Euro/dollar has been one of the most frustrating currency pairs in the new year, with ranges just becoming tighter and tighter. Where will it go from here? The team at BTMU explains: Here is their view, courtesy of eFXnews: The EUR/USD rate did not repeat the sharp declines of January 2015 in 2016 with a … “EUR/USD: Opposing Forces: Where To Target? – BTMU”

Month: February 2016

GBPUSD Reverses Gains, Eyes More Strength

GBPUSD: With the pair reversing its Friday losses to close higher on Monday, further recovery is now envisaged in the days ahead. It must trade and hold above range to create scope for more strength. Support lies at the 1.4400 level where a break will turn attention to the 1.4350 level. Further down, support lies … “GBPUSD Reverses Gains, Eyes More Strength”

January NFP: Preview & FX Trading Strategy – BofA

The Non-Farm Payrolls is the highlight of this week’s trading calendar. Here is the view from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: Employment growth likely slowed in January with nonfarm payrolls rising by 170,000. This follows a robust 2015 finish, as jobs increased by an average of 284,000 in … “January NFP: Preview & FX Trading Strategy – BofA”

Canadian Dollar Withstands Negative Impact of Falling Oil Prices

The Canadian dollar was able to overcome the negative impact of falling prices for crude oil, bouncing from the daily lows during the Monday’s trading session. Crude oil fell today as poor economic data from China had a negative influence on commodity markets. Additionally, crude declined amid doubts that major oil producers would be able to reach an agreement about cutting output. Usually (especially at the recent times), the loonie … “Canadian Dollar Withstands Negative Impact of Falling Oil Prices”

Britain’s Manufacturing Looks Good, Pound Higher

The Great Britain pound gained against its major peers today with the help of a good manufacturing report. It was the third consecutive day of gains for the currency against the euro and the Japanese yen. The Markit/CIPS UK Manufacturing PMI increase to the three-month high of 52.9 in January from 52.1 in December. The actual reading was noticeably higher than the median forecast of 51.8. The Bank of England is going to hold a policy meeting on Thursday, and it … “Britain’s Manufacturing Looks Good, Pound Higher”

Aussie Down Intraday, Attempts to Recover

The Australian dollar dipped intraday due to disappointing manufacturing data from China but has managed to recover as of now, at least against the US dollar and the Japanese yen. The Caixin China General Manufacturing PMI ticked up a little from 48.2 to 48.4 in January but remained below the neutral 50.0 level. Government data also indicated contraction of the sector. This bodes ill for the whole global economy, but for the economy of Australia in particular … “Aussie Down Intraday, Attempts to Recover”

Sell AUD/JPY – Barclays Trade Of The Week

The Australian dollar is a “risk” currency while the yen is a “safe haven”. This makes moves quite sharp, and now the team at Barclays sees opportunities: Here is their view, courtesy of eFXnews: We expect China’s PMI to remain in contraction territory and anticipate a below-consensus decline in the Caixin PMI (48.0, versus consensus … “Sell AUD/JPY – Barclays Trade Of The Week”

Euro Rallies a Bit as Gold Gains Ground

Euro is rallying today, following on the heels of a choppy couple of weeks. Last week the euro didn’t perform quite as well as expected, considering the data released about the eurozone, but at the start of this week the 19-nation currency seems to be making up for it. As gold gains ground in the markets, the euro is getting some support. Euro often moves with gold prices, and with gold surging today, the 19-nation currency is … “Euro Rallies a Bit as Gold Gains Ground”

EUR/USD: The Painter’s Dilemma

It’s interesting to compare the expectations of the European Central Bank and those of the US Federal Reserve Bank at the time when the policies of the two major central banks began to diverge. The 22 October 2015 ECB statement specifically noted that, “…While euro area domestic demand remains resilient, concerns over growth prospects in … “EUR/USD: The Painter’s Dilemma”

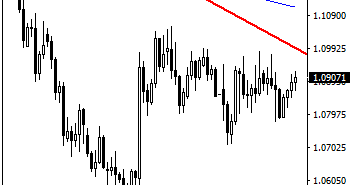

EURUSD Threatens Trendline Resistance

EURUSD: With EUR continuing to trade and hold above the 1.0777/1.0800 zone but maintaining upside bias, further recovery higher is envisaged. Support lies at the 1.0850 level. Further down, support lies at the 1.0800 level where a violation will aim at the 1.0750 level. A break of here will aim at the 1.0700 level. Conversely, … “EURUSD Threatens Trendline Resistance”