The Great Britain pound fell on Monday as the market was plagued by concerns that the United Kingdom may exit the European Union. Traders did not like the lack of clarity about whether Great Britain stays in the union or not as well as uncertainty about what an exit would mean for the economy of the country. Britain’s Prime Minister David Cameron announced a Brexit referendum on June 23 after he reached a deal with other European … “UK Pound Dives on Brexit Fears”

Month: February 2016

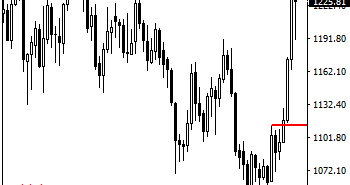

GOLD Targets Further Bullishness Short Term

GOLD: Having GOLD taken back almost all of its gains to close a rejection candle the past week, further bullishness is likely. On the downside, support comes in at the 1210.00 level where a break will turn attention to the 1200.00 level. Further down, a cut through here will open the door for a move … “GOLD Targets Further Bullishness Short Term”

USD: Sideways; EUR: Upward Pressure – Barclays

While the US dollar looks a bit mixed, the team at Barclays has a clear tendency about the euro, and they provide their views: Here is their view, courtesy of eFXnews: USD: Resilient inflation The latest prints in wage increases and inflation have been relatively supportive for the USD. After having reached multi-year highs in mid-January, … “USD: Sideways; EUR: Upward Pressure – Barclays”

Are Central Bankers Out Of Ammunition? – BofA Merrill

The words uncertainty and volatility have a strong presence and usually we had central banks stabilizing things at these times. But are they out of ammunition? The team at Bank of America Merrill Lynch explains: Here is their view, courtesy of eFXnews: …Central banks still can move the markets, but do they have enough ammunition to … “Are Central Bankers Out Of Ammunition? – BofA Merrill”

Dollar Ends Week Mixed as Interest Rate Outlook Unclear

The US dollar ended the trading week mixed. The greenback fell against commodity currencies and the Japanese yen but gained on its two most liquid rivals — the euro and the Great Britain pound. The main theme for the US currency remains the outlook for monetary tightening from the Federal Reserve, which stays dubious. The Fed itself is relatively optimistic, believing that interest rates hikes are still possible this year. Markets are … “Dollar Ends Week Mixed as Interest Rate Outlook Unclear”

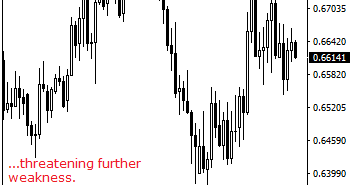

NZDUSD Faces Further Downside Threats

NZDUSD: Having continued to remain vulnerable, NZDUSD faces further downside threats. Support lies at the 0.6600 level where a break will aim at the 0.6550 level. Further down, the 0.6500 level comes in as the next downside target. Its daily RSI is bearish and pointing lower suggesting further weakness. Conversely, resistance resides at the 0.6650 … “NZDUSD Faces Further Downside Threats”

US data is on a winning streak – the Fed

US figures were quite lousy for quite some time, but things are a-changin. Here are few things to note. Consumption remained illusive: the fall in the price at the pump was supposed to leave more money in Americans’ pockets but they didn’t spend it. Report after report, the headlines talked about a disappointing retail sales read. … “US data is on a winning streak – the Fed”

Traditional drivers of FX undermined – GBP/USD to 1.35

Simon Smith, Chief Economist for FxPro, joined Zak Mir on the Tip TV Finance Show to discuss the move away from traditional drivers of the FX market, using UK and US current account deficit and GBP/USD to show the developing situation. Topics Covered: FX Market, USD/CAD, Fed, GBP/USD, UK, US, Current Account, Brexit Get the … “Traditional drivers of FX undermined – GBP/USD to 1.35”

US Dollar Index Gains as Core Inflation Rises

The US dollar is trading mixed against its major counterparts today, but the US dollar index is higher. The latest inflation numbers are in, and it looks as though prices are rising at a fairly rapid pace. Inflation numbers reported today show that CPI was flat month over month, but on a year over year basis, there has been some growth. Main CPI is … “US Dollar Index Gains as Core Inflation Rises”

Yen Gains While Risk Appetite Wanes

The Japanese yen rallied today against other most-traded currencies as the traders’ mood soured. Risk appetite waned after the rally of crude oil prices had come to a halt, making risky assets less appealing to investors. Crude halted its rally due to a build-up of US inventories, and this made riskier currencies, particularly those linked to the commodity market, weaker. Consequently, the yen became more attractive as a safe currency. Of course, it … “Yen Gains While Risk Appetite Wanes”