The European Central Bank meets for the first time in 2016, and it certainly is under a lot of pressure, from various angles. The team at Barclays analyzes:

Here is their view, courtesy of eFXnews:

We expect the ECB to ease policy further in 2016 as deflationary pressures worsen. However, we think new measures are unlikely to be deployed before June, unless we see another bout of (REER) euro appreciation or a further significant drop in inflation expectations.

Monetary and Financial conditions have deteriorated again after the ECB failed to convince the market that measures announced at the December meeting would be sufficient to bring inflation back closer to its target. The deterioration is worsening at the start of 2016 as a result of stock markets jitters and the further depreciation of the CNY.

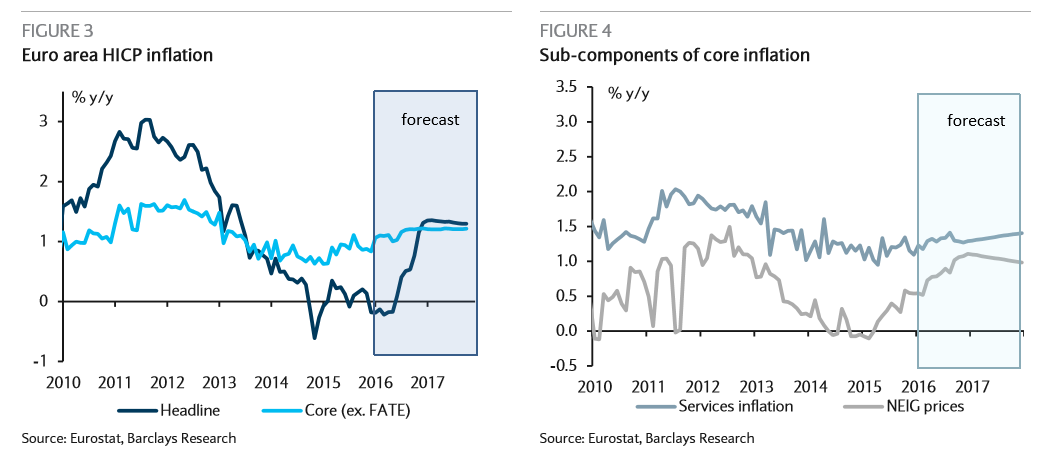

We now expect inflation to return to negative territory between February and July 2016, picking up thereafter as a result of base effects, but averaging only 0.1% for the year as a whole (vs. 1% in the ECB’s December projections). This will put pressure on the ECB to announce another round of monetary easing measures.

As part of the semi-annual review of the Asset Purchase Programme, which will likely take place in March, the Governing Council (GC) may decide to expand the pool of eligible assets and include more corporate bonds, in order to offset the risk that it encounters volume constraints on the purchase of covered, ABS and Supranational bonds.

Another depo rate cut is a possibility. However, we think that there is a risk of a negative impact on banks, which the ECB has to factor in. We think the ECB will likely wait several months to see the impact of its last cut, and we do not envisage such an option before June.

The same applies to QE: after the measures announced in December, the ECB is likely to wait before adjusting the size or the timeframe of its asset purchase programme. Given the market constraints that we review in this report, we think an increase in the monthly pace of asset purchases is less likely and would require further deterioration in the inflation outlook. Furthermore, the accounts of the ECB’s December meeting suggest that another 10bp depo rate cut may face less resistance at the GC than QE extension.

The ECB is approaching the limits of what it can realistically deliver in order to comply with its mandate to ensure price stability. Whether it decides to make another depo rate cut, give more explicit forward guidance, or extend QE, the impact on inflation, in our view, is unlikely to be sizeable. Fiscal and structural policies at the euro area and country level will need to be put in place, as President Draghi has repeatedly said at each press conference.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.