UK pound is struggling today, heading lower as a global stock selloff weighs on the currency. Sterling is down nearly across the board today, thanks to concerns about stocks, and earnings misses by major European banks. UK pound has taken something of a beating in recent weeks. With a variety of concerns weighing on the British currency, it’s no surprise that the sterling is struggling. Today, the pound is in a selloff as global stocks … “Global Stock Selloff Sends Sterling Lower”

Month: February 2016

Are markets losing faith in central banks?

Central banks have been ever-powerful in markets: support for stocks via the Bernanke Put, Draghi’s “Whatever it Takes” and Kurdoa’s Shock and Awe QQE are prime examples. They not only gave boosts to stock markets but also pushed down the currencies, thus making exports more competitive. Yet recently, it seems that these very powerful institutions with their … “Are markets losing faith in central banks?”

How Long Will Loonie Remain a Petro-Currency?

The Canadian dollar is heading lower again today, thanks in large part to the fact oil prices are once again falling. However, while the loonie is likely to retain some of its ties to oil, some analysts are starting to question how long it will remain a true petro-currency. After a short period of gains, oil prices are once again heading lower. Today, oil prices dropped below … “How Long Will Loonie Remain a Petro-Currency?”

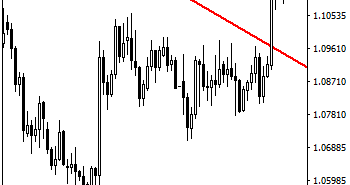

EURUSD: Faces Further Bullish Offensive Short Term

EURUSD: Having taken back all of its intra day losses to close flat on Wednesday and following through higher during Thursday trading session , EURUSD faces further bullish offensive short term. Support lies at the 1.1250 level. Further down, support lies at the 1.1200 level where a violation will aim at the 1.1150 level. A … “EURUSD: Faces Further Bullish Offensive Short Term”

Solid New Zealand Economic Health Doesn’t Make NZD Stronger

The New Zealand dollar was yet another victim of the risk-negative sentiment prevailing on the Forex market that led to less than stellar performance of risky growth-related currencies. Solid domestic fundamentals were not enough to support the currency. Seasonally adjusted Business NZ Performance of Manufacturing Index ticked up from 57.0 to 57.9 in January. The report commented on a healthy state of New Zealand’s economy. Yet this did not prevent the NZ … “Solid New Zealand Economic Health Doesn’t Make NZD Stronger”

Australian Dollar Drops Together with Other Commodity Currencies

The Australian dollar fell today along with other commodity-related currencies despite relatively positive economic data from Australia. The most likely reason for the sluggish performance was concern about slowdown of the global economy. Released today, Melbourne Institute Inflation Expectations remained unchanged at 3.6 percent. The Westpac Consumer Sentiment Index released yesterday demonstrated an increase of 4.2 percent in February following the 3.5 percent drop in January. Yet positive … “Australian Dollar Drops Together with Other Commodity Currencies”

Turning Bearish On USD For First Time Since Mid-2014 –

The US dollar is finding less love these days, especially against the yen. The team at Creidt Suisse turns bearish on the greenback for the first time since mid 2014 and explains: Here is their view, courtesy of eFXnews: Risk aversion in markets continues to play out, with our technical team now targeting an S&P 500 level … “Turning Bearish On USD For First Time Since Mid-2014 –”

Little Italy is getting little again

The Italian debt poses great danger to the economy – Watch today’s discussion on the Italian economy, and the financial markets with Nicole Elliott, Private Investor and Technical Analyst, joined by Mike Ingram, Strategist at BGC Partners, and Zak Mir, Technical Analyst at Zak’s Traders Café. Key points: Bullish or Bearish – Sort out your … “Little Italy is getting little again”

ABX – first global institutional exchange for precious metals

Allocated Bullion Exchange made a soft launch today as the world’s first electronic exchange for precious metals allocated physically. Here are more details from the official press release: 10 February 2016: Allocated Bullion Exchange (ABX) has today launched as the world’s first global institutional electronic exchange for allocated physical precious metals, which will provide market participants … “ABX – first global institutional exchange for precious metals”

Euro Finally Pulls Back Against Other Currencies

Euro is finally pulling back against many of its other currencies, dropping as Forex traders consider that the ECB will need to make a move soon. Euro has been heading higher in recent days, gaining ground in spite of uncertainty in the market and other issues that would normally be considered euro-negative. Now, though, the 19-nation currency is finally losing ground against its major counterparts. The data out … “Euro Finally Pulls Back Against Other Currencies”