The US dollar continued to rally against the euro and the Japanese yen today due to divergent monetary policies of the nations’ central banks. The greenback demonstrated mixed performance against other most-traded currencies as the rebound of global stocks limited demand for the currency as a safe haven option. The flash Markit manufacturing PMI climbed from 51.2 in December to 52.7 in January, rising far above economists’ expectations, though it remained close to multi-year lows. Existing … “Dollar Higher vs. Euro & Yen, Mixed vs. Other Majors”

Month: January 2016

Q3 Eurozone Debt Report Doesn’t Help Euro in Forex Trading

The latest numbers out of the eurozone, showing a reduction in government debt during Quarter 3 of 2015 aren’t helping the euro in Forex trading against its major counterparts. Euro is down against the dollar and the pound today, as well as losing ground against other currencies. Euro is heading lower against the sterling and the greenback today, thanks in large part to the remarks of Mario Draghi earlier this week. The ECB kept its rate … “Q3 Eurozone Debt Report Doesn’t Help Euro in Forex Trading”

Loonie Gains for Third Session vs. Greenback & Euro

The Canadian dollar gained today, extending its rally versus the US dollar and the Japanese yen for the third straight session. The reason for the admirable performance was the surprise rally of crude oil. Forecasts of cold weather in the United States and Europe promise higher demand for heating oil. As a result, crude oil prices snapped their decline, surging during the Friday’s trading session. As for Canada’s economic data, retail sales were very good, exceeding … “Loonie Gains for Third Session vs. Greenback & Euro”

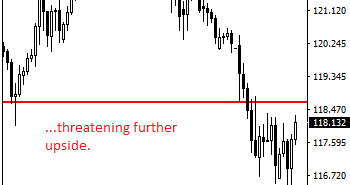

USDJPY Builds Up On Bull Pressure

USDJPY: Having followed through higher on the back of its Thursday gains on Friday, further bullishness is expected. On the downside, support comes in at the 117.50 level where a break if seen will aim at the 117.00 level. A cut through here will turn focus to the 116.50 level and possibly lower towards the … “USDJPY Builds Up On Bull Pressure”

Yen Under Pressure During Friday’s Trading

The Japanese yen fell against its major peers (though not against the euro) during the Friday’s trading session due to prospects for monetary tightening from the Bank of Japan. The unexpected drop of manufacturing index was not helpful to the currency either. The Nikkei Flash Japan Manufacturing Purchasing Managers’ Index ticked down to 52.4 in January from 52.6 in December while experts had promised an increase to 52.8. Meanwhile, analysts continue to speculate … “Yen Under Pressure During Friday’s Trading”

Great Britain Pound Extends Bounce from Multi-Year Lows

The Great Britain pound started to rise yesterday, bouncing from multi-year lows against the US dollar and the Japanese yen, and continued its rally today. Negative retail sales data made the rally pause but just briefly. UK retail sales dropped 1 percent in December from the preceding month while analysts had promised basically no change. Not all Friday’s reports were bad as public net sector … “Great Britain Pound Extends Bounce from Multi-Year Lows”

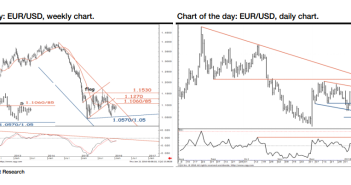

Multiyear Channel Limits In EUR/USD & GBP/AUD – SocGen

Draghi dragged the euro down, but it didn’t go too far. Nevertheless, it is now approaching an interesting technical level and so is GBP/AUD. Here is the view from SocGen: Here is their view, courtesy of eFXnews: Having broken below the flag formation, EUR/USD retested last March lows and it continues to sustain below 20 … “Multiyear Channel Limits In EUR/USD & GBP/AUD – SocGen”

US Dollar Rallies on Divergent Monetary Policies of Major Central Banks

The US dollar gained against a basket of major currencies on Thursday and kept its gains at the start of Friday’s trading. The reason for the rally was divergent monetary policies of major central banks. The European Central Bank refrained from expanding monetary policy during yesterday’s meeting, but President Mario Draghi sent a strong signal during his press-conference that European policy makers would review and may reconsider the policy in March. Meanwhile, … “US Dollar Rallies on Divergent Monetary Policies of Major Central Banks”

Draghi Statement Sends Euro Lower Against Majors

It’s been an interesting week in the financial markets, and now the ECB is adding its bit. The latest statement from Mario Draghi is sending the euro lower against its major counterparts as Forex traders get ready for more easing. This month, as expected, the ECB kept rates steady. After the disappointment in December, few analysts expected policymakers to make a move. However, ECB President Mario Draghi did surprise nearly … “Draghi Statement Sends Euro Lower Against Majors”

Buy Opportunity in EUR/USD?

Draghi dragged EUR/USD down by talking and detailing about downside risks and basically promising action in March. The downside risk for EUR/USD could be limited, at least in time, and could provide a buy opportunity. In the third week of doom and gloom in financial markets, central banks have begun reacting. First came Carney: the governor … “Buy Opportunity in EUR/USD?”