Euro is mostly lower today, falling against many of its major counterparts after the release of factory output data. The US dollar is one of the few currencies that the euro is seeing gains against today. Eurozone factory output data was released today and it was a little disappointing. Many PMIs across the eurozone performed negatively, weighing on the euro in early trading. The 19-nation currency is mostly lower, … “Euro Down on Factory Data, Except Against the Dollar”

Month: February 2016

New Zealand Dollar Gets Help of Employment Data

The New Zealand dollar gained today with the help of positive employment report released overnight. Graeme Wheeler, Governor of the Reserve Bank of New Zealand, was speaking early during the Asian session, sending mixed signals about the future monetary policy. New Zealand employment rose 0.9 percent in the December quarter from the previous three months after falling 0.5 percent in the September quarter. The unemployment rate sank from 6.0 … “New Zealand Dollar Gets Help of Employment Data”

Britain’s Services PMI Shows Stable Growth, Sterling Rallies

The Great Britain pound rallied today after the release of the services Purchasing Managers’ Index. The index was safely above the neutral level, showing stable growth of the sector. The Markit/CIPS UK Services PMI was at 55.6 in January, little changed from the December’s 55.5. The reading was good even though it missed analysts’ expectations of 57.6 and the preliminary estimate of 57.8. The sterling got boost from the positive data as well as from the reports … “Britain’s Services PMI Shows Stable Growth, Sterling Rallies”

Buy AUD/USD suggest February seasonal patterns

Seasonality cannot always be explained but it’s certainly another pattern to look out for. The team at ANZ show that February is a good month for going long Aussie against the USD: Here is their view, courtesy of eFXnews: Long AUD/USD is the best seasonal FX trade for the month of February, notes Australia and … “Buy AUD/USD suggest February seasonal patterns”

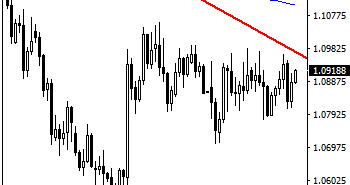

EURUSD Looks To Test Is Falling Trendline

EURUSD: With EUR taking back more than half of its Friday losses on Monday and following through higher on Tuesday, it looks to test is falling trendline at 1.0971. But be cautious ahead of the mentioned declining trendline. Support lies at the 1.0850 level. Further down, support lies at the 1.0800 level where a violation … “EURUSD Looks To Test Is Falling Trendline”

cTrader Web undergoes a significant update

The cTrader web platform is not sitting on its hands. It underwent a significant update. All the details are here in the press release: Spotware Systems announce the completion of cTrader Web updates for all supporting brokers. These exciting features are now available to all traders inside cTrader Web next time they visit the application. “We … “cTrader Web undergoes a significant update”

Greenback Trades Mixed as Global Stocks Plummet

Global stocks are once again plummeting. The dollar is trading mixed, however, as many traders await economic data to determine whether or not recent dollar strength remains relevant. Stocks around the world are heading lower and there is a great deal of volatility in the markets. Safe haven demand is helping the greenback to some degree, but the currency is trading mixed. The dollar, while a traditional safe haven, is … “Greenback Trades Mixed as Global Stocks Plummet”

Yen Edges Up on Demand for Safer Assets

Yen is heading higher as investors and traders turn to more traditional safe haven assets in response to uncertainty and volatility in the stock market. Yesterday, the yen was still relatively week. Thanks to the recent announcement from Bank of Japan policymakers that there would be negative interest rates in an effort to stimulate the economy, yen has been struggling. The BOJ seems determined that Japan will “win” the currency wars underway to make … “Yen Edges Up on Demand for Safer Assets”

Forex Crunch Key Metrics – January 2016

The beginning of the year saw a nice rise in visitors and sessions but not in page views. The end of the vacation season and volatility in many pairs countered the extremely stable EUR/USD. It is hard to compete with the SNBom-ed month of January 2015. The impact of the new site is examined. Anyway, here … “Forex Crunch Key Metrics – January 2016”

GBP/USD: Trading the British Services PMI Feb 2016

British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on … “GBP/USD: Trading the British Services PMI Feb 2016”