Australian CPI (Consumer Price Index), which is released each quarter, measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at 00:30 GMT. … “AUD/USD: Trading the Australian CPI Jan 2015”

Month: January 2016

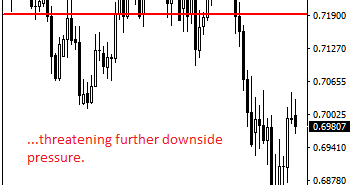

AUDUSD Remains Vulnerable To The Downside

AUDUSD: With AUDUSD remaining and vulnerable to the downside, further weakness is envisaged. On the downside, support resides at the 0.6950 level where a breach will aim at the 0.6900 level. Below that level will set the stage for a run at the 0.6850 level with a cut through here targeting further downside towards the … “AUDUSD Remains Vulnerable To The Downside”

Week Starts with Risk-Off Sentiment, Sending Yen Higher

The Japanese yen found help from the risk-negative sentiment that prevailed on the Forex market at the start of the trading week. The drop of crude oil and global stocks soured the traders’ mood, making them less willing to take risk. The drop of crude oil prices and the subsequent fall of stock markets were the main drivers for the FX market today. As a result, risky currencies found themselves under pressure while safer options, like the yen and gold, … “Week Starts with Risk-Off Sentiment, Sending Yen Higher”

NZ Dollar Fails to Rally, Dragged Down by Crude Oil

The New Zealand dollar has attempted to rally earlier during the current trading session but fell back below the opening level as of now. The reason for the decline was the drop of crude oil prices that dragged commodity prices down at the start of the week. Crude oil resumed its decline, falling more than 2 percent today. The drop of oil prices triggered a rout of global stocks. All these factors made the trading … “NZ Dollar Fails to Rally, Dragged Down by Crude Oil”

EUR/CHF 4: Wenn Atlas Gezuzkt

It has been a little more than a year and two weeks since the Swiss National Bank simply could not hold the line any further in its defense of a weakening Euro. The SNB was not under any obligation to maintain a peg, but rather agreed to one in order to maintain purchasing parity with … “EUR/CHF 4: Wenn Atlas Gezuzkt”

GOLD Threatens Additional Downside Pressure

GOLD: Having remained weak and continued to trade within its range, GOLD threatens additional downside pressure on bearishness. On the downside, support comes in at the 1090.00 level where a break will turn attention to the 1080.00 level. Further down, a cut through here will open the door for a move lower towards the 1070.00 … “GOLD Threatens Additional Downside Pressure”

BOJ Likely On Hold This Week But…

After the yen strengthened quite a bit, we heard different tunes from the BOJ and the government, willing to act and feeling uncomfortable with the strength of the yen. But will they act? Here is the view from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: Main focus on assessment of … “BOJ Likely On Hold This Week But…”

EUR: Hedge Downside, GBP: Correction Ahead – Barclays

We certainly had some moves in markets, with EUR moving down and the pound crashing only to stage a nice recovery. What’s next? Here is the view from Barclays: EUR: Hedge the downside while it is still cheap. Here is their view, courtesy of eFXnews: The EUR weakened last week as the ECB’s Governing Council unanimously … “EUR: Hedge Downside, GBP: Correction Ahead – Barclays”

Central Banks in the Spotlight for Another Week

Next week will have traders preoccupied with more central bank action. On Wednesday, the Federal Reserve will reconvene for their first meeting of 2016. Although few expect the Fed to raise interest rates, we may hear more details about the Fed’s economic outlook and the pace at which they plan on raising rates. Recall that … “Central Banks in the Spotlight for Another Week”

Week Ends with Losses for Euro vs. Most Currencies

The euro fell against the majority of most-traded currencies during this week as the European Central Bank hinted at a strong possibility of another round of monetary easing next month. There were few currencies that were even weaker than the euro, the Japanese yen and the Swiss franc among them. The ECB has refrained from making changes to its monetary policy just yet. But ECB President Mario Draghi said during … “Week Ends with Losses for Euro vs. Most Currencies”