The Marubozu candlestick – Explanation

You are probably familiar with Japanese candles and their role in technical analysis. If not, the first thing you need to know is that Japanese candles are commonly used by Forex traders and help them in recognizing price trends and finding good trading opportunities.

Today I would like to introduce you with the “Marubozu” candlestick which is a specific candlesticks formation.

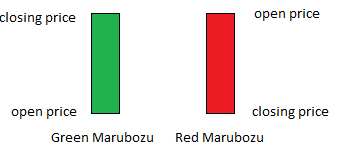

Marubozus are very long candles that indicate that an asset was traded strongly in one direction, whether bearish or bullish. This type of candles does not have upper or lower shadows while their high and low prices are represented by the same levels of the opening/closing.

A Green (or white) Marubozu candle forms when the opening price is equal to the lowest price and the closing price is equal to the highest price. When you see a green Marubozu candle on your trading platform, you know that the price action was strongly bullish. Buyers were in control from the very first trade of the candlestick to the last one, within the certain time frame represented by the candle.

On the contrary, a red (or black) Marubozu candle is formed when the opening price is equal to the highest price and the closing price is equal to the lowest price. That means that the price action was controlled by the sellers from the beginning until the end of the trading session, during the relevant time frame.

Marubozu candles may provide strong trading signals to a trend direction, when used in conjunction with other technical indicators for confirmation. Signals that are provided by the Marubozu candlestick will be stronger when occur on longer time frames, such as a 4 hour chart or even higher time frames. So When you do recognize the Marubozu formation

Look for a confirmation and consider joining the ride on the trend. Your chances of taking a profitable trade in this case are significantly higher than usual!

Guest post by Jonathan Grab of http://www.forextradingchannel.com/