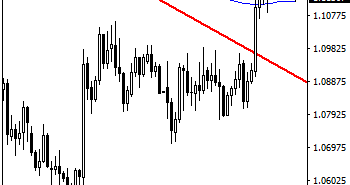

EURUSD: With continued downside pressure seen, EURUSD targets the 1.1059 support zone . This leaves the pair targeting its key support located at the 1.1059 level. However, immediate support lies at the 1.1100 level with a cut through there opening the door for more weakness towards the 1.1050 level and then the 1.1000 level. A … “EURUSD Targets The 1.1059 Support Zone”

Month: February 2016

AUD/USD: Base Of Triangle; NZD/USD: Trendline Resistance – NAB

The better market mood has helped both antipodean currencies but the road is certainly bumpy. What do the technical lines say? Here is the view from NAB: Here is their view, courtesy of eFXnews: The corrective bounces of recent weeks have challenged the integrity of the downtrend but not broken its structure. Dual trend line resistance … “AUD/USD: Base Of Triangle; NZD/USD: Trendline Resistance – NAB”

US Economic Data Surprises to the Upside

US dollar is heading higher today, thanks in large part to the fact that a number of US data economic prints surprised to the upside. With the US economy continuing to show signs of recovery, many hope to see the Federal Reserve take more steps to tighten policy, which could mean more strength. Even though housing starts missed expectations this month, there are plenty of other economic data releases … “US Economic Data Surprises to the Upside”

Australian Dollar Finds Support in Rising Oil Prices

The improvement of the risk sentiment allowed the Australian dollar to bounce even though domestic macroeconomic fundamentals were not particularly supportive to the currency. The rally of crude oil prices translated into good performance of commodity-geared currencies, including the Aussie. News from Australia itself was not good the leading index continued to weaken. Westpacâs Chief Economist Bill Evans commented: The Index has now been growing below trend for the last nine … “Australian Dollar Finds Support in Rising Oil Prices”

Japanese Yen Fails to Rally as Crude Oil Prices Bounce

The Japanese yen attempted to rally today on the back of the weaker Chinese yuan and falling oil prices, which hurt risk appetite. Yet Japan’s currency retreated after crude bounced, easing investors’ worries. The People’s Bank of China set the reference rate for the yuan lower today, reigniting fears about hard landing of the world’s second biggest economy. Meanwhile, disappointment about the deal between Saudi Arabia and Russia hurt oil prices, … “Japanese Yen Fails to Rally as Crude Oil Prices Bounce”

AUD/USD: Trading the Australian jobs Feb 2016

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Feb 2016”

Canadian Dollar Goes Down Along with Crude Oil

The Canadian dollar declined against its major peers today as the news about a deal between Saudi Arabia and Russia to keep output of crude oil the same was not welcomed by markets. The news that the major oil producers are going to keep production unchanged was not what markets have been waiting for. Preserving nearly record high output levels is not going to solve the supply-demand imbalance. As a result, … “Canadian Dollar Goes Down Along with Crude Oil”

Euro Mixed as Economic Sentiment Worsens Yet Beats Expectations

The euro fell against the US dollar and the Japanese yen but gained on other most-traded counterparts today. The economic sentiment both in Germany and the whole eurozone deteriorated this month yet was better than analysts had predicted. The ZEW Indicator of Economic Sentiment for Germany dropped from 10.2 to 1.0 in February but was above the median forecast of 0.1. The report commented on the result: The looming slowdown of the world economy and the uncertain consequences of the falling … “Euro Mixed as Economic Sentiment Worsens Yet Beats Expectations”

Inflation Data Doesn’t Help UK Pound

The latest economic data out of the United Kingdom shows that inflation has improved, but that isn’t doing much to help the economy. The inflation news is paired with falling prices, and there are concerns about what the Bank of England will do next. Sterling is down almost across the board. The Office for National Statistics reports that the annual figure for inflation is at 0.3 per cent, which is … “Inflation Data Doesn’t Help UK Pound”

NZ Dollar Declines as Economic Data Fuels Monetary Easing Outlook

The New Zealand dollar dropped today as economic data released from New Zealand over the trading session was not particularly good, leading to speculations that the nation’s central bank may be forced to cut interest rates. Retail sales rose 1.2 percent in the December quarter of the previous year, failing to meet market expectations of a 1.4 percent increase. The Reserve Bank of New Zealand lowered its 2-year inflation expectations … “NZ Dollar Declines as Economic Data Fuels Monetary Easing Outlook”