Chinese Gross Domestic Product (GDP) is a measurement of the production and growth of the economy, and analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published … “AUD/USD: Trading the Chinese GDP Jan 2016”

Month: January 2016

EUR: ECB Under Mounting Pressure – Barclays

The European Central Bank meets for the first time in 2016, and it certainly is under a lot of pressure, from various angles. The team at Barclays analyzes: Here is their view, courtesy of eFXnews: We expect the ECB to ease policy further in 2016 as deflationary pressures worsen. However, we think new measures are … “EUR: ECB Under Mounting Pressure – Barclays”

Yen Profits from Safe Haven Status During Second Trading Week of 2016

The past trading week has started with risk aversion and the same theme continued throughout the week with just short bouts of risk appetite. Unsurprisingly, the Japanese yen profited in such an environment from its perceived role as a haven currency. Trading started with yet more bad news from China and the same theme dominated the market till the weekend. While the sentiment was showing signs of improvement once in a while, trading … “Yen Profits from Safe Haven Status During Second Trading Week of 2016”

Risk Aversion & Poor US Data Leave Dollar Mixed

The US dollar fell against some of its major peers due to the slew of poor economic reports released from the United States during the current trading session. Yet the greenback also gained on many other currencies as risk aversion drove them even lower than the dollar. There were quite a few economic indicators released today but basically only the Michigan Institute Sentiment Index could be considered positive … “Risk Aversion & Poor US Data Leave Dollar Mixed”

Safe Haven Demand Continues to Send Yen Higher

Japanese yen is higher again today, thanks to safe haven demand. Today’s global stock market sell off is resulting in an interest in stable assets, and that means the yen is gaining ground against its major counterparts. US economic data was a bit disappointing today, with major releases. While consumer sentiment rose, retail sales and manufacturing conditions were less than comforting. When added … “Safe Haven Demand Continues to Send Yen Higher”

Falling Oil Prices Put Pressure on Loonie

Canadian dollar continues to weaken today, thanks in large part to the fact that oil prices are falling. Oil is below $30 a barrel, and the loonie hit its lowest level in 13 years in earlier trading. Oil is one of the major cornerstones of the Canadian economy. It is a major export, including to the United States. When oil prices drop, the Canadian economy struggles, and the loonie heads lower against its major … “Falling Oil Prices Put Pressure on Loonie”

GBPUSD Broader Bias Remains Lower

GBPUSD: With the pair continuing to target further weakness, GBPUSD broader bias remains lower. Support lies at the 1.4300 level where a break will turn attention to the 1.4250 level. Further down, support lies at the 1.4200 level. Below here will set the stage for more weakness towards the 1.4150 level. Its daily RSI is … “GBPUSD Broader Bias Remains Lower”

4 Reasons To Sell AUD/USD, NZD/USD – Deutsche Bank

The Australian and New Zealand dollar both suffered from the “risk off” sentiment, but there may be more in the pipeline. The team at Deutsche Bank explains: Here is their view, courtesy of eFXnews: In a strategy note, Deutsche Bank advises clients to sell AUD/USD, and NZD/USD arguing that Chinese depreciation and deteriorating basic balances should … “4 Reasons To Sell AUD/USD, NZD/USD – Deutsche Bank”

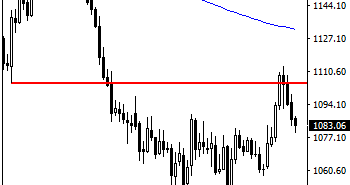

GOLD Remains Weak And Vulnerable To The Downside

GOLD: Having followed through lower strongly on Tuesday GOLD remains weak and vulnerable to the downside on more weakness. On the downside, support comes in at the 1070.00 level where a break will turn attention to the 1060.00 level. Further down, a cut through here will open the door for a move lower towards the … “GOLD Remains Weak And Vulnerable To The Downside”

Euro Gets Help From Expectations of Limited Stimulus

Euro is getting a little help today in Forex trading on the expectation that further stimulus is likely to be limited. With markets struggling, and safer assets likely to be supported, the need for stimulus is weakening. Many analysts and traders had expected something dramatic from the ECB’s meeting in December. However, the situation didn’t pan out, and policymakers didn’t do anything drastic. Now, many doubt that the ECB will … “Euro Gets Help From Expectations of Limited Stimulus”