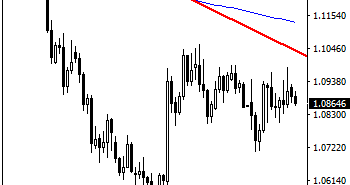

EURUSD: Having remained weak and vulnerable to the downside, EURUSD faces more downside pressure below key resistance. Support lies at the 1.0800 level. Further down, support lies at the 1.0750 level where a violation will aim at the 1.0700 level. A break of here will aim at the 1.0650 level. Its daily RSI is bearish … “EURUSD Faces More Downside Pressure Below Key Resistance”

Month: January 2016

Where will USD/CAD go on a BOC cut?

A consensus is gathering around a rate cut by the Bank of Canada. Can it send USD/CAD further up? Or is priced in, with a “buy the rumor, sell the fact” move coming? Here are two opposing opinions. Which one has you convinced? Here is the view from Bank of America Merrill Lynch: Here is … “Where will USD/CAD go on a BOC cut?”

GBP/USD: Trading the British Wages Jan 2016

British Average Earnings Index, released each month, is a leading indicator of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK employment data OK – GBP/USD attempts recovery Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 9:30 GMT. Indicator Background The Average Earnings Index … “GBP/USD: Trading the British Wages Jan 2016”

Orbex launches new financial trading instruments

Cyprus based forex broker Orbex introduces new trading instruments: indices, exotic pairs and more. Here is all the data from the press release: Limassol, January 19, 2016– Orbex constantly strives to provide flexible trading solutions in order to fulfil the particular trader’s needs. The company is happy to introduce two sets of new instruments that will … “Orbex launches new financial trading instruments”

Will Draghi Down the euro this time around?

After the big Draghi disappointment, an easing of monetary policy that didn’t meet the expectations created by the man himself sent EUR/USD 400+ pips higher, the Draghi show is back. What can we expect? Here are views from Nomura and Barclays: Here is their view, courtesy of eFXnews: Nomura: We do not expect the ECB … “Will Draghi Down the euro this time around?”

GBPUSD Targets Further Downside Pressure Medium Term

GBPUSD: Having continued maintain its long term bearishness, GBPUSD targets further downside pressure. Support lies at the 1.4200 level where a break will turn attention to the 1.4150 level. Further down, support lies at the 1.4100 level. Below here will set the stage for more weakness towards the 1.4050 level. Its daily RSI is bearish … “GBPUSD Targets Further Downside Pressure Medium Term”

New Zealand Dollar Higher Ahead of Tuesday’s Economic Releases

The New Zealand dollar was higher today, after opening sharply lower on Monday, as traders were waiting for economic data from China due to release overnight. Additionally, there are a couple of reports scheduled for release from New Zealand by the end of Tuesday’s session. The New Zealand dollar followed its Australian counterpart in rally on Monday, bolstered by the positive news from China. While drop of crude oil could have been … “New Zealand Dollar Higher Ahead of Tuesday’s Economic Releases”

Canadian Dollar Weakens Ahead of BoC Policy Meeting

The Canadian dollar was falling today, though the losses were relatively small. The major theme for the currency this week will be the monetary policy meeting scheduled by the Bank of Canada on Wednesday. Crude oil continued to fall today, staying below the $30 level. Crude is the key export for Canada, meaning that continuing decline of prices bodes ill for the nation’s economy. Market participants are wondering if the BoC is going … “Canadian Dollar Weakens Ahead of BoC Policy Meeting”

BOC expected to cut rates to 0.25% – Barclays, Nomura

The Bank of Canada is facing a dilemma regarding its policy: on one hand, the economy needs support with falling oil prices. On the other hand, the low value of CAD is certainly supportive. Here are views from two banks that see a cut coming: Here is their view, courtesy of eFXnews: Barclays: We expect … “BOC expected to cut rates to 0.25% – Barclays, Nomura”

Dollar Index Moves Above 99.00

US dollar index is moving higher today, even as the greenback itself trades mixed. There is reason to suppose that the dollar will retain support, thanks to global economic uncertainty. The US dollar index, which measures the greenback’s performance against a weighted basket of currencies, is higher today. Helping the dollar index move through the 99.00 mark is the fact that the euro is lower against the dollar right … “Dollar Index Moves Above 99.00”