EUR/USD is trading in a very narrow range ahead of the Fed, still digesting Draghi. What do the charts tell us? Here is the view from Credit Suisse:

Here is their view, courtesy of eFXnews:

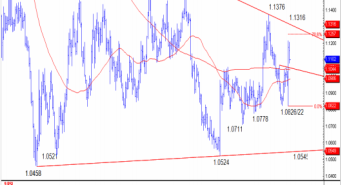

EUR/USD spotlight remains on the “point of breakout” and 200- day average at 1.1068/44, notes Credit Suisse.

“We look for this to ideally hold to keep the bias higher in the range for 1.1176, then a test of the recent price high at 1.1218.

“Extension through here can aim at gap and 78.6% retracement resistance spanning from 1.1230 to 1.1256/59. Above here would find a tougher test at potential trendline resistance from the August 2015 high at 1.1316,” CS projects.

“With the February peak just above at 1.1376 we would look for a fresh cap in this area,” CS adds.

Immediate support shows at 1.1068/44. Capitulation back below here is needed for a more neutral theme to then target 1.1020, then 1.0973,” CS adds.

In line with this view, CS maintains a long EUR/USD from 1.1140, targeting a move to 1.1370 with a stop at 1.1058.

*This trade has been recorded in eFXplus Orders on March 11.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.