After the yen strengthened quite a bit, we heard different tunes from the BOJ and the government, willing to act and feeling uncomfortable with the strength of the yen. But will they act? Here is the view from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

Main focus on assessment of downside risk BoJ. The next BoJ monetary policy meeting is scheduled for 28-29 January. Since the last meeting the risk scenarios that the BoJ previously warned about have started to materialize. Though at the upcoming meeting we expect the BoJ to stay on hold while keeping a close eye on the market and moves by governments such as China, we maintain our view that the BoJ is likely to ease further during 1H 2016, probably around March or April.

The BoJ is shifting to a new monetary policy meeting schedule this year consisting of eight meetings (down from 14 until last year). Of these, at four meetings (January, April, July and November) the BoJ will also release its Outlook for Economic Activity and Prices report. We expect the upcoming Outlook report to acknowledge the downside risk to growth forecasts, but maintain its outlook for a continued domestic demand-led recovery and only make minor adjustments. On the other hand, on the prices outlook we think the BoJ is likely to lower its FY2016 consumer price inflation forecast (ex-fresh food) from 1.4% into the 1.0% range, which is likely to be ascribed to the bigger-thanexpected decline in oil prices. We expect market focus in the Outlook report and postmeeting press conference by BoJ governor Haruhiko Kuroda to be on 1) how the BoJ views the current state and outlook for exports, and 2) whether the BoJ cites any other reasons for lowering its inflation forecast besides oil, such as slower-than-expected wages growth.

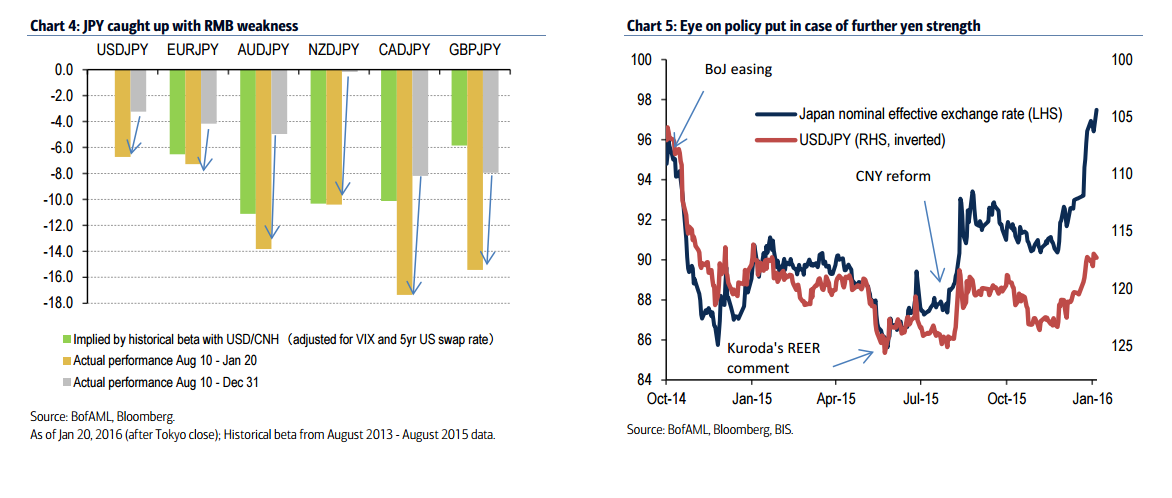

Additional easing in March or April our main scenario: We think three factors in particular are being focused on by the BoJ in monetary policy decisions, namely: 1) conditions overseas and in financial markets (particularly forex); 2) inflation expectations and wages trends; 3) the capex trend. On capex, we believe the BoJ remains fundamentally optimistic, despite the sharp YoY decline in machinery orders in November, as this can be attributed to a reaction to the sharp growth in September and October, and due to growth in planned capex reported in the December Tankan. However, as a result of the rising risk-off mood in the markets amid uncertainty over the Chinese economy and the steep fall in oil, the yen has started to strengthen. Now USD/JPY is lower than the average forecast (¥119.40) of large manufacturers in the December Tankan, and this could be starting to have a negative impact on corporate profits. Moreover, as the trend for EM currencies to weaken versus USD has become clearer since China embarked on its change in currency policy since August, the yen’s effective exchange rate, a weighted average measure of its strength versus other major currencies, has strengthened even more than the actual USD/JPY rate. The effective exchange rate is now higher than in 31 October 2014, when the BoJ strengthened its QQE policy. In other words, the effective exchange rate is telling us that the yen weakening impact of the additional easing carried out in October 2014 has been more or less entirely negated. As the effective exchange rate tends to show up in core-core consumer prices (ex- energy and fresh foods) at an around one-year time lag, continued yen strengthening would raise concerns of a drag on inflation from 2H 2016.

The trends in inflation expectations and wages could also pose some concerns for the BoJ.Though the number of respondents expecting inflation of at least 2%, in the oneyear forward price forecast in the Consumer Confidence Survey, remain in the majority at 51.9% in the latest December survey, the downward trend has been gathering momentum. Meanwhile the proportion saying inflation will be under 2% or no change has risen to 38.9%. Although to some extent a result of the decline in oil prices, the fact that household inflation expectations are back where they were before the introduction of QQE (in April 2013) cannot be ignored.

The BoJ also released its latest Regional Economic Report (Sakura report) on 18 January 2016, containing an assessment of jobs and wage conditions in each of Japan’s regions. According to the report, while labor shortages are increasingly being felt around the country, wage increases have been “in recent years mainly occurring in urban based companies,” and while bonuses are increasing, base salary increases spreading steadily and hourly rates for non-full time employees increased across many regions, on the other hand there remains substantial caution in raising salaries “particularly at regionally-based SMEs.” On the outlook, the report states that “supply/demand conditions in the labor market are likely to remain tight for the time being. Despite which we are not yet seeing any increase in moves by companies to raise salaries in FY2016.” The BoJ also appears to be starting to recognize that wage growth is possibly lacking momentum. This makes the outcome of the 2016 spring wage negotiations, effectively underway since the 19 January policy announcement by employers’ association Keidanren, all the more important.

In light of the above, the possibility that the BoJ will loosen monetary policy further in 1H 2016 has increased in the past month, in our view. However, as a central bank the BoJ does need to avoid over-reacting to short-term trends in the stock market, and with the current market concerns being mainly due to overseas factors, we believe the BoJ will need more time to assess the policy reaction of the Chinese authorities and US economic data. Also, by March it should have various other data on which to assess the trend in salaries, including the outcome of the 2016 spring wage negotiations (most settlements being made by mid-March), the trend in winter bonus payments (December monthly data is for release on 8 February), and January onward wages data free of sample bias (for January due for release on 4 March). Given the size of the volatility in financial markets and time-lag before monetary policy works its effects, our main scenario is for additional BoJ easing in March or April, though we cannot entirely rule out the possibility of additional easing at the upcoming meeting.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.