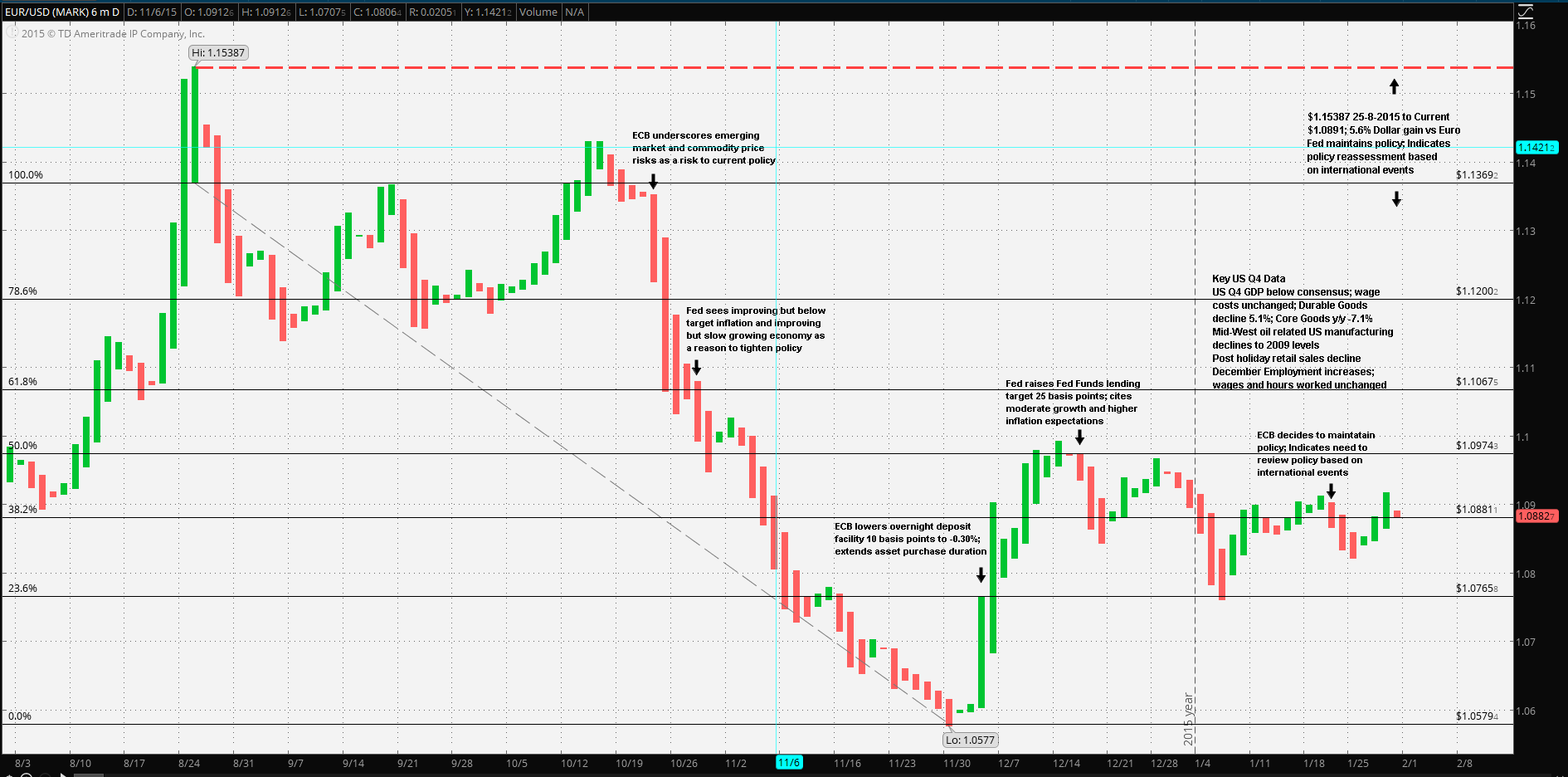

It’s interesting to compare the expectations of the European Central Bank and those of the US Federal Reserve Bank at the time when the policies of the two major central banks began to diverge. The 22 October 2015 ECB statement specifically noted that, “…While euro area domestic demand remains resilient, concerns over growth prospects in emerging markets and possible repercussions for the economy from developments in financial and commodity markets continue to signal downside risks to the outlook for growth and inflation...” It should be noted it was very evident at the time that China’s economy continued to slow as it transitioned from an emerging market, state supported manufacturing economy to a more independent, free market, self-sustaining domestic production and consumer driven economy. At that timeAsia-Pacific markets were volatile, but not yet beginning to completely unravel. The ECB’s concern was most likely due to a sustained and accelerating decline in commodity prices, particularly energy prices. The decline in prices was counteracting ECB efforts to reflate the Eurozone: consumer prices were straddling the deflation-inflation fence.

Guest post by Mike Scrive of Accendo Markets

It should be noted that three of Europe’s largest energy producers are Norway, Russia and the UK. Over the past several years UK petroleum production has declined. Norway and Russia are the largest energy produces and neither nation is a European Union members. Further, a combination of sanctions and depressed crude petroleum prices has severely affected the Russian economy. Norway has resorted to its ‘rainy day fund’. The Russian petroleum industry has resorted to an increase in petroleum output which added to already high global production. Further, Iran is expected to come online now that sanctions were lifted in January 2016. Globally, other strategic commodities, iron, copper and aluminum, just to name a few, have also seen dramatic price declines. The point is that the ECB was properly concerned about the decline of commodity prices. They were not transitory, or to be fair, not nearly transitory enough, to risk not taking these price declines seriously.

The US Fed, on the other hand did not see it that way and this may be a costly oversight. Over the past decade advances in drilling technology created something of an oil boom in the US. First, many abandoned wells, particularly those without enough natural pressure to drive oil to the surface were now able to produce again. Second, oil and gas trapped in shale deposits might now tapped with much greater cost efficiency. This in turned led to many ‘start-ups’, many offering high yielding debt instruments to fund drilling, creating many thousands of high paying jobs, and positively affecting local oil region economies. However, this new technology was cost efficient at a much higher price per barrel than the current price.

The 28 October Fed statement noted that “… economic activity has been expanding at a moderate pace… …The pace of job gains slowed and the unemployment rate held steady…” Job losses in the US oil sector were continuing, with many companies announcing that more cuts were in the works. Further, the yield spread between high yield energy bonds and benchmark US Treasuries were hitting record highs. The central US, from as far south as Texas to the northern Canadian border state of North Dakota were severely impacted by the shale oil bust.

The statement went on to observe that “…The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring global economic and financial developments…” This, in spite of the continuing Asia-Pacific slowdown and oil prices low enough to bring the US oil production boom to a complete halt even at the time of the 28 October meeting. Lastly, the October statement also noted that “…In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments…”

It isn’t often that a major global leader admits that their economy faces downside risks. However, that’s precisely what Chinese President Xi Jinping acknowledged at the Asia-Pacific Economic Cooperation forum held in November 2015: “...In general, China’s positive economic fundamentals and long-term trajectory remain unchanged.. …On the other hand, China’s economy is still coping with the complicated internal and external environment, considerable downward pressure and the temporary pain of deep reforms...”

PBOC multiple and varied easing methods failed to halt equity markets from nearly free falling. Also, it was becoming clear that with current supply and unchecked production that there would be no oil price recovery in the near term and perhaps all of 2016.

At the 3 December 2015 meeting the ECB acted, but cautiously: “…we decided to lower the interest rate on the deposit facility by 10 basis points to -0.30%… …we decided to extend the asset purchase programme… … The monthly purchases… …are now intended to run until the end of March 2017, or beyond, if necessary...”

Between the ECB and Fed meeting, an OPEC meeting concluded with absolutely no agreed upon restriction of member production. The most influential member, Saudi Arabia, seemed to have taken a ‘laissez faire’ stance and petroleum prices continued to plummet. A week before the Fed meeting the Yuan weakened, capital flowed out of China, global stock markets declined and the Yen strengthened against the majors.

At the 16 December meeting the Fed saw it prudent to “…raise the target range for the federal funds rate to 1/4 to 1/2 percent..” In the statement the FOMC made particular note of “… considerable improvement in labor market …” and that “… it is reasonably confident that inflation will rise, over the medium term, to its 2% objective…” Lastly the board “… taking into account domestic and international developments, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced…”

The Fed may now be having second thoughts and mentioned in the January statement that “…In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives… … This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments…”

It would be too difficult for the Fed to ‘roll-back’ the previous meeting’s increase. That would cast a shadow over future policy decisions and might cause panic in global markets already on edge from the unraveling of commodity markets.

Hence it’s likely that the Fed will refrain from further increases while the ECB may take a further measured step if necessary.

It’s then reasonable to expect EUR/USD to trade between $1.0577 November low support and the 14 December high of $1.0991 resistance.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”