Norges Bank last lowered its Key policy rate 25 basis point to 0.75% in June of 2015 citing “…Developments in the Norwegian economy have been slightly weaker than expected and the economic outlook has deteriorated somewhat… …output growth has edged down and reporting enterprises expect growth to remain weak over the next half-year…”

Norway’s economy is heavily dependent on the oil industry as is the government for revenues. However, Norges Bank has diligently followed age old advice: save during the good years thus be prepared for the lean years. Norges Bank manages the largest sovereign wealth fund on the planet, and perhaps in all history. The bank has diversified assets totaling well over half a trillion Pounds Sterling. Recent headlines made much about expectations of a sale of £7.5 billion (appx. $10 billion USD) in assets. However, what didn’t make headlines was that the fund is there for just such contingencies.

Guest post by Mike Scrive of Accendo Markets

The very largest bulk of Norway’s export trade trade is with the EU; about 20% of that with the UK. Of that 20% nearly 85% is petroleum or petroleum related products. Hence, the GBP/NOK cross is an important factor affecting the balance of trade between these two nations. A weak Krone increases consumer purchasing power in the UK through lower fuel cost as well as manufacturing costs. The reasonably well performing UK economy has been advantageous to both economies. Further, below target inflation has allowed the Bank of England to remain accommodative with its monetary policy.

However, a strengthening of the Krone against sterling will have the opposite effect: decrease consumer spending power and well as increasing the cost of production. The dynamic here needs to be noted. The Norwegian economy is actually experiencing an economic slowdown, not just disinflation with slow growth. Norges bank had noted this in September and at subsequent meetings. “… Unemployment has edged up as expected, while household goods consumption has been lower than projected…” in November and again, “…household consumption and private sector investment are expected to be lower than previously projected… …Unemployment is expected to rise slightly more than projected in the September Monetary Policy Report…”, in December.

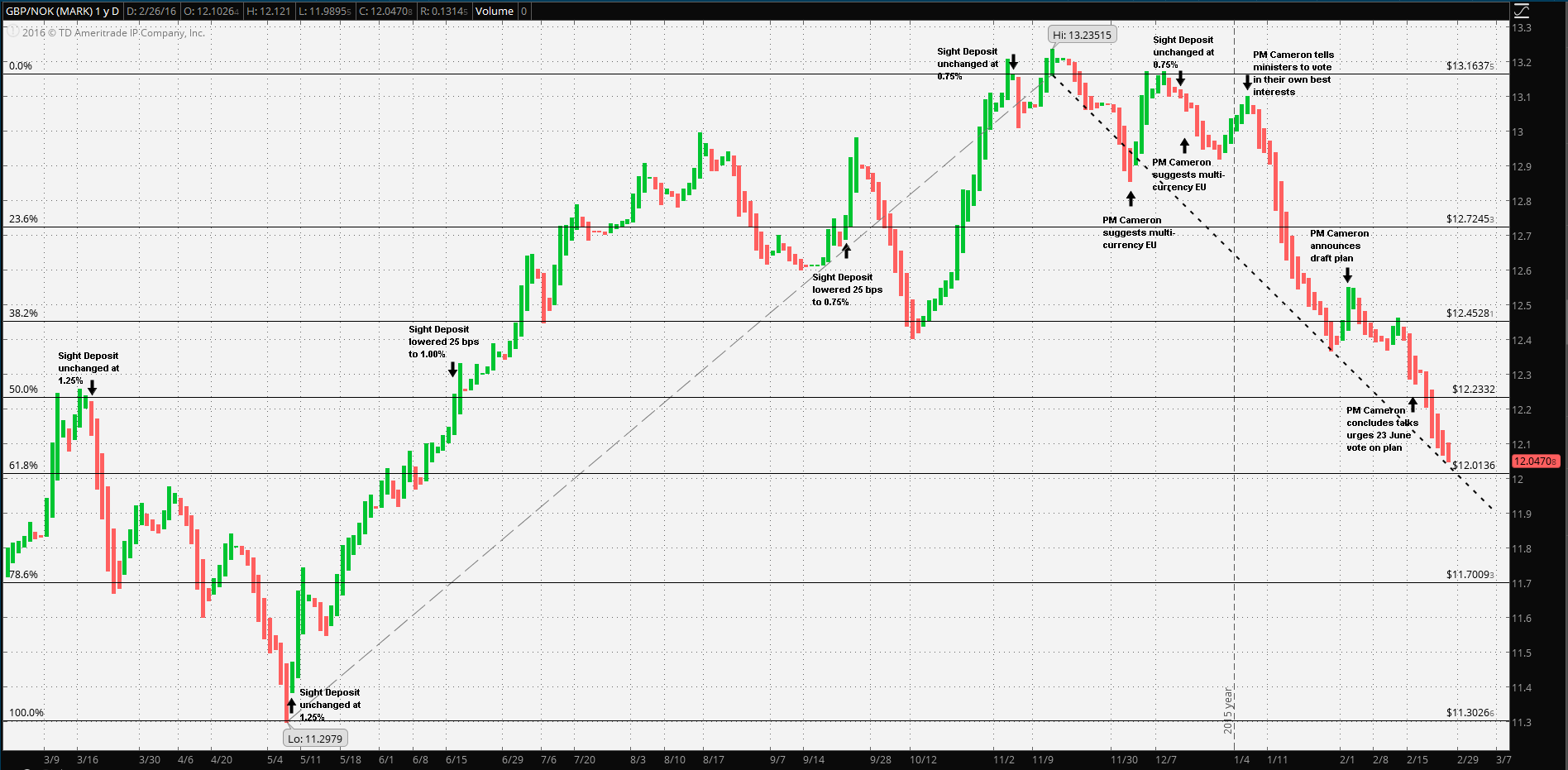

The UK economy, if anything, is meeting expectations or modestly exceeding them; i.e., the UK has growth. Hence, the expectations would then be for a weaker Krone against a strong Pound Sterling. This is clearly not the situation as demonstrated by the chart.

As demonstrated above, as Norges Bank eased from GBP/NOK cross low of kr11.2979 in early May, 2015 the Krone steadily weakened, breaking through one level after the other. It broke through kr12.7245 in July, but regained some ground against Sterling, testing and then failing that same level as support. GBP/NOK met and tested the kr12.7245 resistance level just before Norges Bank Executive Council September meeting at which time the sight deposit rate was reduced again. The Krone then broke through kr12.7245 resistance, regained a bit and then off to the next level at kr13.1637 per, just at the November Norges Bank meeting; rates remained unchanged. It regained a bit and then tested and broke resistance to the 52 week high of kr13.23515 per. The pattern repeated once more: it strengthened, and retested resistance just before the December Executive Council meeting. The sight rate remained unchanged, in December.

The point of the narration is that GBP/NOK behaved textbook-precise as what should be expected of the currency of a steady economy versus that of a weakening economy whose central bank was in an easing cycle, up until this point.

The pattern nearly repeated after the December meeting but there was one important difference. At this point Sterling had already been weakening considerably against most other advanced economy currencies, but not against the Krone. The Krone hit up against resistance right into the first week of 2015. It’s important to keep in mind that Norway is experiencing an actual economic slowdown, not simply moderate growth economy with disinflation, as are its neighbors. Norges Bank had recognized that and embarked on an easing cycle in an effort to stimulate economic growth. Whereas little has change in the UK economy and if anything it has grown modestly. Perhaps not enough to warrant a rate increase, but far from the need for a rate increase. Yet, from the 11 November 2015 GBP/NOK high, the trend is clearly down. It couldn’t possibly be a result of a strengthening Krone; Norges Bank has clearly voiced its concerns about commodity markets, household spending, rising unemployment and the need for further easing. Therefore the reversal must be a result of a weakening of Sterling. This in spite of the fact that the UK economy is relatively strong!

The cause is obvious and noted on the chart. As the UK-EU referendum negotiations gained momentum leading up to an agreement and a vote date, the GBP/NOK cross fell in line with other advanced economy currencies vs Sterling. The import point here is that the upcoming referendum vote demonstrates the technical consequences Sterling must bear as global financial institutions and central banks pre-position for the possibility of UK secession from the EU.

This may not be evidenced so clearly in other currency pairs, but it’s clear here. Norway is a major European trade partner; it’s a petro-economy; it may be entering recession and further weakening of the Krone is almost a given. There is no other similar comparison with a major European economy.

Although a reversal at some point might be expected as the 23 June vote approaches, this serves as a clear demonstration of the potential volatile extremes which Sterling may experience vs its peers.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”