What’s next for major pairs? Here are detailed ideas from Barclays:

Here is their view, courtesy of eFXnews:

EUR: EURUSD – A cheaper alternative to hedge EU referendum risks.

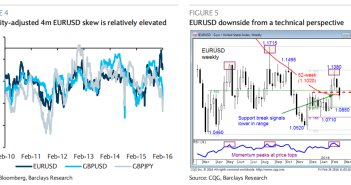

We recommend owning EURUSD downside options as a cheaper way to hedge against the EU Referendum risk. We continue to argue that the referendum is at least as big a risk to EU and EMU stability as it is to the UK economy. With GBP option prices already heavily skewed to the downside, EURUSD is a cheaper alternative.

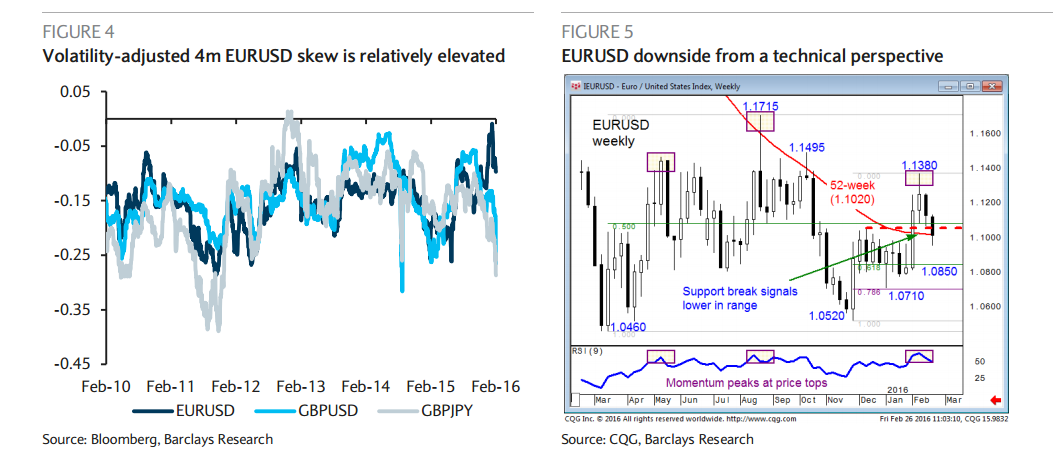

Our technical bearish view for EURUSD was encouraged by the break below support in the 1.1060 area. The weekly close below the 1.1020, 52-week average points lower toward initial targets in the 1.0850 area and then the 1.0710 year-to-date lows. We would become more bearish following a break below 1.0710. Our greater targets are toward 1.0460 and then the 1.0215 area

The data calendar this week is relatively quiet. We expect no changes in the final readings of euro area PMIs (Tuesday). Moreover, we are below consensus in expecting euro area headline HICP inflation to decline to -0.1% in February (consensus: +0.0%). We think that core inflation is likely to soften, easing to +0.9% from +1.0% in January. Risks to both our core and non-core forecasts are tilted to the downside (see February inflation round-up (Part III), 25 February 2016). With medium-term inflation expectations, measured by the 5y5y HICP inflation swaps, trading at new all-time lows last week, we see increasing pressure for the ECB to deliver at its March policy meeting.

JPY: Global risk and safe-haven flows continue to dominate.

The outcome of the G20 meeting and upcoming economic data globally, including US PMI/ISM and NFP, should set the tone for risk assets and the JPY this week. Perceived policy limits on some major central banks including the BoJ led the market to shift its focus to fiscal stimulus going into the G20. However, fundamental improvement, particularly in the US and China, will likely be needed to provide any material support for risk assets. In such an environment of fragile global risk dynamics, we expect USDJPY to decline to 100 in the quarters ahead.

In terms of Japan’s economic data, January industrial production (Monday), January labor market data (Tuesday), and January wages per worker (Friday) will be watched. We expect January IP to increase +3.8% m/m (consensus: +3.3%), the January unemployment rate to stay flat at 3.3% (consensus: 3.3%), and January wages per worker to increase +0.7% y/y (consensus: +0.4%). In addition, the Ministry of Finance will release its FX intervention data for February on Monday. While we are doubtful that it has conducted intervention, this month-end data will be closely watched given rising political jawboning and market speculation about interventions.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.