The ECB is about to ease in March: it told us so. However, the team at BNP Paribas still sees the common currency rallying against the greenback.

Here is their view, courtesy of eFXnews:

In its weekly note to clients today, BNP Paribas discusses its outlook for EUR/USD making the case for the pair to rally into mid-year. The following is BNPP’s rationale behind this call along with its EUR/USD targets over the coming months.

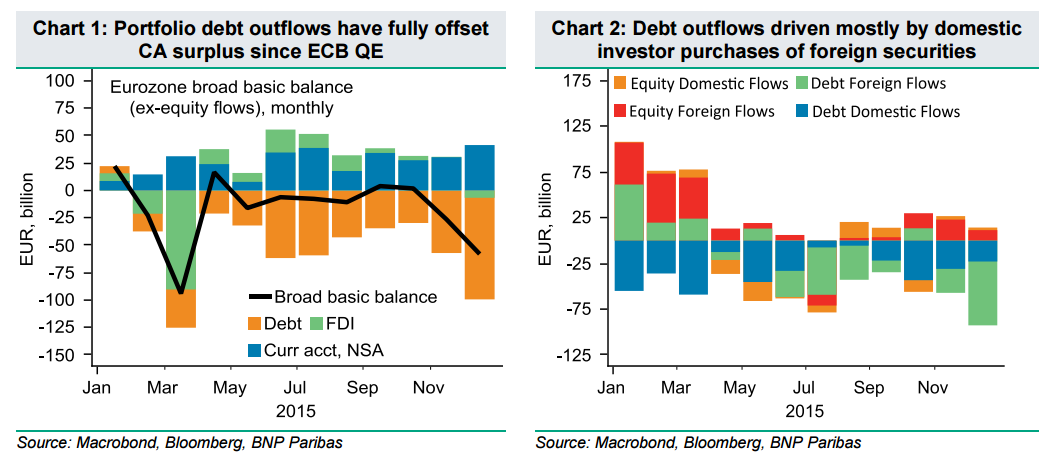

“The key factor underpinning our near-term bullish forecast is that we expect the fragile risk environment preventing the Fed from tightening will also not be conducive to a recycling of the eurozone’s EUR 25bn/month current account surplus.

The combination of (1) ultra-low EUR real yields and (2) the large size of the ECB’s asset purchase programme relative to new eurozone government bond issuance should theoretically stimulate EUR outflows, as eurozone investors are crowded out of domestic fixed income markets and search for yield abroad. However, we think these factors will be outweighed by fragility in the risk environment which will not be conducive to portfolio outflows, leaving the EUR supported by its EUR 25bn/month current account surplus. The EUR has outperformed this year as a deteriorating risk environment has left eurozone domestic investors presumably reluctant to take foreign currency risk by seeking yield overseas,” BNPP argues.

“Our economists are now forecasting unchanged Fed policy in 2016, in line with market pricing, but are more aggressive in their expectations for ECB easing….The more direct effect of our new Fed forecast profile is to limit the extent of rate divergence between the US and the eurozone. While we expect further ECB easing to push eurozone front-end rates down by around 15bp in Q2, the degree of projected divergence with US rates resulting from this forecast is far less than would have occurred against a backdrop of steady quarterly 25bp rate hikes from the Fed. This alone would be a reason to curtail the extent of EURUSD downside likely this year, while the less risk-friendly environment anticipated leads us to an outright near-term bullish forecast profile for the pair,” BNPP adds.

BNPP now targets EUR/USD at 1.16 by end of Q2 and at 1.14 by end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.