The initial crash in oil prices caused a big drop in inflation. While oil prices are certainly pressured, the huge fall seen in late 2014 is already over a year behind us, changing the “base effect” behind. That is going to be the talk and what moves currencies:

Here is their view, courtesy of eFXnews:

“The one-year anniversaries of the 31 October 2014 Bank of Japan (BoJ) surprise easing, the December 2014 OPEC meeting and the 22 January 2015 European Central Bank quantitative easing announcement are past or soon will be, and so the effects of these events are rapidly dropping out of year-on-year comparisons. Stabilisation of the USD at high levels or oil prices at low levels will be of little comfort for US exporters and for oil producers. However, for central banks focused on meeting year-on-year inflation targets, the disappearance of base effects can be very important and could encourage further policy divergence in 2016,” BNPP notes.

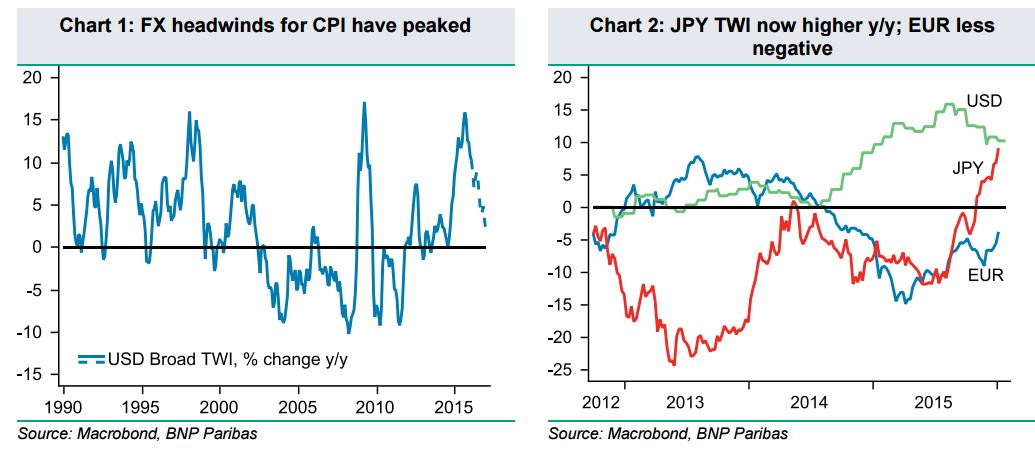

Year-on-year gain in the USD has already peaked and will probably fall further:

“For the USD, the passing of the anniversary of big USD moves in late 2014 has already begun to damp the year-on-year rise in the Fed’s broad trade-weighted index (TWI). At the time of the September 2015 FOMC meeting, when the central bank left policy unchanged, citing international headwinds, the year-on-year rise in the Fed’s broad TWI exceeded 15%. However, by December, this headwind had moderated to 11% y/y. By the March 2016 meeting, the rate should have moderated further to just 5% y/y – even on our bullish USD forecasts – and by September, to less than 2%. The implication is that the Fed should be considerably less worried about the effects of FX headwinds on inflation. Indeed, Fed chair Janet Yellen made this very point in her December post-FOMC press conference,” BNPP adds.

Strong base effects will fade for European and Japanese inflation:

“FX is, of course, a zero sum game, and the moderation in USD year-on-year gains over 2016 will also mean that economies with year-on-year declines in their FX rates, which supported their year-on-year inflation rates, will see this boost fade. For example, just after the ECB’s QE announcement in Q1 2015 the EUR’s effective exchange rate was down 13% y/y. Since then the EUR’s decline has shrunk to 6% y/y and if the EUR TWI were to remain at its current level, it would show a year-on-year rise at the end of Q1 2016 for the first time since H1 2014.

The loss of FX support for EUR inflation is likely to be a concern for the ECB as it struggles to raise the headline inflation rate back towards 2%, increasing the prospects for further ECB easing in the coming months,” BNPP argues.

Effective JPY rate is now showing a rise in year on-year terms.

“The swing is even sharper in the JPY, which has seen the change in the BoJ effective exchange rate swing from -12% y/y as of May 2015 to +9% y/y currently. Base effects dynamics for the JPY are being enhanced by the yen’s outperformance in early 2016, as it even outperforms other funding currencies. Our central expectation remains for stable BoJ policy this year, although continued yen outperformance would increase the chances of further BoJ easing, particularly as yen front-end yields are now at a premium to rates for a number of European currencies,” BNPP adds.

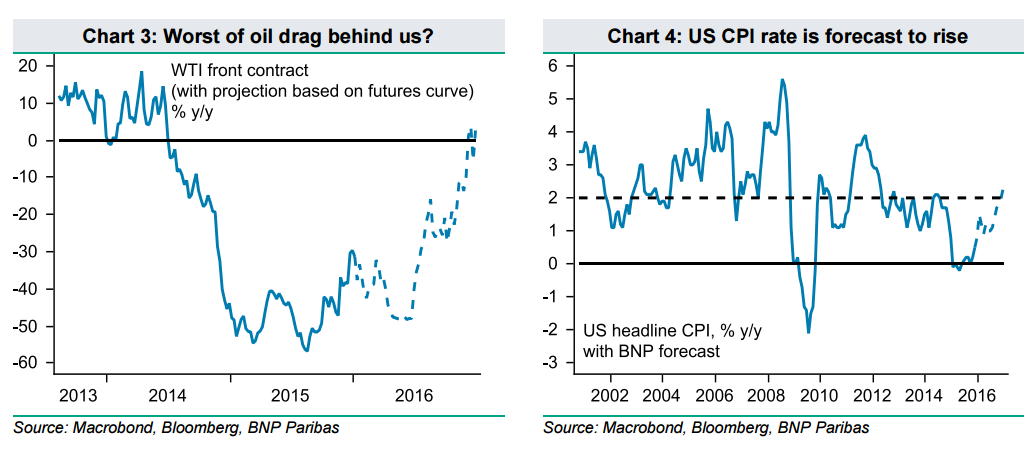

Oil has continued to weaken but base effects means annual fall has moderated.

“Base effects are also evident in commodity prices, which have now been declining broadly for well over a year. The year-on-year decline in the WTI oil price troughed in August 2015 at -60% and has now moderated to -32%, even with the latest leg lower in crude prices. To be sure, this is still a significant headwind to inflation. Even if prices recover modestly in line with the futures curve, we will still see the year-on-year change fall back again towards -50% by mid-2016 before trending towards flat during H2 2016. However, the biggest negative impact on the headline CPI rate of the crude oil price fall is very likely behind us, as it would take a decline in WTI to USD 22/bbl in the next six months to lower the year-on-year rate back to its 2015 lows.,” BNPP projects

US CPI rate likely to rise on a year-on-year basis in Q1.

“Taking all this together, our economics team recently updated their projections for US core and headline CPI inflation, taking into account the latest oil price falls and the stabilisation in the USD. The headline CPI (NSA) rate troughed at -0.2% y/y in April 2015 and we expect it to reach 1.5% in January, moderate to 0.9% in March and hold at or above 1% for the rest of the year. Core CPI inflation is expected to hold at or above 2% for all of 2016. The numbers should be sufficient to allow the Fed to move forward with quarterly rate hikes through Q3, provided labour market indicators remain solid,” BNPP adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.