The Bank of Japan surprised markets with the 29 January press release in which a 3 tier negative rate policy was introduced. In a general sense, the implications were serious. The BOJ negative rate was unprecedented. It was also an indication of a continuing global “disinflationary trend” in spite of easing policies having been in place for several years and in many cases, expanded. It also may signify that the BOJ does not foresee any significant positive change in the Asia-Pacific regional economy, particularly with respect to commodity demand and thus pricing.

However, as far as negative rate policies go, it wasn’t as severe as the headlines made it out to be. On the other hand it may have been intended to serve more as an indication, implicitly suggesting that the BOJ will henceforth take a more active inter-meeting policy role if conditions should warrant actions. Perhaps the underlying reason for this new policy stance is in response to the quite strong appreciation of the Yen against almost all major currencies over the past several months. All indications pointed to a Yen ‘flight-to-safety’ trade.

Guest post by Mike Scrive of Accendo Markets

The BOJ specifically noted that “…The Bank will apply a negative interest rate of minus 0.1 percent to current accounts that financial institutions hold at the Bank… … It will cut the interest rate further into negative territory if judged as necessary…”

Further, the policy applies only to the top third of reserve deposits in excess of a threshold. The BOJ further specified that its goal was to “…achieve the price stability target of 2 percent… …It will examine risks to economic activity and prices, and take additional easing measures in terms of three dimensions — quantity, quality, and interest rate — if it is judged necessary…” Thus is indicating that the BOJ had the means to weaken the Yen by applying ‘a combination’ of measures. For example, that BOJ noted that it would purchase assets with yields lower than -0.1%.

The BOJ used the term ‘dimensions’ although it might just as well used the term ‘vectors’, all acting on the Yen.

Lastly, the BOJ made the extra effort to point out that the negative rate was not such an unusual measure nor as extreme, citing the policy rates of the Swiss National Bank, RiksBanken and Danmarks Nationalbank. The point of the matter is that the BOJ seems to be putting markets on the back foot by establishing a flexible, open ended, Yen defense and making it clear that the 29 January should be considered a first step.

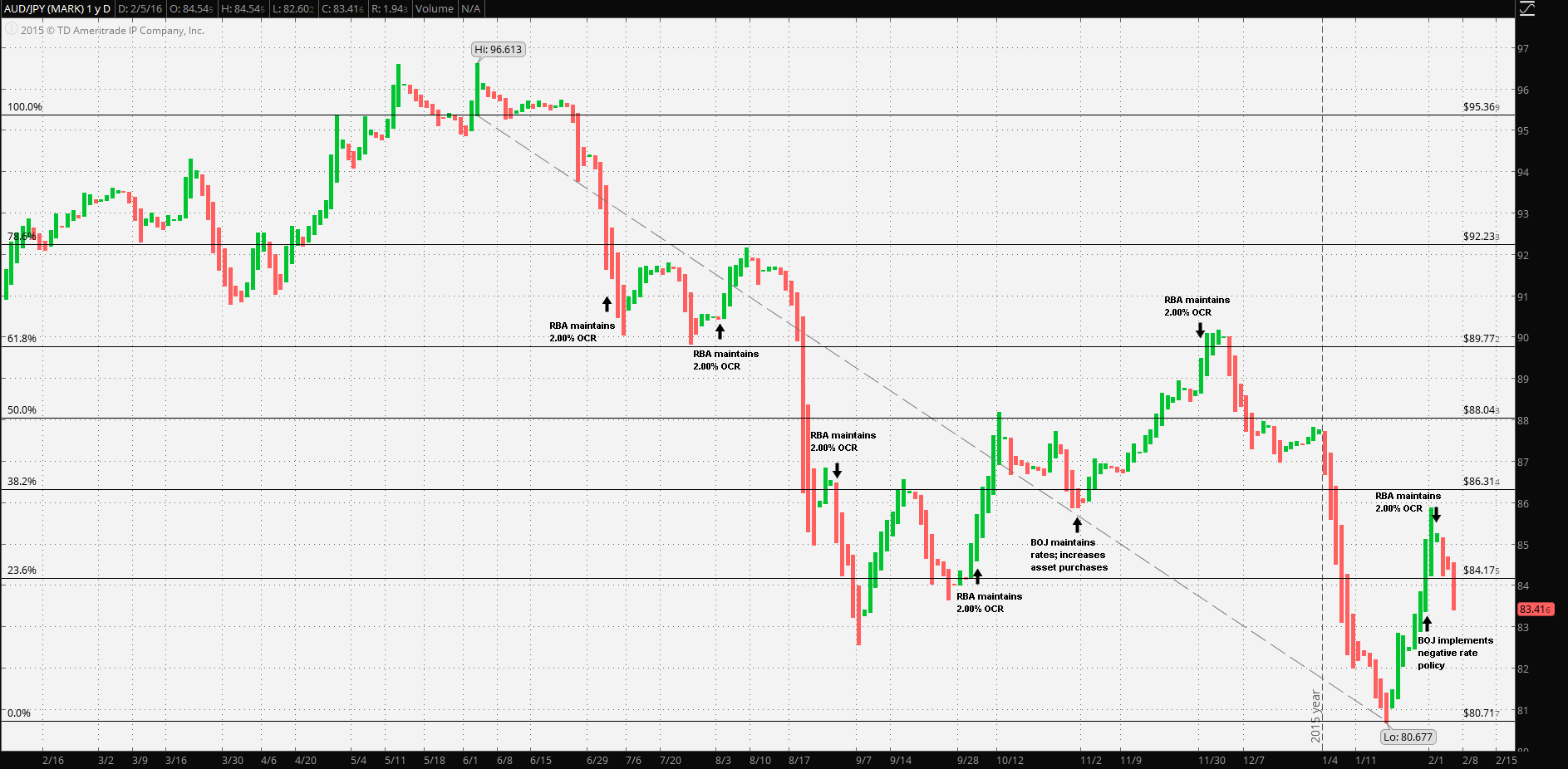

The Reserve Bank of Australia has been firm in its OCR policy in spite of being a central player in an economic region where all the players are trying to stimulate growth; (most notably the region’s largest commodity consuming nation, China). The RBA managed with only two rate reduction in 2015. First, a 25 basis point reduction in February to 2.25% and a further 25 basis in May points to 2.00%.

The RBA would make note of the volatility in the region, sound cautions but remain steady in its response. “…commodity prices have declined over the past year, in some cases sharply. These trends appear largely to reflect increased supply, including from Australia. Australia’s terms of trade are falling nonetheless… …The Federal Reserve is expected to start increasing its policy rate later this year, but some other major central banks are stepping up the pace of unconventional policy measures…” It’s worth noting this as an example as to how the US Federal Reserve needs to speak with one voice. The Fed was signaling a change in policy which would affect commodity export economies, yet it would be eight full months from the time of this RBA meeting before the Fed actually took action & .

At following meetings in the RBA followed the same script, noting the decline in commodity prices, declining terms of trade and its concern over the Fed decision to diverge from the global strategy. In September the RBA specifically noted its concerns over the “… further softening in conditions in China and east Asia…” . This specific wording pertaining to this particular economic region would be repeated in future meetings; yet the RBA maintained its 2.00% OCR rate.

Lastly, at the 2 February meeting, Governor Stevens noted that “...While several advanced economies have recorded improved growth over the past year, conditions have become more difficult for a number of emerging market economies. China’s growth rate has continued to moderate… …Commodity prices have declined further, especially oil prices…” The RBA referenced the Fed action by remarking “...Financial markets have once again exhibited heightened volatility recently, as participants grapple with uncertainty about the global economic outlook and diverging policy settings among the major jurisdictions…” However, the most significant sentence spoken by Governor Stevens in the introductory remarks specifically pointed out that “…The decline in Australia’s terms of trade, which began more than four years ago, has therefore continued…”

Clearly, the RBA has played the smarter game. It has steadfastly adhered to its 2.00%, perhaps realizing that most other policies far in excess those of the RBA were having little effect. There adherence to the 2.00% OCR with commodity prices continuing to fall and major economies continuing to weaken, logically, presented a small risk. If they were wrong, they were either only one move behind the curve or one move ahead of the curve. The statement is pointing out that the 2.00% rate neither hindered nor helped the economy.

The RBA is demonstrating confidence by staying the course, while the BOJ is clearly dissatisfied with a too strong Yen. Hence, there’s a far greater likelihood of further BOJ actions, perhaps between meetings, than any RBA actions.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”