Loonie is getting a little help today in currency trading on the FX market. Canadian dollar is a little higher as North American markets are set to open a little higher, and as oil prices inch up. Once again, there is a bit of uncertainty in world markets. Chinese markets are starting the week down, but the rest of the world’s markets aren’t being affected as much as last week. Instead, North American markets … “Loonie Gets a Little Help from Oil Prices”

Month: January 2016

Is It Time To Cash In On USD/CAD Bets? – CIBC

USD/CAD has reached highs last seen in August 2003, 12.5 years ago, at nearly 1.42. But are we nearing an end of these gains? Here is an opinion from CIBC: Here is their view, courtesy of eFXnews: We’ve had a bearish near-term outlook on the Canadian dollar since mid-2014, admittedly one that we’ve had to move … “Is It Time To Cash In On USD/CAD Bets? – CIBC”

JPY: 115 Next, CAD: No Respite, AUD: Breaking Out –

Risk aversion remains the name of the game, with the yen standing on one extreme while CAD and AUD are on the other side. The team at Barclays analyzes what’s going on: JPY: Global risk sentiments to remain the main driver of the JPY Here is their view, courtesy of eFXnews: Amid a sharp deterioration in … “JPY: 115 Next, CAD: No Respite, AUD: Breaking Out –”

South African Rand Touches New Record Low

The South African rand sank to the new record low during the current trading session as bad news from China continued to hurt risky currencies of emerging economies. The rand tumbled almost 9 percent intraday before limiting its decline to about 1.5 percent as of now. The drop was the biggest since October 2008. The reason for the decline was yet another bunch of bad news from China that kept the market in the risk-negative … “South African Rand Touches New Record Low”

NZ Dollar Fights to Bounce amid Adverse Fundamentals

The New Zealand dollar rose a little today, but gains were limited as fundamentals were not particularly positive to the currency, which has been in decline since the beginning of the year. Domestic data was relatively positive as New Zealand building consents rose 1.8 percent in November. It was news from overseas, China specifically, that was troubling. Chinese stocks continued to crash, tumbling more than 5 percent … “NZ Dollar Fights to Bounce amid Adverse Fundamentals”

GOLD Eyes Further Upside Pressure On Rally

GOLD: Having closed strongly higher on a rally the past week, GOLD eyes further upside pressure. On the downside, support comes in at the 1098.00 level where a break will turn attention to the 1088.00 level. Further down, a cut through here will open the door for a move lower towards the 1080.00 level. Below … “GOLD Eyes Further Upside Pressure On Rally”

USD: Will The Fed Blink, Again? – Credit Agricole

Recent market turmoil resembles what we’ve seen back in August. That led to a postponement of the rate hike. Will the Fed react again? The team at Credit Agricole explores: Here is their view, courtesy of eFXnews: Risk aversion reared its ugly head yet again at the start of the new year with concerns about … “USD: Will The Fed Blink, Again? – Credit Agricole”

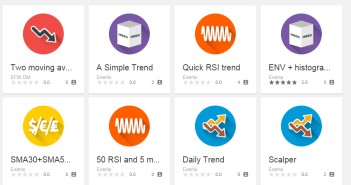

Exeria – Simplifying Algo Trading

Exeria is a Poznan, Poland based startup which offers traders to build robots in a very easy and visual way. In addition, they offer sharing the ideas with the community. Here are some of their capabilities, as explained by the company: The options are many in Exeria, let’s say that you are a beginner in … “Exeria – Simplifying Algo Trading”

GBP/USD: Trading the British Manufacturing Jan 2016

British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background The … “GBP/USD: Trading the British Manufacturing Jan 2016”

Risk Aversion Secures Gains of USD vs. Most Other Currencies

The major theme this week was risk aversion due to the news from China. This allowed the US dollar to gain against the Great Britain pound and commodity-linked currencies during the past trading week. At the same time, the greenback fell against the Japanese yen and, surprisingly, against the euro. The week has started with bad news from China, and that theme continued to affect the Forex market for the whole week. As a result, safe … “Risk Aversion Secures Gains of USD vs. Most Other Currencies”