The Mexican peso fell against the US dollar today as Mexico’s economy disappointed economists, growing slower than analysts had anticipated. Mexico’s economic growth slowed to 0.5% in the fourth quarter of the previous year down from 0.8% in the third quarter, below analysts’ expectations. One of the reasons for the stagnating growth was the decline of oil prices and weakness of the US manufacturing sector that was limiting demand for Mexican exports. The falling currency may … “Mexico’s Slowing Growth Makes Peso Less Attractive”

Month: February 2016

Falling Crude Oil Prices Lead to Drop of Canadian Dollar

The Canadian dollar slid against other most-traded currencies today due to the slump of crude oil prices and the resulting risk-negative sentiment. Prices for crude was falling as traders started to realize that capping production close to record level is not going to alleviate oversupply on the market. Unsurprisingly, the Canadian currency reacted negatively to the drop of oil prices. The loonie fell not just because Canada’s economy heavily depends on oil exports but … “Falling Crude Oil Prices Lead to Drop of Canadian Dollar”

Euro Continues to Slide, Gains on Pound

The euro continued to slide against its most-traded peers as concerns about the potential Brexit and economic stagnation in the eurozone undermined the strength of the currency. As one could expect, the shared 19-nation currency fared better that the Great Britain pound that has been the weakest major currency this week so far. Brexit fears are on the rise despite the recent deal between the United Kingdom and the European Union to secure a special status of the UK … “Euro Continues to Slide, Gains on Pound”

US Dollar Gains Ground as Stocks, Oil Fall

It looks to be another unsettling day in the markets, and the US dollar is benefitting from the uncertainty. Greenback is gaining against its high beta counterparts, but falling against the yen. US dollar index is higher today as the greenback gains against its high beta counterparts, like the euro and the pound. Stocks are struggling today, and oil is lower. Even though OPEC is looking at a production freeze, … “US Dollar Gains Ground as Stocks, Oil Fall”

EUR/PLN: Concern and Confidence

The Easternmost members of the European Union have similar economies with similar outlooks. It’s important to note that Hungary, Czech Republic and Poland have robust manufacturing export economies within the EU. One notable example is semi-manufacturing automobile production with Germany. Fortunately, this was among the strongest sectors in the 2015 global economy. Robust demand from … “EUR/PLN: Concern and Confidence”

Weaker Zloty Good for Polish Economy

The Polish zloty fell against the US dollar today as the market sentiment soured, making riskier currencies of emerging economies less attractive. This may be not that bad in the long run, at least for those Polish policy makers that want the currency to be lower. Eryk Lon, the newly appointed member of Poland’s central bank Monetary Policy Council, voiced his desire to see the zloty moderately weaker. He said … “Weaker Zloty Good for Polish Economy”

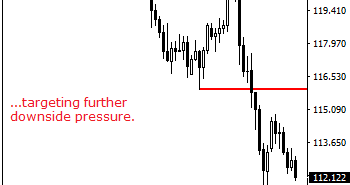

USDJPY: Pressure Builds Up On The 111.65/00 Zone

USDJPY: With the pair remaining weak and following through lower on Tuesday trading session, further weakness is envisaged. On the downside, support comes in at the 111.50 level where a break if seen will aim at the 111.00 level. A cut through here will turn focus to the 110.50 level and possibly lower towards the … “USDJPY: Pressure Builds Up On The 111.65/00 Zone”

Euro Weakens on Economic Data, Gold

Euro is heading lower today, thanks in part to weaker economic data and lower gold prices. Also contributing to a lower euro is the concern brought about by a potential UK exit from the European Union. Euro is mostly down against its major counterparts today, with its only substantial gains against the UK pound. The latest eurozone composite PMI shows that business activity is at a 13-month low … “Euro Weakens on Economic Data, Gold”

Canadian Dollar Gains Ground Along With Oil

Canadian dollar is higher today, thanks in large part to the fact that oil prices are higher. Unrest in the Middle East might be providing some of the support for oil prices. Loonie is heading higher today, thanks in large part to gains by oil prices. Oil is back above $31 per barrel, and that is providing a great deal of support for the Canadian dollar against its major counterparts. Unrest … “Canadian Dollar Gains Ground Along With Oil”

Japanese Yen Lower vs. Dollar & Commodity Currencies

The Japanese yen fell against the US dollar after the release of disappointing manufacturing PMI data. The yen also dropped against commodity currencies as prices for crude oil rallied. The Nikkei Flash Japan Manufacturing PMI dropped from 52.3 in January to 50.2 in February, far below the predicted figure of 52.0. The report said: Data suggests that the fall in total new work intakes was caused primarily by a contraction in international demand, with … “Japanese Yen Lower vs. Dollar & Commodity Currencies”