EUR/USD closed the last week of January slightly lower but still in range.. What is really going on? The team at CIBC explains:

Here is their view, courtesy of eFXnews:

Mario Draghi’s punishment for disappointing markets in December was swift, with investors bidding up the value of the euro during the following trading days.

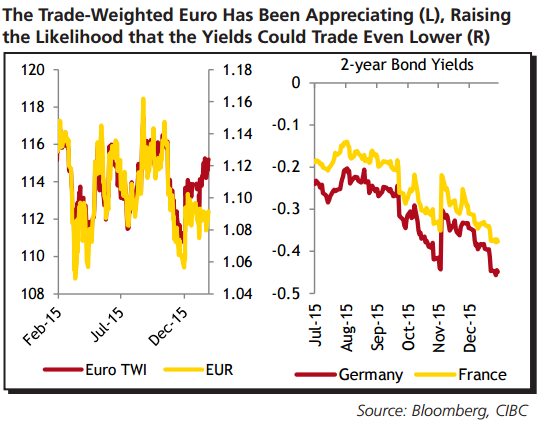

Although EURUSD has settled down, the need for further easing is more dire than what’s suggested in just the EURUSD cross.

The trade-weighted euro index has been moving in the opposite direction. And it’s recent gains, which were the result of the sharp depreciation in sterling, will weigh on the monetary union’s trade sector.

As a result, despite the EURUSD cross trading weaker and bond yields very low already, look for the EUR to trade weaker as the ECB’s March meeting approaches.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.