The recent talk of downside risks sent EUR/USD down but it quickly recovered since. Will Draghi deliver next time? The team at Credit Agricole discusses:

Here is their view, courtesy of eFXnews:

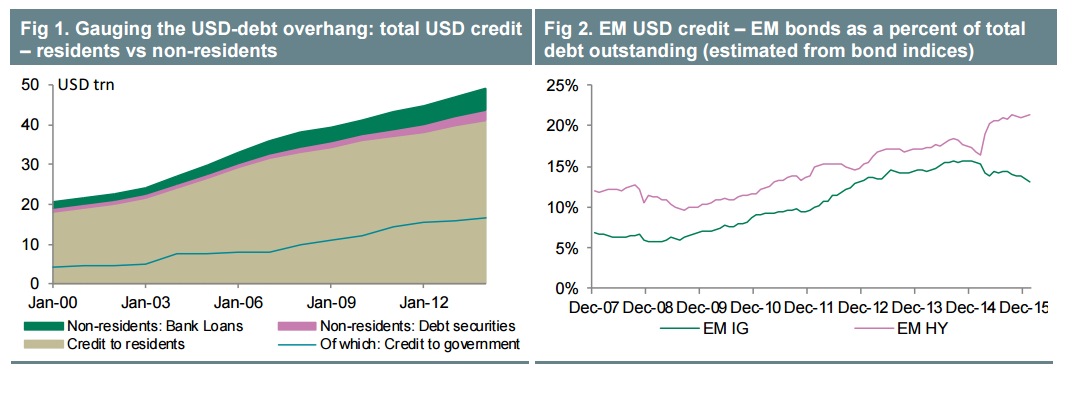

The latest market turmoil signalled growing fears about the outlook of the global economy. These concerns are exacerbated by the overhang of USD-debt that fuels fears about sovereign and corporate defaults, and chokes the recovery.

The Eurozone debt markets with the help of the ECB could act as a circuit breaker and continue to offer international borrowers a way out of their increasingly expensive USD-debt. This should help contain the risk of a global debt crisis for now in our view.

Foreign borrowers should continue to issue EUR-debt in the Eurozone, and convert the proceeds into USD in the FX spot and forward market, keeping EUR/USD under selling pressure.

The ‘EUR-funding’ trades should also weaken the positive correlation between EUR and risk aversion. Indeed, recent bouts of risk aversion have boosted the appeal of EUR-funding relative to USD-funding, attracting more EUR-sellers.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.