The euro gained on the US dollar as well as against other most-liquid currencies during the Thursday’s trading session. The notable exception was the Swiss franc, against which the shared 19-nation currency declined. The eurozone inflation ticked to -0.1% in March (year-on-year) up from -0.2% in February. What is even better, core annual inflation was at 1.0%, exceeding analysts’ expectations. Other economic data released from the eurozone over the session was … “Euro Gains on Major Rivals, Falls vs. Swiss Franc”

Month: March 2016

Canadian Dollar Fails to Maintain Rally vs. US Dollar

The Canadian dollar attempted to rally against its US rival during the current trading session but has failed and is trading near the opening level right now. The currency was also flat against the Japanese yen but fell versus the euro. Canada’s gross domestic product demonstrated growth by 0.6% in January, two times the rate of growth that had been forecast by analysts. GDP expanded by just 0.2% in the previous … “Canadian Dollar Fails to Maintain Rally vs. US Dollar”

NZ Dollar Bounces After Drop, Struggles to Rise Above Opening Rate

The New Zealand dollar bounced after falling against the US dollar and the Japanese yen earlier today but was unable to rally so far. The business confidence report released on Thursday was not helpful to the currency. The ANZ Business Confidence dropped from 7.1 in February to 3.2 in March. The report said that “business confidence continues to wane” but “firms are more optimistic about prospects for their own business and this … “NZ Dollar Bounces After Drop, Struggles to Rise Above Opening Rate”

Pound Stable After Mixed Data

The Great Britain pound was little changed today as Thursday’s economic data released from the United Kingdom was mixed, allowing the currency to stabilize after the earlier drop but not providing enough support to initiate a rally. On the positive side, growth of UK gross domestic product in the fourth quarter of 2015 was finalized at 0.6%, a bit higher than the preliminary reading of 0.5%. On the negative side, the current account deficit widened to £32.7 … “Pound Stable After Mixed Data”

EUR/USD: Trading the US Non-Farm Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Non-Farm Payrolls”

Fallout From Yellen Continues to Weigh on Dollar

Interest rate expectations for the US dollar are changing following a speech from Fed Chair Janet Yellen. Greenback is down almost across the board today as the fallout from yesterday’s remarks continues. Yesterday, Janet Yellen, the chair of the Federal Reserve’s Federal Open Market Committee, remarked that interest rate hikes should be taken slowly. She spoke of caution in interest rate policy and seemed to indicate that the economic … “Fallout From Yellen Continues to Weigh on Dollar”

Swiss Franc Gains After Release of Decent Economic Data

Decent economic data released from Switzerland over Wednesday allowed the Swiss franc to gain on the US dollar as well as on some other most-liquid currencies like the Japanese yen. The UBS Consumption Indicator rose from 1.45 to 1.53 points in February, according to the report “indicating consistent, solid growth in private consumption.” The KOF Economic Barometer was almost unchanged in March even though economists promised a decline. The franc reacted positively to the reports, … “Swiss Franc Gains After Release of Decent Economic Data”

USD/CAD: Trading the Canadian GDP

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Thursday at 12:30 … “USD/CAD: Trading the Canadian GDP”

Yen Unfazed by Sharp Drop of Japan’s Industrial Production

The Japanese yen was little changed today despite the sharp drop of industrial production that put the Bank of Japan under pressure to add even more stimulus for Japan’s struggling economy. Industrial production was down as much as 6.2% (seasonally adjusted) in February from the previous month, more than even pessimistic forecasts had predicted. It was the biggest drop since 2011 when Japan was hit by an earthquake. Yet … “Yen Unfazed by Sharp Drop of Japan’s Industrial Production”

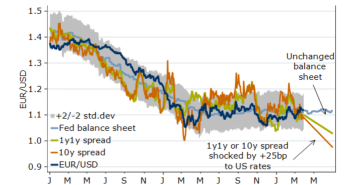

EUR/USD: Dealing With The Fed’s Confusion – Nordea

Yellen went full dovish, once again, and this certainly hurt the US dollar. Was does this mean for EUR/USD? The team at Nordea analyzes: Here is their view, courtesy of eFXnews: The Fed has done its best to propagate confusion recently. Why the Fed chose to walk the dovish path in March is crucial for the … “EUR/USD: Dealing With The Fed’s Confusion – Nordea”