Risk aversion remains the name of the game, with the yen standing on one extreme while CAD and AUD are on the other side. The team at Barclays analyzes what’s going on:

JPY: Global risk sentiments to remain the main driver of the JPY

Here is their view, courtesy of eFXnews:

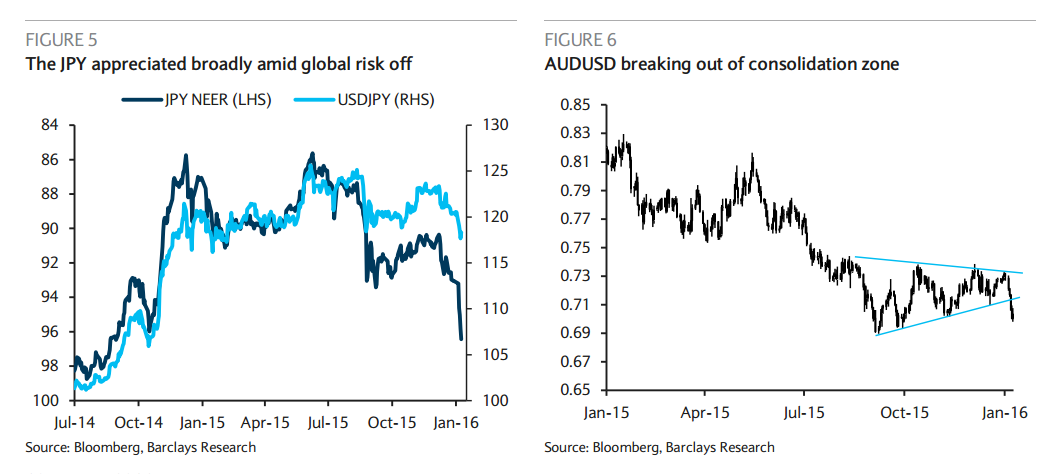

Amid a sharp deterioration in global risk sentiments, the JPY outperformed other currencies on flight-to-quality bids since the beginning of 2016. USDJPY has fallen close to 117, or the lowest level since last August, while the JPY NEER reached the pre-QQE2 high (Figure 5). Fluctuations in global risk sentiments will likely remain the main driver of the JPY this week. Further weakness in global equity markets may drive USDJPY lower to test 115, the resistance level held since the BoJ delivered QQE2 in October 2014.

In terms of economic releases in Japan this week, November Machinery Orders (Thursday) should paint the latest picture on investment outlook. We expect core machinery orders to have decreased -8.7% m/m (consensus: -7.3%), payback from a solid October reading of +10.7%. Elsewhere, we expect December PPI (Thursday) to have fallen 3.5% y/y (consensus: -3.5%). The focus will be on the recent declines in import prices of food, whose impact on CPI will also be closely watched.

CAD: No respite for the loonie

The Canadian dollar continues trading on the weak side as oil prices reached new lows. There seems to be no catalyst for a rally in oil prices as supply continues to be more than enough, and the demand outlook worsens amid concerns about the outlook for global growth. We think that momentum will continue dominating the price action energy space and that risks are tilted towards lower prices. Therefore, even after a sharp rally in USDCAD, we think there are upside risks ahead. We would be more cautious adding short CAD positions as the market already prices around 40bp of a cut in the year to come and USDCAD looks a bit overbought on charts.

There are no major releases for Canada next week except for Finance Minister Morneau’s speech in Montreal. We would look for further details regarding the fiscal stimulus that lies ahead.

AUD: Breaking out of consolidation

The AUD has been the worst performing G10 currency YTD, as weak China and US PMI prints, CNY depreciation, lower commodity prices and the global stock market turmoil have weighed on the currency. Spot AUDUSD has fallen below the upward trend line (Figure 6) that demarcates the lower bound of the choppy ranges from September to December, and our technical strategist thinks the move below our targets near the 0.7015 November lows would signal further downside.

Fundamentally, we see AUDUSD at 0.63 at end-2016 as any hawkish repricing of RBA rate expectations will likely be outweighed by the drop in terms of trade, as well as the likely narrowing of the AU-US policy rate differential as the Fed hikes rates.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.