The Fed decision is coming shortly. Here are last minute views from Deutsche Bank and Credit Agricole. Stay tuned for our live coverage. Here goes.

Here is their view, courtesy of eFXnews:

How The FX Market Will Likely React To Today’s FOMC? – Credit Agricole

The outcome of the March Fed meeting is the main event on the day and should attract considerable attention. The USD-investors will be looking for more conclusive indications about the timing of the next rate hike as well as the likely ‘glide path’ from here.

The FOMC has adopted a more cautious language in January to reflect the tightening financial conditions in the US (on the back of global risk off and weaker US data) as well as the lacklustre outlook for inflation (partly because of persistently weak oil prices). Since then, market conditions have improved in tandem with the US data and the oil prices have staged a rebound. While market measures of US inflation expectations remain close to the lows, core inflation gauges have accelerated, alleviating concerns about potential second-round disinflationary effects. Last but not least, the USD TWI came off sharply from its recent highs and helped ease the US financial conditions further, The changing fundamental backdrop in the form of easier US financial conditions and improving fundamentals should allow the Fed to signal greater confidence in the US recovery. Key for the timing of any rate hikes would be comments about the outlook for inflation. In January, the Fed no longer saw the risks to its outlook as balanced.

Gone was also the phrase that the Fed is ‘reasonably confident’ inflation will return to its 2%-target. A reinstatement of at least one of these statements could encourage investors to frontload rate hike expectations. In addition, the revisions of the ‘dot plot’ should be marginal so that it can continue to signal several (eg three) rate hikes this year. At present, investors are fully pricing in one Fed rate hike, to come only at the end of this year.

We suspect that the March Fed statement, the updated dot plot, growth and inflation forecasts as well as Yellen’s press conference could encourage some frontloading of rate hike expectations and that should support USD. A more constructive Fed view on the US could be perceived as hawkish and could add to the recent pick up in risk aversion.

As a result, we expect the likes of AUD, NZD, CAD and NOK to continue to underperform the USD. Liquid safe haven currencies like EUR, CHF and JPY could lose some ground as well even if they could prove more resilient in relative terms.

USD: Trading The FOMC – Deutsche Bank

We expect the March meeting to break as follows:

i) The dot plot. DB’s econ team expects the median dots to come down by 25bps for all of 2016, 2017, 2018 and the longer-run. Prima facie this may seem dovish but the dots will have to come down by more than this, especially the 2016 dot, to be seen as genuinely bullish, because the market is pricing in so much less than the Fed projects. The market has less tightening priced in for the end of 2018 than the Dec FOMC median dot for the end of 2016!

ii) The balance of risks. This is where the recovery in domestic and international risk appetite kicks in. Expect this to shift to “risks are nearly balanced”. This is a minimum condition needed to signal that all FOMC meetings (including the April meeting) are ‘live’.

iii) The forecasts: Expect minor adjustments. 2016 median inflation forecasts will likely be revised up 0.1% to reflect recent stronger PCE inflation; and, median growth forecasts revised down 0.2% to 2.2% because of weak international growth. The tone on inflation should be less concerned about a target undershoot, compared to the prior statement that mentioned a ‘current shortfall in inflation’.

iv) The tone of the press conference. Here Janet Yellen will try keep her options open. This also means leaving the door wide open to a June hike, and even ajar to an April hike, on the big provisos that March NFP is strong enough, and global risk appetite holds up. The market will see this as more hawkish than currently discounted.

The above signals should affirm that the Fed remains considerably more hawkish on both the short and longer-term trajectory for fed funds relative to the market. At the margin this is USD positive, even if the market has treated the Fed’s views with some skepticism for many years. This is different from 2015 when the USD ended weaker versus the EUR after every FOMC meeting where there was a press conference.

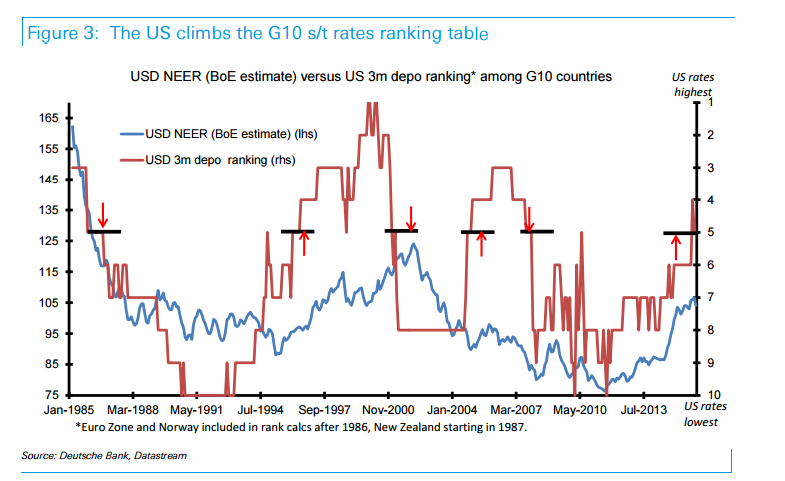

….While we expect the immediate market reception to the FOMC meeting will be USD positive, the follow through reaction will be very restrained. For one thing, USD bulls have been recently burned. Until the market can see the whites of the eyes of the Fed – which means the market gaining confidence that the Fed will pull the trigger at the next FOMC, whenever that is – USD gains in response to more ‘hawkish’ Fed news will be constrained, and the market’s attention will quickly shift elsewhere. Fed tightening, and US policy rates climbing the G10 ranking table is still key to the long-term USD cycle support, but we are not in the thick of this policy story, yet.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.