The ECB meeting is drawing near and here is a quick and short preview from SocGen:

Here is their view, courtesy of eFXnews:

1. Deposit rate: current -0.30%

SG forecast: -20bp to -0.50%

Consensus: -10bp Forecast range: no change to -20bp

2. Asset purchase programme : current €60bn/month until March 2017 (sovereign, ABS, CB)

SG forecast: no change

Consensus: no change, 60% chance of programme expansion by €10bn to €70bn

3. 3y TLTROs

SG forecast: extension to 2017

Consensus: n/a

4. Tiered interest rate system on excess reserves

SG forecast: two-tier system ECB to copy the BoJ? Required minimum reserves with the BoJ have an interest rate of 0%, excess reserves in existence in January will earn 0.1%, new excess reserves created by the future expansion of the BoJ balance sheet are subject to an interest rate of -0.1%.

Consensus: n/a

Bottom line:

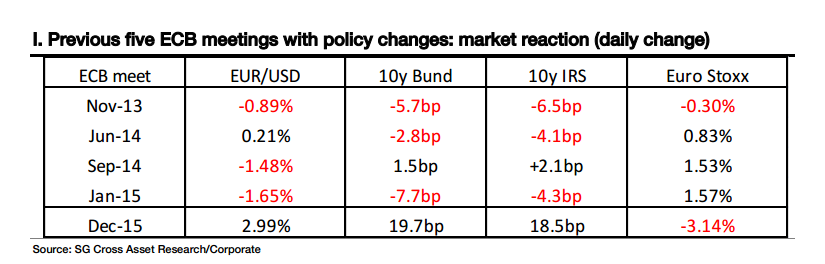

Further easing is expected from the ECB this week, but it is unlikely to push the EUR/USD exchange rate lower durably. We do not expect EUR/USD to break below the 1.04/1.05 low reached in 2015 over the course of this year, short of a Brexit scenario.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.