A sharp and short lived spike on Thursday, February 11th seemed like the work of the Bank of Japan. And according to recent talk by governor Kuroda, they are “watching”. Can they succeed with intervention? Not so fast. Here is the opinion from HSBC:

Here is their view, courtesy of eFXnews:

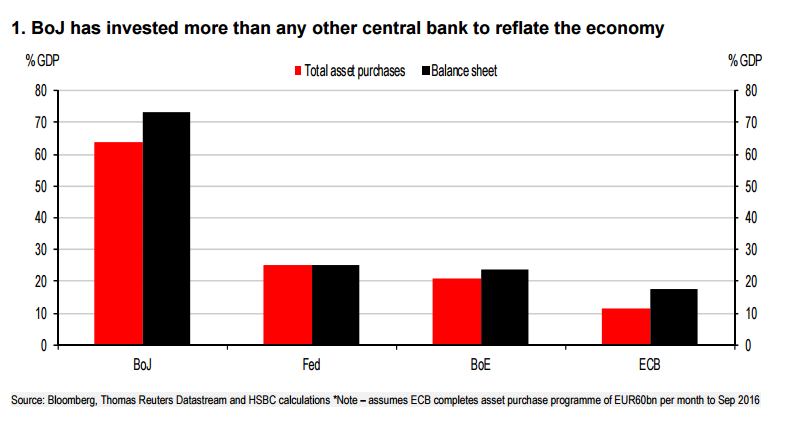

Direct FX intervention remains a major threat on USD/PY moves below 115 as the move to negative rates by the Bank of Japan (BoJ) had only a fleeting impact on JPY and showed a desire for a weaker currency, argues HSBC.

“FX markets will have to remain mindful of the intervention threat, particularly in Japan.

This may take many forms, including rhetoric and more rate cuts (we expect two more later in 2016), but the growing event risk is that Japan intervenes directly in the FX market. Markets may mistakenly assume that, as interest rates up to 10 years are negative in Japan and yields on excess deposits at the BoJ are now negative, intervention may be more successful. After all, any counterpart to BoJ intervention will be sitting on JPY with a negative yield,” HSBC clarifies.

Is intervention justified, and will it work?

“So the door remains open to direct FX intervention, especially in response to a rapid move fostered by international developments rather than a shift in domestic fundamentals. The BoJ may argue FX intervention is justified in the same way that the SNB justified putting in a floor on EUR-CHF given the drivers of the current JPY surge. A worried world is prioritising capital preservation, and Japan’s branding as a ‘safe haven’ is being reflected in a strengthening JPY.

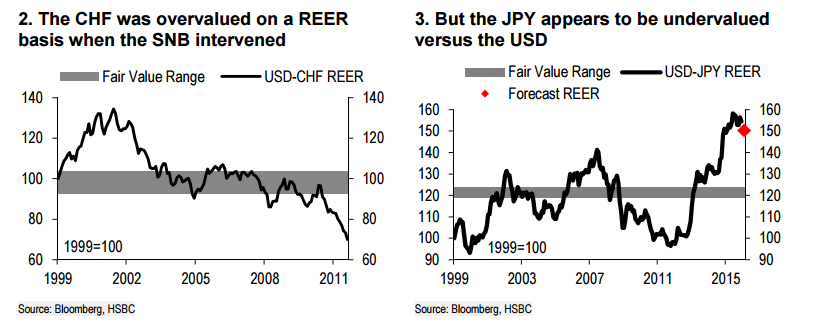

This argument falls down when we look at valuations. When the SNB intervened and implemented the EUR-CHF floor in late 2011, the CHF appeared to be significantly overvalued, according to the HSBC Little Mac Valuation Ranges. The JPY is at the other end of the spectrum. The Abenomics-induced rally in USD-JPY from below 80 in 2011 to around 115 has actually left the JPY notably undervalued relative to the USD.

This makes FX intervention harder to justify. We believe there would be little empathy from other nations for BoJ intervention, as there was in March 2011, when the JPY was both overvalued and reeling from the shock of the Tohuko earthquake and tsunami,” HSBC argues.

“However, even in the unlikely event that any BoJ intervention is unsterilized, Switzerland’s experience with FX intervention with negative interest rates shows that success is not guaranteed, even under these conditions,” HSBC concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.