US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls +292K – much better than … “EUR/USD: Trading the US NFP Jan 2016”

Month: January 2016

South African Rand Touches Record Low as China Scares Markets

The South African rand tumbled today, demonstrating the biggest drop among most-traded currencies and touching the historic low. The reason for the dive was yet more bad news from China. The Shanghai Stock Exchange Composite Index sank 7 percent at the start of today’s trading. This prompted China to close markets as a measure to prevent further slide. Chinese policy makers also devalued the yuan to the lowest level since March 2011 in a bid … “South African Rand Touches Record Low as China Scares Markets”

Australian Dollar Moves Further Down

Today, the Australian dollar declined for the fourth day in a row against the US dollar and the sixth session versus the Japanese yen. Economic data from Australia was mixed, giving no edge to the currency, while China remained a major source of concerns for investors. Australia’s building approvals sank 12.7 percent on a seasonally adjusted basis in November, ten times the drop predicted by specialists. On the bright side, the trade balance deficit shrank to A$2.91 billion … “Australian Dollar Moves Further Down”

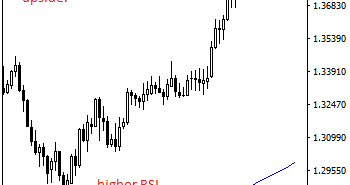

USDCAD Remains Bullish Above The 1.4000 Level

USDCAD remains bullish above the 1.4000 level following a break and hold above that level during Wednesday trading session. This is coming on the back of its Tuesday downside price rejection to close higher. On the upside, resistance resides at the 1.4150 level where a break will target the 1.4200 level. Further out, resistance comes … “USDCAD Remains Bullish Above The 1.4000 Level”

No ‘Sweet 16’ For The USD – HSBC

The US dollar had an excellent 2015 and is beginning 2016 on a strong footing against most currencies. Can this last? The team at HSBC sees a sour 2016 for the dollar against the euro and the yen, and sets targets: Here is their view, courtesy of eFXnews: In contrast to a consensus that expects … “No ‘Sweet 16’ For The USD – HSBC”

Tumbling Crude Oil Prices Drag Canadian Dollar Along

The Canadian dollar dropped today against its major counterparts, dragged down by falling prices for crude oil. The general risk-negative sentiment on the currency markets added to the weakness of the loonie. Futures for crude oil lost more than 5 percent of their value during the current trading session as US gasoline inventories demonstrated the biggest gain since 1993. The performance of the Canadian currency strongly correlates with that of crude oil as the commodity is … “Tumbling Crude Oil Prices Drag Canadian Dollar Along”

Dollar Drops vs. Euro & Yen, Retains Gains vs. Other Majors

The US dollar fell against the euro and the Japanese yen today as minutes of the latest Federal Reserve policy meeting were relatively dovish. The greenback retained gains against most other major currencies thanks to the strong private employment report. While US policy makers have raised interest rates in December, they were worried about low inflation: Consumer price inflation continued to run below the FOMC’s longer-run objective of 2 … “Dollar Drops vs. Euro & Yen, Retains Gains vs. Other Majors”

Trading Insights: What is ‘Scalping’?

Dr. Corvin Codirla, Founding Partner of CCFX, and Trading Educator at FXMasterCourse, explained the meaning of ‘scalping’, when he joined Zak Mir on the Tip TV Finance Show.

Continued Safe Haven Demand Helps Greenback

Forex traders are still looking for a safe haven today, and the US dollar is providing that feeling of confidence. With upheaval in the stock markets and uncertainty over North Korea and the Middle East, it’s no surprise that the dollar is gaining ground today. Risk appetite is low right now as investors and traders move away from the assets likely to be impacted by recent developments in Asia. Disappointing news out of China … “Continued Safe Haven Demand Helps Greenback”

PMI Reading Helps Euro Hold Its Own

Euro is holding its today in currency trading on the FX market, in spite of global jitters related to the latest news out of China and North Korea. Better economic data is helping the 19-nation currency as some expect to see growth in 2016. The latest PMI reading for the eurozone came in at 54.3 during December, representing an increase from the November reading of 54.2. This increase was good news, since many analysts had expected … “PMI Reading Helps Euro Hold Its Own”