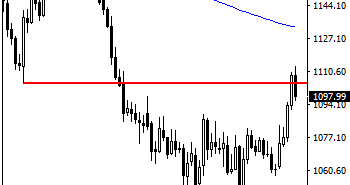

GOLD: Having capped its strength at 1113.09 level to weaken during Friday trading session, GOLD faces more downside risk on pullback. Except it retakes the 1113.09 resistance, it should target further weakness. On the downside, support comes in at the 1090.00 level where a break will turn attention to the 1080.00 level. Further down, a … “GOLD Faces More Downside Risk On Pullback”

Month: January 2016

EUR: 4 Cross-Currents In Play: What Is The Trade? –

EUR-USD had an exciting week with various forces influencing it. Morgan Stanley explains what’s going and what’s next: Here is their view, courtesy of eFXnews: In its weekly note to clients, Morgan Stanley argues that the cross-currents of negative flow dynamics and upward pressure from risk appetite may keep EUR without a clear trend in the … “EUR: 4 Cross-Currents In Play: What Is The Trade? –”

Euro Heads Lower as Economic Concerns Weigh

After maintaining some degree of strength this week, the euro is heading lower today. Economic concerns are weighing on the 19-nation currency, and comparisons are again being made with the US economic recovery. Now that some of the concern over China is easing, Forex traders and investors are looking at what could be next for the world’s economies. As traders contemplate the eurozone, concerns about what’s next are rising. … “Euro Heads Lower as Economic Concerns Weigh”

GBPUSD: Halts Weakness On Rejection Candle

GBPUSD: GBP has halted its weakness to close on a rejection candle on Thursday. This development has set the tone for a recovery higher threats. Support lies at the 1.4550 level where a break will turn attention to the 1.4500 level. Further down, support lies at the 1.4500 level. Below here will set the stage … “GBPUSD: Halts Weakness On Rejection Candle”

What If Oil Goes To $20? How To Trade It? – SocGen

Oil prices have been in the center of attention, with both Brent and WTI Crude trading at levels last seen in 2004. What if this goes all the way to $20? Here is the view from Olivier Korber at SocGen: Here is their view, courtesy of eFXnews: “Tensions in the Middle East between Saudi Arabia … “What If Oil Goes To $20? How To Trade It? – SocGen”

Greenback Gains on Employment Data

US dollar is heading higher today, gaining after the announcement of the latest job figures. With an unexpectedly high gain in jobs, the US economy appears to be on firm footing and many analysts are looking forward to more interest rate hikes. The US economy added 292,000 jobs in December, according to a release from the United States Department of Labor. Analysts and economists had expected a gain of 215,000, so this was a pleasant … “Greenback Gains on Employment Data”

Will China Scupper The USD Divergence Trade, Again? –

The Chinese stock market is dominating the financial news in the wake of 2016. The team at Credit Agricole examines the impact on the greenback: Here is their view, courtesy of eFXnews: The scrapping of the so called circuit breakers used to arrest the slide of the China stock market and the firmer CNY fix … “Will China Scupper The USD Divergence Trade, Again? –”

Here Is How Uncertainty Creates Opportunity For USD Bulls

The US dollar has gained against commodity currencies and the pound, but is ceding territory to the safe haven euro and yen. Yet the team at BNP Paribas explains how the greenback could regain ground, especially against the yen: Here is their view, courtesy of eFXnews: BNP Paribas outlook for the USD remains favourable as … “Here Is How Uncertainty Creates Opportunity For USD Bulls”

UK Pound Continues to Soften Against Dollar and Euro

UK pound is heading lower again, dropping as concerns about the economy continue to weigh. This time slightly disappointing PMI is leading to a lower sterling. Sterling continues to struggle in currency trading, especially against the euro and the dollar. UK pound is being affected by the latest PMI readings. Service sector PMI came in at 55.5, when many analysts had expected to see 55.6. Even though the data was slightly … “UK Pound Continues to Soften Against Dollar and Euro”

EUR/USD to be range bound; EUR/GBP being forced lower;

Richard Perry, Market Analyst for Hantec Markets, joined Nick Batsford on the Tip TV Finance Show to discuss the outlooks for both EUR/USD and EUR/GBP, as well as a view on gold and a prediction for oil. Topics Covered: EUR/USD, EUR/GBP, US NFP, Gold, Oil