The Australian dollar gained against its US counterpart today with the help of monetary policy minutes from the Australian central bank and the rally of crude oil. The currency was less successful in rising against its other major rivals. For example, it lost earlier gains versus the Japanese yen. The Reserve Bank of Australia released minutes of its latest policy meeting today. The central bank had rather positive view on the nation’s … “Australian Dollar Higher vs. US Rival, Loses Gains vs. Yen”

Month: February 2016

US Dollar Gains vs. Majors, Falls vs. Commodity-Linked Currencies

The US dollar was rising against its major rivals during the Monday’s trading session but was less successful against commodity-related currencies that had profited from the rally of crude oil prices and the general risk-positive market sentiment. The greenback got a bit of support from economic data released from the United States on Friday. In particular, it showed that retail sales grew 0.2 percent in January, exceeding analysts’ … “US Dollar Gains vs. Majors, Falls vs. Commodity-Linked Currencies”

Euro Gains Against Safe Currencies, Lower vs. Other Major Peers

The euro rallied versus safe currencies, like the Japanese yen and the Swiss franc, but fell against other most-traded currencies today amid the positive market sentiment. The rally of European and other global stocks improved the traders’ mood, which has been rather poor at the start of this year. The big gain of the yuan eased concerns that China would devalue its currency, adding to deflation that threaten developed economies. Yet … “Euro Gains Against Safe Currencies, Lower vs. Other Major Peers”

Australian Dollar Gains Strength as Traders’ Mood Improves

The Australian dollar rose on Monday, climbing more than 1 percent against the Japanese yen, as the positive mood of the Forex market participants helped riskier currencies tied to commodities and growth to gain strength. The same risk appetite that was driving safe currencies down helped the Aussie to log gains. The currency was especially strong against the vulnerable yen. The Chinese yuan surged, demonstrating willingness of China to stabilize its currency and preserve … “Australian Dollar Gains Strength as Traders’ Mood Improves”

Investors Feel Less Need for Safety, Making Yen Less Desirable

The week has started with a risk-on mode that limited demand for the Japanese yen in its role of a safe currency. Economic data released from Japan was not helping the yen either. Japan’s gross domestic product shrank 0.4 percent in the fourth quarter of 2015 according the preliminary estimate, a bit more than analysts’ had predicted. Japanese Prime Minister Shinzo Abe voiced hope that Group of Twenty finance … “Investors Feel Less Need for Safety, Making Yen Less Desirable”

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Economic Sentiment”

Is bad news good news now?

Since the beginning of the European session on Friday, the market mood has certainly improved. And now it seems that nothing can stop markets, even significantly bad news. Or perhaps the faith in central banks is returning and bad news is becoming good news? Some of this correction can be explained by a correction to the exaggerated doom … “Is bad news good news now?”

GOLD Weakens On Corrective Pullback

GOLD: Having continued to decline following its Friday downside pressure after price failure, more weakness is now envisaged in the days ahead. On the downside, support comes in at the 1210.00 level where a break will turn attention to the 1200.00 level. Further down, a cut through here will open the door for a move … “GOLD Weakens On Corrective Pullback”

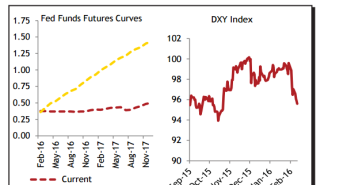

Traders, Beware Of A Near-Term Reversal In The US Dollar

The US dollar has been on its back foot for quite a while, suffering from weakness in the US economy among other issues. Can this turn around though? Here is an explanation from CIBC: Here is their view, courtesy of eFXnews: The fed funds futures curve is now essentially flat, with market-based expectations pointing to … “Traders, Beware Of A Near-Term Reversal In The US Dollar”

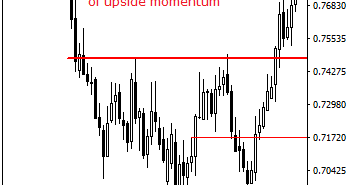

EURGBP Bull Momentum Stalls Ahead Of 0.8000

EURGBP- Although the cross remains biased to the upside, it faces a move lower on correction on loss of upside momentum. However, with a loss of upside momentum seen on Friday (see daily chart) Support comes in at 0.7700 level. Further down, support lies at the 0.7650 level where a violation will turn focus to … “EURGBP Bull Momentum Stalls Ahead Of 0.8000”