The US dollar has been on the back foot against safe haven currencies and gaining only a bit against commodity currencies and the pound. Yet this may turn around, perhaps after some time. The team at Deutsche Bank explains:

Here is their view, courtesy of eFXnews:

Policy divergence (hiking Fed, other central banks easing) was to drive strong dollar this year.

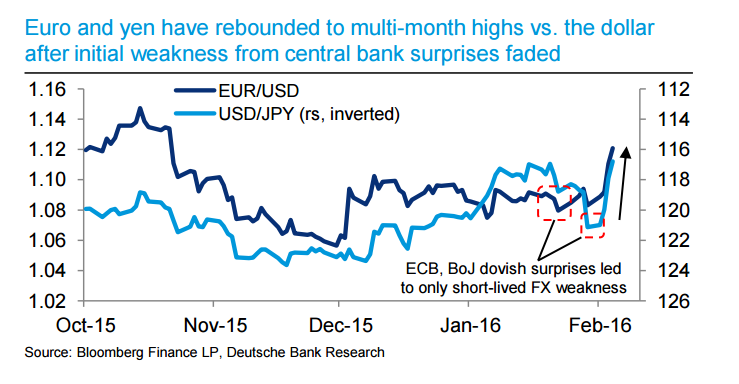

Instead, the dollar has weakened, despite signals of further ECB easing in March and the BoJ’s surprise rate cut into negative – Euro near strongest level since Oct-2015, yen strongest since Nov-2014

Less scope for FX moves to be driven by ECB, BoJ policy surprises. – Dollar-specific stories now more important.

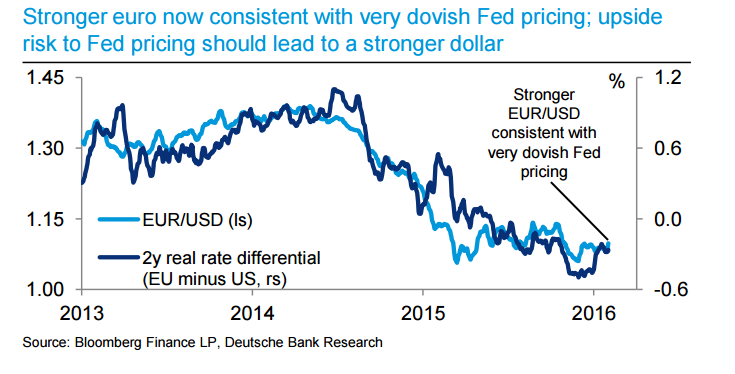

The dollar should strengthen from here, even if this may not be immediate:

− Upside risks to market pricing of Fed hikes

− Better US news and shift in focus to non-US risk concerns − Structural drivers still in place (e.g., persistent outflows from Europe; Brexit referendum, large fiscal tightening to weigh on sterling).

In China, after recent stability yuan weakness vs. the dollar should continue at a gradual pace in 2016

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.