After the Carney Carnage, the BOJ’s beating of the yen and Draghi’s dovishness, many expect the Fed to send a dovish message and to weaken the dollar.

This may not be the case. Here are two opinions:

Here is their view, courtesy of eFXnews:

SEB:

After the fireworks in December, we expect only small changes to the January FOMC statement. With no formal forward guiding with respect to the plans for the next rate hike, the March FOMC meeting is expected to remain a “live” meeting. Back in December, when the Fed hiked rates for the first time since 2006, the Fed was looking for the next hike at the March meeting and for a total of four hikes in 2016. With respect to 2017, another four 25 basis point hikes was the baseline. Amid the plunge in oil prices and other risk assets since the turn of the year, the future market is now pricing in less than one hike for 2016 as a whole. Back in December, the market was looking for 2 additional hikes both in 2016 and 2017.

With respect to the March meeting, according to market pricing the probability of a hike is around 20% now compared to 45% a month ago. Tighter financial conditions mean less need for actual rate hikes and we are looking for the Fed to take it easy and assess the situation for a while. As such, our forecast is for the next 25 basis point hike in June, followed by hikes in September and December.Higher wage growth will ultimately force the Fed to resume the tightening cycle.

While the factory sector is weak, the domestic economy is doing well and there is a potential for consumer spending to surprise to the upside in 2016. The labor market is getting drum tight so this year higher wage growth will finally materialize according to our forecasts. While less inventory buildup and weak exports have depressed Q4 real GDP growth the weakness is likely temporary and those looking for the Fed to signal that a March hike is off will likely be disappointed.

That said, it will be interesting to see how the Fed describes the recent financial market volatility without voicing too much concern. In the December FOMC statement the “monitoring global economic and financial developments” was taken out but given the circumstances it is prudent to incorporate such wording again. The “balanced” risks to the outlook in December may be replaced with “nearly balanced” without ruling out a March hike.

BNP Paribas expects the Federal Reserve to keep rates unchanged at its 26-27 January meeting.

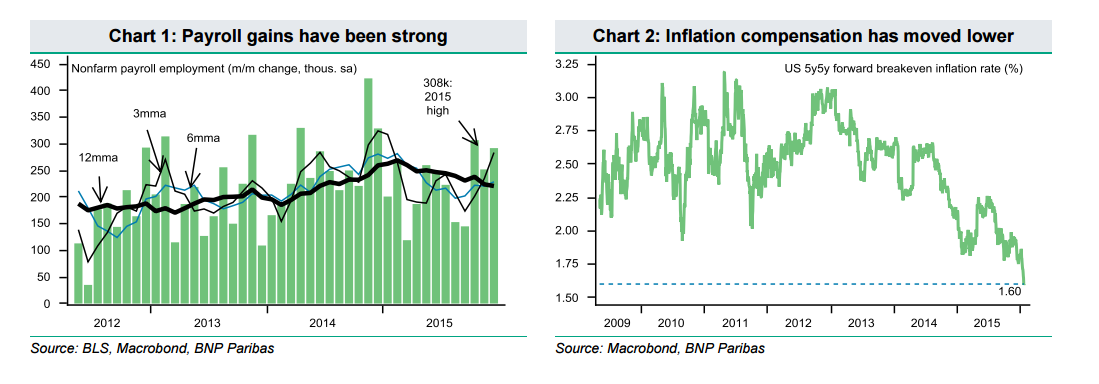

“While January’s policy statement is likely to acknowledge some softer incoming data on nearterm growth and some tightening in financial conditions, we would expect the Federal Open Market Committee (FOMC) to cite a continued strong labour market and to reaffirm that, so far, its medium-term outlook remains broadly intact.

The Committee could attribute near-term weakness in part to “temporary factors” like it did in April 2015 when the first estimate of GDP showed essentially no growth in the economy. Such language would likely increase market expectations of a March hike while leaving open an escape route for the Committee in case it needed one,” BNPP projects.

“If increased risks or a worse baseline were to be acknowledged without mention of resilience in the medium-term outlook, this would be an extremely dovish signal which, would likely raise the chance of the market pricing in a pause in March, and open the door to excessive volatility if a rate-hike were delivered. Such a dovish stance is therefore unlikely in our view.

Central banks move more slowly than markets. Those expecting a strongly dovish statement are likely to be disappointed by fewer changes,” BNPP argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.