Forex Broker Admiral Markets now offers a web based Meta Trader 4 experience for its traders. More details from the official press release: Admiral Markets, Forex and CFD broker now offers a browser-based version of the world’s most popular trading platform – MetaTrader 4. Designed to provide traders with high flexibility, MT4 WebTrader allows hassle-free trading … “Admiral Markets launches web-based MT4 offering”

Month: January 2016

Pound Ignores Supportive Construction Data

The Great Britain pound fell today, extending its decline versus the US dollar for the sixth consecutive trading session. The construction report released from the United Kingdom today was solid, but the currency shrugged off the supportive data. At the same time, the sterling managed to outperform the extremely soft euro. The Markit/CIPS UK Construction Purchasing Managersâ Index bounced to 57.8 in December up from the seven-month low of 55.3 in November. The actual reading … “Pound Ignores Supportive Construction Data”

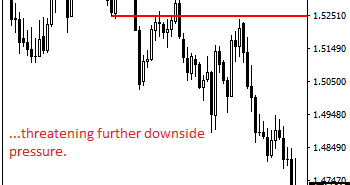

GBPUSD: Risk Of More Weakness On The Cards

GBPUSD: Having GBP continued to hold on to its downside pressure, it leaves risk of more weakness on the cards. Support lies at the 1.4700 level where a break will turn attention to the 1.4650 level. Further down, support lies at the 1.4600 level. Below here will set the stage for more weakness towards the … “GBPUSD: Risk Of More Weakness On The Cards”

Long USD Exposure In Spot Starting To Look Attractive –

The US dollar is gaining ground not only against risk currencies but also against the euro and the pound. Is it destined for more? The team at BNP Paribas weighs in: Here is their view, courtesy of eFXnews: BNP Paribas is watching for opportunities to enter new long USD spot trades. “Risk-off sentiment continues this … “Long USD Exposure In Spot Starting To Look Attractive –”

Euro Extends Move Down for Third Day

The euro extended its move down against the US dollar and the Japanese yen for the third straight session today as the eurozone inflation came out below analysts’ expectations. The flash eurozone inflation was stable at 0.2 percent in December, the same rate as in November. Yet the reading missed the median forecast of 0.4 percent. The report followed yesterday’s data that showed that Germany has entered deflation (at least on the monthly basis). EUR/USD declined … “Euro Extends Move Down for Third Day”

GBP/USD: Trading the British Services PMI Jan. 2016

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published … “GBP/USD: Trading the British Services PMI Jan. 2016”

EUR, GBP: How Much More Downside Ahead? – Credit

Both the euro and the pound have suffered losses against the US dollar. Is the fall close to the end or not? Here is the view from Credit Agricole: Here is their view, courtesy of eFXnews: EUR: more downside likely on the back of growing demand for EURfunding. While we cannot rule out further easing … “EUR, GBP: How Much More Downside Ahead? – Credit”

Australian Dollar Logs Small Gains

The Australian dollar bounced today following yesterday’s rout due to bad news from China. The gains were limited, though, and far from being enough to erase the Monday’s decline. China injected a generous share of liquidity into markets, namely 130 billion yuan ($20 billion). The Australian currency often reacts strongly to news from China as the Asian nation is the biggest trading partner of Australia. As the Tuesday’s news was good, … “Australian Dollar Logs Small Gains”

Dollar Starts Week with Gains amid Pessimistic Sentiment

The US dollar started the week with gains as the risk-negative market sentiment drove market participants to safer currencies. The same pessimistic mood boosted the Japanese yen as well, allowing it to gain even more than the US currency. The major theme of the day was the disappointing manufacturing data out of China. Another one was the growing tension between Iran and Saudi Arabia that threatens to spread to the whole Middle Eastern region. As a result, … “Dollar Starts Week with Gains amid Pessimistic Sentiment”

Loonie Drops, Even with Higher Oil Prices

Canadian dollar is heading lower today, despite the fact that oil prices are finally on the rise again. With so much risk aversion, the loonie is down in large part due to a desire to shore up with safe haven currencies as the markets struggle. Loonie has been struggling in recent months as oil prices steadily decline. With global oil production outpacing demand, prices have dropped, impacting … “Loonie Drops, Even with Higher Oil Prices”