The Great Britain pound has attempted to rally during the current trading session but failed and is trading near the opening level as of now. The sterling was attempting to extend yesterday’s rally but was unsuccessful. Fears of Britain leaving the European Union continue to haunt the market, undermining any attempts of Britain’s currency to rally, and the sudden drop of the consumer confidence was not helping the matters. It looks like the pound is going … “Pound Fails to Rally, Trades Close to Opening”

Month: February 2016

Five Things Successful Traders Do

For years, I’ve heard that 90% of traders lose money trading, and they lose it to the 10% who are making money. More recently, it seems that the numbers I hear are 95-5, so even worse. FXCM recently released a report showing, according to them, retail fx traders received better executions than institutional or exchange … “Five Things Successful Traders Do”

Inflation Data Doesn’t Prevent Yen from Rising

Inflation data released from Japan during the Friday’s trading session was mixed, but this did not prevent the Japanese yen from rising against the US dollar and the euro. Japan’s core Consumer Price Index was unchanged in January while experts had predicted a drop by 0.2%. Tokyo core CPI, on the other hand, edged down 0.1% while analysts had promised it to stay unchanged. The mixed data … “Inflation Data Doesn’t Prevent Yen from Rising”

EUR/USD: ‘Disorderly Times’: Where To Target? – Credit Suisse

EUR/USD seems to have found a temporary calm within the 1.0960 to 1.1070 levels, but this may change soon. What’s next in these disorderly times? The team at Credit Suisse weighs in: Here is their view, courtesy of eFXnews: …Many market participants are excited about the 10 March ECB meeting. They hope that a central bank … “EUR/USD: ‘Disorderly Times’: Where To Target? – Credit Suisse”

NZ Dollar Extends Gains as Trade Balance Turns to Surplus

The New Zealand dollar was rising throughout the Thursday’s trading session and extended gains after the release of positive trade balance data from New Zealand. New Zealand’s trade balance registered a surplus of NZ$8.1 million in January after logging a deficit of NZ$38 million in December. The actual reading was far better than the predicted shortage of NZ$250 million. The positive reported helped the New Zealand currency to solidify its already substantial … “NZ Dollar Extends Gains as Trade Balance Turns to Surplus”

Canadian Dollar Moves Higher Following Crude Oil

As it often happens, the Canadian dollar was tracking moves of crude oil prices. The prices were moving up during the Thursday’s trading session, therefore the currency was gaining as well. Oversupply on the oil market remains a major threat to the performance of crude, and the deal among major producers about cutting output does not look particularly probable. Yet all this did not prevent crude oil futures from rallying … “Canadian Dollar Moves Higher Following Crude Oil”

Yen Pulls Back, But Retains Some Safe Haven Strength

Yen is pulling back today, becoming subdued. However, even with the lower performance today and warnings about future monetary policy, the yen is retaining some of its safe haven strength. Soft fundamentals in the Japanese economy are leading to some concerns that Bank of Japan policymakers will need to take more action when they meet in March. The BOJ already shocked Forex traders and investors by instituting negative … “Yen Pulls Back, But Retains Some Safe Haven Strength”

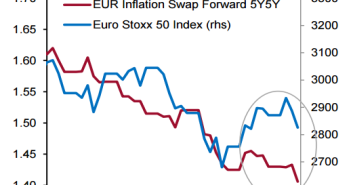

Euro Loses Ground on Inflation Report

Euro is losing ground from earlier, thanks in large part to the latest inflation report, which was downwardly revised for January. After the release of the new information, the 19-nation currency is struggling. The latest year over year inflation reading for the eurozone was downwardly revised from 0.4 per cent to 0.3 per cent for January. Even with this disappointment, though, it looks as though there is still some … “Euro Loses Ground on Inflation Report”

Brazilian Real Unfazed by Moody’s Credit Rate Downgrade

The rally of the European stocks allowed the currency markets to stabilize, leading to a bounce of riskier currencies. The Brazilian real joined the rally against the US dollar even though Brazil’s credit rating was reduced by Moody’s to junk. Yesterday, Moody’s Investor Service cut Brazil’s credit grade to Ba2 with a negative outlook. The agency cited following reasons for the downgrade: i) The prospect of further deterioration in Brazil’s debt metrics in a low growth environment, with … “Brazilian Real Unfazed by Moody’s Credit Rate Downgrade”

Pound Rises, Remains Near Multi-Year Lows

The Great Britain pound rose a little today but was still trading near the seven-year low versus the US dollar and also near the multi-year low against the Japanese yen. Economic data released from Great Britain on Thursday was mixed with economic growth and the Index of Services being in line within expectations, while business investment demonstrated a surprise decrease. The sterling preferred to ignore the negative part of the data, edging higher … “Pound Rises, Remains Near Multi-Year Lows”