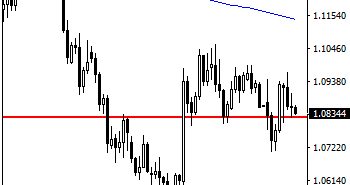

EURUSD: With EUR remaining weak and vulnerable to the downside, risk remains lower on bear pressure. This view remains valid as long as the 1.0969/1.0000 resistance zone remains unbroken. Support lies at the 1.0800 level. Further down, support lies at the 1.0750 level where a violation will aim at the 1.0700 level. A break of … “EURUSD: Risk Remains Lower On Bear Pressure”

Month: January 2016

AUD/USD: Trading the Australian jobs Jan 2016

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Jan 2016”

GBPUSD Looks To Recapture The 1.4400 Zone

GBPUSD: Having sold off during early trading today, GBPUSD looks to recapture the 1.4400 zone. While the 14603 level caps any recovery, our bias remains lower. Support lies at the 1.4400 level where a break will turn attention to the 1.4350 level. Further down, support lies at the 1.4300 level. Below here will set the … “GBPUSD Looks To Recapture The 1.4400 Zone”

Turkish Lira Bounces, Following Improving Market Sentiment

The Turkish lira bounced after falling earlier today. The currency got a boost from the improving market sentiment as well as positive domestic macroeconomic data. Market sentiment was improving as the Chinese stock markets halted decline and the Shanghai Stock Exchange Composite Index edged higher today. Yesterday, a report showed that Turkey’s current account deficit narrowed in November. Today’s explosion in Istanbul made investors worry a little, but it … “Turkish Lira Bounces, Following Improving Market Sentiment”

Soft Data Drives Sterling Lower, GBP/USD at Multi-Year Low

Weak macroeconomic data released from the Unite Kingdom over the current trading session pushed the Great Britain pound lower. The currency reached the lowest level since June 2010 against the US dollar. Britain’s manufacturing production shrank 0.4 percent in November from October while industrial production was down 0.7 percent. Both indexes were below market expectations. The soft data highlighted difficulties that the UK economy … “Soft Data Drives Sterling Lower, GBP/USD at Multi-Year Low”

Sell GBP/JPY – Credit Suisse Trade Of The Week

The pound suffers from poor data and other troubles while the yen enjoys safe haven flows. This and more are behind the short call by Credit Suissse: Here is their view, courtesy of eFXnews: Currency investors should consider selling GBP/JPY this week, advises Credit Suisse in its weekly FX pick to clients. Rationale: “The probability is … “Sell GBP/JPY – Credit Suisse Trade Of The Week”

Flogging The Fallen EUR – Credit Agricole

The common currency is behaving as a “safe haven” one, but not 100% of the time. It sometimes remembers the reasons for the “funding currency” status – easy ECB policy, which could strike again. What’s next? Here is the view from Credit Agricole: Here is their view, courtesy of eFXnews: Relative to other safe haven … “Flogging The Fallen EUR – Credit Agricole”

Canadian Dollar Struggles to Keep Gains

The Canadian dollar was struggling to hold onto earlier gains today but had troubles to fight against adverse fundamentals that were trying to drag the currency down. Intraday, the loonie touched new multi-year lows versus the US dollar and the Japanese yen. While the Canadian currency was rising during the current trading session, it has lost its gains versus the greenback and returned back to the opening level against the yen … “Canadian Dollar Struggles to Keep Gains”

5 Most Predictable Currency Pairs – Q1 2016

In foreign exchange trading, not all currency pairs behave in the same manner: some are more predictable while others are far less predictable. What does this mean? A predictable currency pair slow down upon approaching a clear line of support or resistance. And in case the pair in question has the necessary momentum, it will … “5 Most Predictable Currency Pairs – Q1 2016”

Aussie Heads Higher on Yuan, But Gains Likely Short-Lived

The Australian dollar is higher today, thanks in part to the recent decision to strengthen the yuan. However, the gains are likely to be short-lived, as the Australian economy relies heavily on China. Today, Aussie is regaining some ground lost recently. Australian dollar has been hit by difficulties in China, as well as a drop in the commodities market. Right now, though, there is some support for the Australian dollar. Chinese leaders announced that they … “Aussie Heads Higher on Yuan, But Gains Likely Short-Lived”