The Australian and New Zealand dollar both suffered from the “risk off” sentiment, but there may be more in the pipeline. The team at Deutsche Bank explains:

Here is their view, courtesy of eFXnews:

In a strategy note, Deutsche Bank advises clients to sell AUD/USD, and NZD/USD arguing that Chinese depreciation and deteriorating basic balances should continue to weigh on the Antipodes along with domestic risks which are skewed to the downside.

The following are the main points in DB’s rationale behind this call:

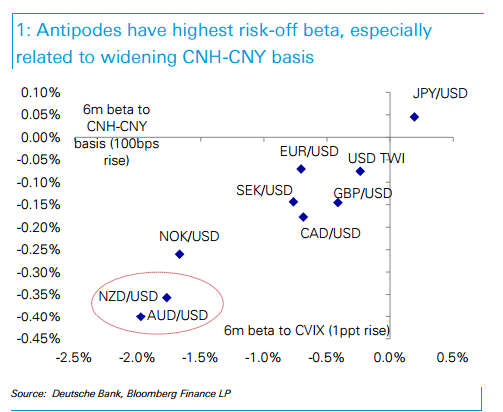

1- China a major negative for Antipodes. “The Antipodes are most vulnerable to China currency weakness in all of G10 FX. To start with, CNY has comparatively large weights in both Australia and New Zealand’s trade-weighted FX baskets making these central banks and economies sensitive to ongoing yuan depreciation. More interestingly, CNY weakness can have a disproportionate impact on the commodity outlook on which both of the Antipodes depend: Chinese commodity producers earn windfall gains whenever CNY weakens, because their earnings are priced in dollars. This pushes down the breakeven price of their commodity production, prolonging Chinese high-cost commodity production and generating additional downward pressure on commodities. The real Achilles’ heel for AUD and NZD is financial flows however. These are likely to come under pressure regardless of Chinese policy. If RMB depreciation remains aggressive, this will remain negative for risk and the Antipodean carry trade in particular. If the PBoC intervenes against outflows more decisively, however, AUD specifically would still suffer, because the PBoC would sell AUD on reverse reserve rebalancing demand. Either way, this is not a bullish environment for the Antipodes,” DB argues.

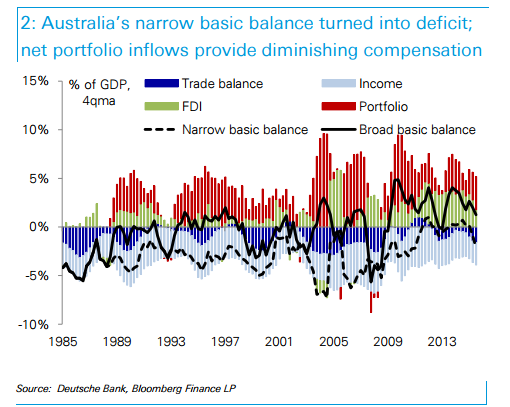

2. Basic balances an increasing drag. “The outlook for the Antipode’s basic balances looks grim. We see little realistic scenario in which export revenues can bounce materially. In New Zealand, the threat of El Nino pushing up prices has diminished after a fortnight of rain. Over in Australia, key export prices of iron ore and coal could only be lifted by accelerating Chinese steel production, of which we see no signs. Meanwhile, import compression is insufficient relief.

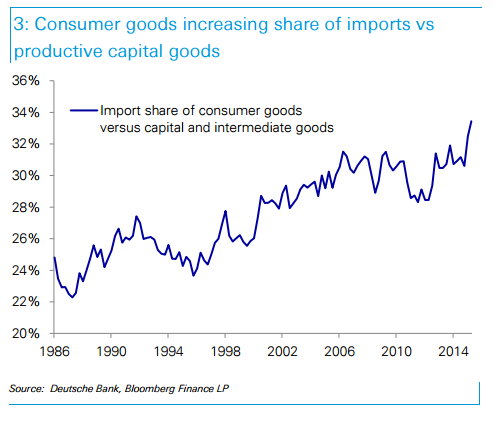

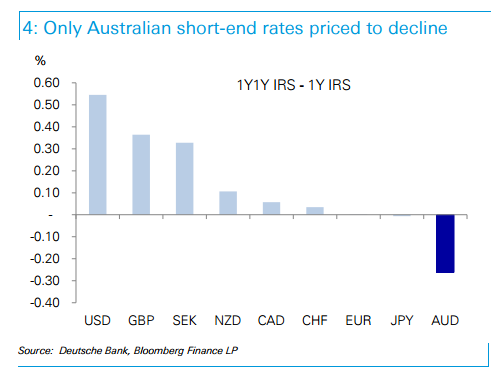

Trade weakness should increasingly weigh on the currencies since foreign investment is harder to come by. FDI inflows no longer finance either economy’s overconsumption, and portfolio inflows are at risk of reversing unless accommodated by further depreciation. In Australia, the structural decline in mining investment has permanently reduced the supply of new equity financing. A large chunk of net FDI investment today consists of ‘retained earnings’. New FDI inflows barely cover the dividends Australia pays foreigners on their net FDI assets, let alone a trade deficit that is increasingly driven by imports of consumer goods rather than capital goods (chart 3). Adding net portfolio inflows renders the basic balance positive, but precariously so. Reserve managers in China as well as oil-producing nations likely remain large suppliers of Australian fixed income. Weighty private investors such as Japan’s GPIF tend to be more price-sensitive than reserve managers traditionally diversifying into AUD, and their demand may be peaking along with the rate differential (figure 4).

Unlike Australia, New Zealand retains a small trade surplus, but it pays foreigners 4% of its GDP in investment income, almost four times more than it could attract in FDI inflows over the past year. Portfolio flows are insufficient to fill the gap. While New Zealand’s basic balance has long been in deficit, some FX demand previously came from reinsurance settlements. Yet these payments, formerly hidden in the ‘net errors and omissions’, have now been settled. The errors and omissions in the BoP statistics remain enormous, not least due to (Chinese) property inflows. While anecdotally these inflows continue, current Chinese policy regarding capital outflows makes it unlikely for now that inflows would accelerate. Hence, as New Zealand lives above its means, it increasingly accumulates financial liabilities that come with no tangible, FX-relevant inflows,” DB adds.

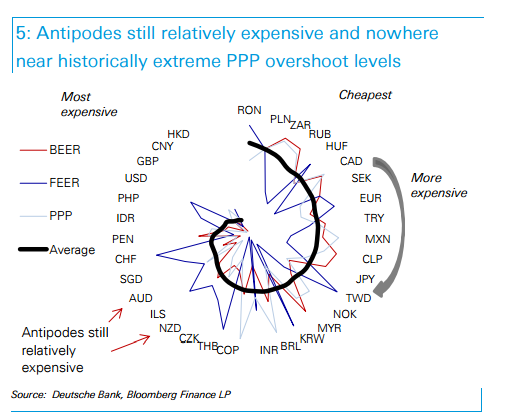

3. Positioning and valuations favourable as well. “Despite some downside skew in the options market, positioning is more favourable for shorts in both AUD and NZD than in a long time. Kiwi positioning is marginally long on the IMM. And while some core AUD shorts have proved resilient, the trade is far less crowded than in the second half of last year. Moreover, despite significant depreciation in the past year both Antipodes remain expensive on our BEER and PPP models relative to most of the FX universe. Both are close to PPP and have a long way to go before reaching overshoot levels observed in the past,” DB notes.

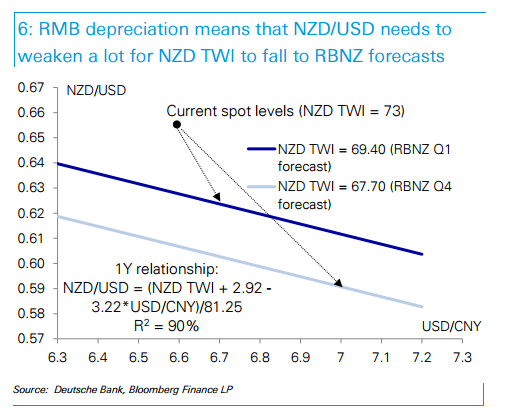

4. Domestic risks skewed to the downside. “We see little upside risk to the currencies from the rates markets, which price no full cut from either Reserve Bank in 2016. While our economists also see both Banks on hold in the coming months, risks are skewed to the dovish side. The RBNZ in particular may soon opt for jawboning in light of the strong TWI jeopardizing their inflation forecasts. Depreciation in NZD/USD needs to be very large indeed if the higherweighted CNY depreciates at the same time. The TWI falling to the RBNZ’s end-2016 forecast 0f 67.7 and CNY rising to 7 implies 0.59/USD, all else constant. The end-Q1 forecast implies 0.62/USD if CNY rises to 6.80,” DB adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.