The ECB’s huge stimulus package backfired and sent EUR/USD higher, but can this last? There are also other factors in play for the common currency. Here is the view from Nomura:

Here is their view, courtesy of eFXnews:

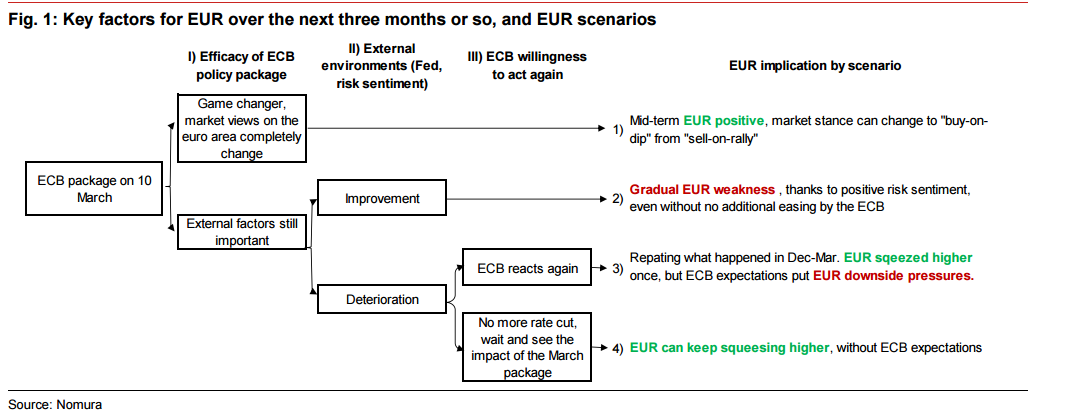

Over the next three months or so, EUR trading will likely depend on three factors: i) efficacy of the ECB policy package, ii) external environment, especially Fed policy and risk sentiment, and iii) ECB willingness to ease further, including rate cuts, when necessary.

Based on these three factors, EUR could take four possible paths; we think a gradual depreciation of EUR/USD thanks to better risk sentiment and Fed rate hikes is now more likely than before the ECB meeting.

We judge the ECB policy package shifting to credit easing from rate cuts to be risk-positive, which should gradually depreciate EUR against USD.

Short-term EUR appreciation due to negative external developments cannot be ruled out, but under this risk scenario, repetition of the EUR cycle between the December and March meetings (EUR squeezing higher once and ECB easing expectations kicking in) is more likely than the scenario of ECB inaction continuing to push EUR higher (this remains a tail risk scenario). We would expect this to be a sixmonth cycle though, rather than a three-month cycle.

Thus, we think an optionalised EUR/USD downside position, with a moderate target, is the position to have.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.