Comments coming out form the Fed suggest more hikes this year, and a general sense of stability. This comes in contrast to the worrying economic indicators and falling stock markets. This may turn against the dollar, warns CIBC:

Here is their view, courtesy of eFXnews:

Recent speeches suggest that most Fed officials are still keen to keep going with rate hikes, and the strong payroll figure certainly didn’t do much to dispel that.

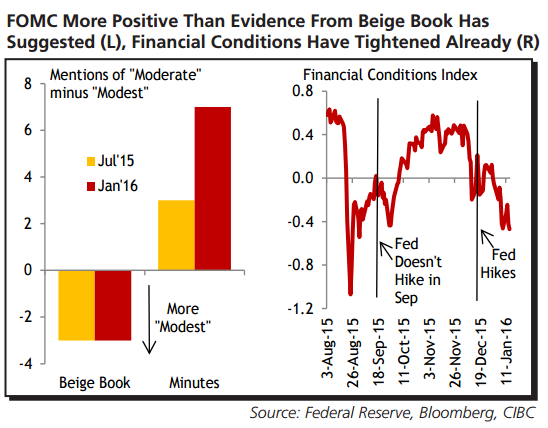

However, other evidence suggests that the Fed may be overly optimistic in its assessment of the economy and how many hikes it will be able to conduct this year. The beige book continues to point towards “modest” rather than the slightly stronger “moderate” pace of growth the FOMC cites.

And with spreads widening, equity markets down but the US$ up, financial conditions have already worsened and enacted a de-facto tightening of policy. While a hike in March is still our base case, a pause after that would see the US$ lose momentum.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.