The decision of the ECB is just around the corner. How will it affect the euro? Here is the view from Goldman Sachs:

Here is their view, courtesy of eFXnews:

We lay out scenarios for EUR/$ for different outcomes on Thursday. Above all, after a year of mixed messages, the ECB needs to signal that it is serious about pursuing its inflation mandate, including via a stepped up pace of monthly QE purchases.

There is little doubt in our minds that the ECB wants to surprise this week, not just because of the inflation picture, but also because it disappointed in December, inadvertently tightening financial conditions materially. The question is whether it will choose to do that on the deposit rate and/or sovereign bond buying.

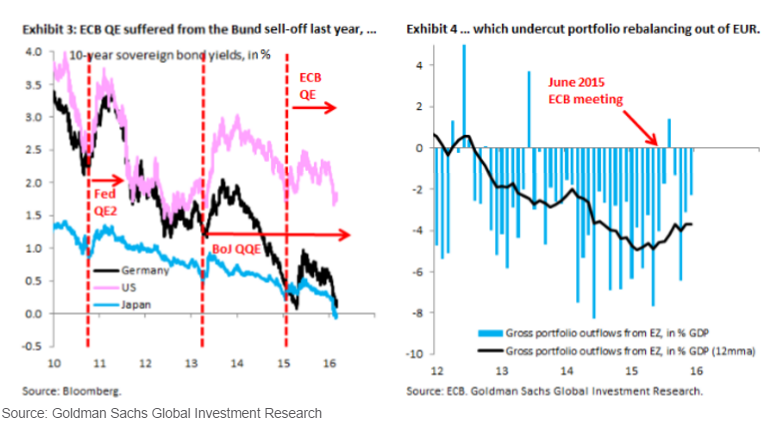

From the perspective of EUR/$, we think it is helpful to go back to first principles. The main goal of any QE program is to encourage a portfolio shift from the safe haven asset – Bunds in the Euro zone – to risky assets, including foreign currencies. The sharp Bund sell-off a year ago, not to mention the volatility since then (Exhibit 3), have impaired the functioning of ECB QE, as can be seen from the pull-back in residents’ portfolio outflows following President Draghi’s comment that “markets should get used to periods of higher volatility” at the June press conference (Exhibit 4).

1- Our first preference is therefore for the ECB to simply stabilize Bund yields at a relatively low level, similar to what the BoJ has done since the start of QQE. This is the most powerful option for Euro down and would require the Bundesbank to adjust the maturity of its Bund purchases to market conditions.

2- A shift from Bunds to more periphery debt, for example by relaxing the capital key, is next up in our list of preferred measures, where our rule of thumb is that an EUR 100 bn surprise is worth one big figure downside in EUR/$.

3- Another cut in the deposit rate is our least preferred option, because we see the effect from negative interest rates as relatively limited. We think a 10 bps surprise is worth two big figures downside in EUR/$. Given how much is priced and the negative perception of tiering, this is the least powerful option.

…Ultimately, we think monetary dominance will reassert itself, given that the ECB has only inflation as its target. That is the underlying reason why we continue to hold to our 0.95 forecast for EUR/$ in 12 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.