Spread betting, forex trading and contracts for difference trading (CFD) are leveraged products. These are alternatives to traditional trades, with tax benefits. Traders seeking long-term yields are turning to spread betting and forex trading! Why are Spread Betting and Forex Trading so Popular Today? Traders are turning to forex trading and spread betting as alternatives … “How Does Spread Betting Really Work?”

Month: January 2016

Euro Mostly Lower on Bank Concerns

Euro is mostly lower today, thanks in part to concerns about various banks and the possibility of more stimulus. All eyes are on the ECB to see what the next move might be. Euro is struggling today on the news that the ECB is inquiring into bank health again. The ECB appears to be looking at non-performing loans and hoping to tackle the bad debt that still plagues many eurozone countries. On top of that, global … “Euro Mostly Lower on Bank Concerns”

Improving Market Sentiment Means Low Demand for Yen

The market sentiment was improving today, meaning that currencies perceived to be safe were not in high demand. As a result, the Japanese yen was falling against its other most-traded peers. Today’s traders’ mood was relatively positive, helping riskier currencies and making safer ones vulnerable. Additionally, the revised estimate of Japan’s industrial production showed a decline while economists had hoped for an increase. Yet analysts argue that … “Improving Market Sentiment Means Low Demand for Yen”

China Brings Good News, Australian Dollar Higher

The Australian dollar edged higher today as the market sentiment improved following good news from China. Chinese policy makers took steps to calm the yuan’s volatility while the nation’s stock market stabilized. The People’s Bank of China raised the yuan’s daily fixing and announced that it is going to implement a reserve requirement ratio on offshore banks’ domestic deposits in an attempt to deter speculation in the currency. Meanwhile, the Shanghai Stock Exchange Composite … “China Brings Good News, Australian Dollar Higher”

AUD/SGD: Against All Odds

The Reserve Bank of Australia has been steadfast in its 2.00% cash rate policy in spite of the continuing regional economic contraction impacting Australia’s commodity export economy. At the 1 December meeting RBA Governor Glenn Stevens’ statement began with an upbeat tone but the challenges faced by the economy did not go unnoticed: “…available information … “AUD/SGD: Against All Odds”

It’s All About The ‘Base Effects’ In FX Market Coming

The initial crash in oil prices caused a big drop in inflation. While oil prices are certainly pressured, the huge fall seen in late 2014 is already over a year behind us, changing the “base effect” behind. That is going to be the talk and what moves currencies: Here is their view, courtesy of eFXnews: “The one-year … “It’s All About The ‘Base Effects’ In FX Market Coming”

How Mobile Moves

Mobile technology is forever changing the way in which we access the internet, pay our bills, communicate with people, make purchases, and pretty much conduct our daily routines. The financial trading industry has traditionally kept traders tied to their desks in case immediate action was needed in moments of high volatility or unexpected movement, but … “How Mobile Moves”

A risk to US because of Fed over-optimism – CIBC

Comments coming out form the Fed suggest more hikes this year, and a general sense of stability. This comes in contrast to the worrying economic indicators and falling stock markets. This may turn against the dollar, warns CIBC: Here is their view, courtesy of eFXnews: Recent speeches suggest that most Fed officials are still keen … “A risk to US because of Fed over-optimism – CIBC”

Odds Tilting On BoC Cut…Slightly – CIBC

With the crash in commodities and CAD, will the Bank of Canada be open to an immediate cut? The team at CIBC previews: Here is their view, courtesy of eFXnews: Being the Bank of Canada Governor is a tough job, but sometimes forecasting what a BoC Governor will do is even tougher. Unlike the Fed, … “Odds Tilting On BoC Cut…Slightly – CIBC”

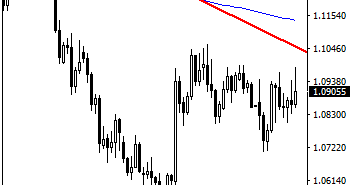

EURUSD Remains Vulnerable Below Falling Trendline

EURUSD: With Having trade flat (weekly chart) the past week on price reversal, EURUSD remains vulnerable below falling trendline. However, we may see price hesitation initially. On the down, support is located at the 1.0850 level and if violated, expect more weakness to happen towards the 1.0795 level. Further down, support lies at the 1.0750 … “EURUSD Remains Vulnerable Below Falling Trendline”