The latest Canadian data release, from the end of last week, hasn’t been doing much to help the loonie in Forex trading. Although the Canadian dollar is getting a bit of help against some of the high beta currencies like the pound and the euro, it is down against the dollar and the yen. Loonie is mixed in currency trading today, struggling against the dollar as oil prices continue to struggle and as economic data is discouraging. At the end … “Canadian Data Doesn’t Do Much for the Loonie”

Month: February 2016

AUD/JPY: Constant/Variable

The Bank of Japan surprised markets with the 29 January press release in which a 3 tier negative rate policy was introduced. In a general sense, the implications were serious. The BOJ negative rate was unprecedented. It was also an indication of a continuing global “disinflationary trend” in spite of easing policies having been in … “AUD/JPY: Constant/Variable”

Forex Crunch wins Best Buy Side Analysis Contributor in

I am proud and honored to spread the news that Forex Crunch won the Best Buy Side Analysis Contributor in FXStreet’s Best Awards 2016. The vote was based on both a professional jury and an open survey in which 2859 votes were cast. Thank you very much for all the support in the vote, in visiting the … “Forex Crunch wins Best Buy Side Analysis Contributor in”

5 ways to implement innovation in your brokerage

Back in 1998, e-commerce giant Alibaba, was in the brink of failure. His company had not turned a profit during its first three years in business and Executive Chairman, Jack Ma, had no way of processing payments and no bank wanted to work with him. Ma found himself at a crossroad and instead of closing … “5 ways to implement innovation in your brokerage”

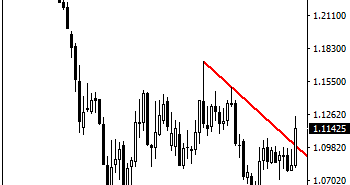

EURUSD: Looks To Pullback Ahead Of Key Resistance.

EURUSD: With EUR pulling back (see daily chart) ahead of its key resistance following its rally above its declining trendline the past week, EURUSD looks to pullback ahead of key resistance. On the downside, support is located at the 1.1100 level and if violated, expect more weakness to happen towards the 1.1050 level. Further down, … “EURUSD: Looks To Pullback Ahead Of Key Resistance.”

Pound Hurt by Policy Outlook, Manages to End Week Higher vs. Dollar

The Great Britain pound sank against most of its major currencies during the past trading week as the UK central bank signaled that monetary tightening is not in sight. Still, the sterling managed to gain on the US dollar over the week, though it trimmed its gains by the weekend. The pound has started the week on a positive note as economic data looked good. Yet everything changed after the Bank of England made its … “Pound Hurt by Policy Outlook, Manages to End Week Higher vs. Dollar”

Economic Data Helps US Dollar

US dollar is heading higher today, thanks in large part to the latest data releases. With the economic outlook for the United States continuing to improve, some analysts are still predicting another rate hike in March, while other think that the Fed will rate a little longer. Rate hike hopes are still alive for some analysts. The latest data out of the United States shows that the unemployment rate dropped … “Economic Data Helps US Dollar”

Euro Pulls Back on Profit Taking and Consolidation

Euro has been enjoying quite the rally in recent days, due mostly to dollar weakness and policy misses. However, the 19-nation currency is pulling back a bit right now as Forex traders consolidate their positions and take profits. In the last few days, the euro has surged, and yesterday the currency reached the 1.1200 level against the US dollar. Since then the euro has fallen back below that point, but this … “Euro Pulls Back on Profit Taking and Consolidation”

Are wages all the rage or is it profit taking?

It is quite uncommon to see the US dollar rising across the board on a significantly worse than expected Non-Farm Payrolls. Jobs advanced by 151K, worse than 190K expected and well below the average of recent months. The dollar initially dropped, with EUR/USD reaching 1.1244, USD/JPY continuing its reversal of the BOJ move and other currencies … “Are wages all the rage or is it profit taking?”

EUR/USD: Trading the US NFP Feb 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP Feb 2016”