers, for the next few years, it’s unlikely to move far enough to rekindle much capital spending in Canada. US shale oil projects will come back on line first, delaying the next leg of any price recovery. If Canada is going to rebalance its economy towards non-resource exports and related capital spending, we’re going to need a 70-75 cent exchange rate to prevail long enough to influence new business location decisions. That horizon stretches out years, not months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.